Close your eyes.

Take 10 seconds and imagine it’s Wednesday morning.

OK, you can open your eyes now.

Hopefully for a moment, things didn’t feel as crazy as the media is portraying. I myself imagined a very regular morning: a cup of joe and making breakfast for the family. No chaos.

Last night, as I channel-surfed, the election rhetoric was hot. As I’m sure you’ve seen, conservative news stations tend to point fingers one way, while more liberal outlets paint a different picture.

Heck, I don’t even know what to believe at this point. But, as it relates to markets, does it really matter?

History says no.

Sure, we can all agree 2020 is a crazy year. The election… coronavirus… civil unrest…

What’s an investor to do?

For me, it’s simple…

Bet on America.

I’ve found that over time, uncertainty usually absolves itself. And while it’s always important to know what’s going on in the world around us, we want to keep our investment decisions free of emotion.

Leading up to Election Day, markets tend to act a certain way. This year is no different.

Largest week of selling since March

The S&P 500 (SPY ETF) fell 5.56% last week. It capped off a month that started strong, rising 5.24% in the first 12 days of October. The volatile month ended with the SPY down 2.49%.

This is after September posted a -3.74% return. As unsavory as that sounds, it fits prior election years dating back to 1990. I spoke about this weeks ago: Big Money usually sells stocks ahead of Election Day and buys them shortly after.

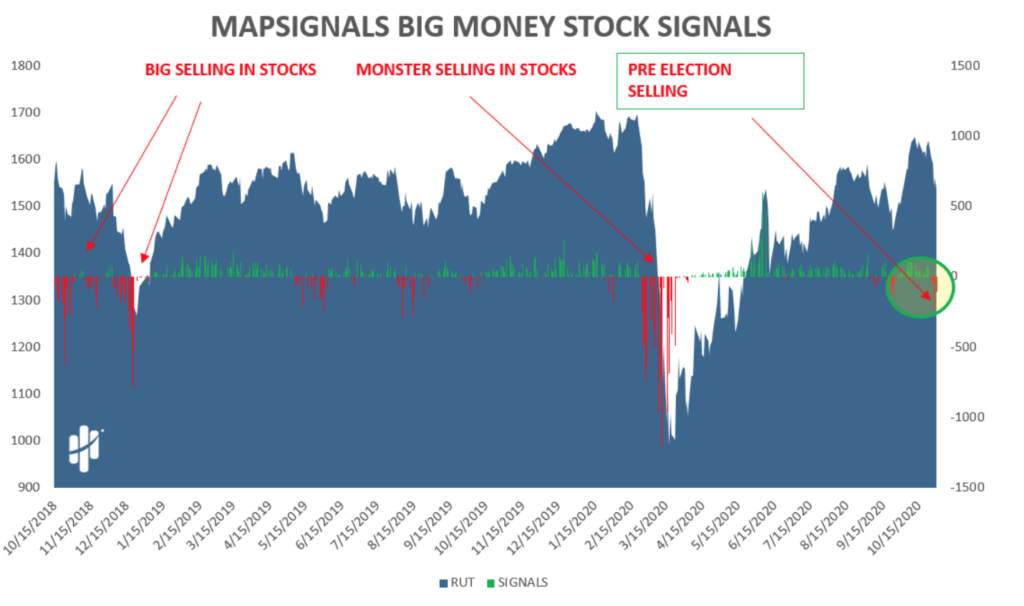

It appears the first leg of that narrative played out with last week’s big selloff. Below you can see the daily Big Money stock signals. The chart shows the net signals on the day. A green bar indicates buying. A red bar means selling.

What is glaring to me (circled in the chart) is that it was the largest week of selling since the March lows. This lines up with our theory that Big Money flattens out risk heading into an election.

That makes sense because high uncertainty, like we have now, creates a low risk/reward setup. That’s why we believe the indices fell hard. But, if history is any guide, markets should catch their footing soon after the election results are revealed.

At that point, investors can better grasp their future prospects and wager accordingly. I expect 2020 to be no different. A clear victor will likely be good for the markets overall.

The markets will eventually work themselves out. That’s been the case for decades. And that’s why I always bet on America.

Make sure you do, too, by voting!

Editor’s note:

One of the simplest ways to bet on America is to hold a diversified portfolio with stocks hand-selected by Frank’s network of industry insiders…

The Dollar Stock Club boasts double-digit gains across a range of market sectors, from gold to consumer staples to crypto plays.

At only $1 each, this club is the no-brainer way to access some of the best ideas on Wall Street… before Main Street catches on.