With the category 4 Hurricane Ian barreling down on Florida this week, you might not have noticed a different kind of storm brewing across the Atlantic…

Last week, newly appointed U.K. Prime Minister Liz Truss proposed a tax cut of 45 billion pounds (approximately $48 billion) and spending increases… without any plan to replace that money within the government budget. This staggering unfunded spending would almost certainly mean massive new money printing… and higher inflation.

No wonder the U.K. financial system revolted… the pound plunged to an all-time low… and the U.K. market lost more than 5% in a single day.

Fear of financial contagion from the world’s fifth-largest economy quickly spread… with U.S. stocks declining 1.6% on Friday in response to the news. Since the plan was announced, the U.K. and U.S. markets have lost a total of 6% and 3.5%, respectively.

Here in the U.S., we’re facing many of the same problems as the rest of the developed world: high energy prices, record inflation, and slowing economic growth. As the U.K. just showed, you cannot print your way out of these issues.

There’s simply no painless solution to the dual problem of low growth and high inflation… which means the road ahead will be bumpy for a while.

Fortunately, you can protect yourself—and even reap the rewards of a sinking market—by hedging against further declines.

One of the simplest ways to do this, without having to short stocks or trade options, is with inverse ETFs—exchange-traded funds designed to generate the opposite returns of the market (or a specific sector).

In short, if stocks decline, these funds will deliver profits.

For example, the ProShares Short S&P 500 ETF (SH) is designed to mirror the daily moves of the S&P 500—when the S&P goes down, SH goes up by approximately the same amount (and vice versa)…

The ProShares Short Dow 30 ETF (DOG) is designed to go up when the Dow is down…

The ProShares Short Russell 2000 (RWM) does the same for the Russell 2000 small-cap index…

And the AXS Short Innovation Daily ETF (SARK) moves in the opposite direction of the popular ARK Innovation ETF (ARKK).

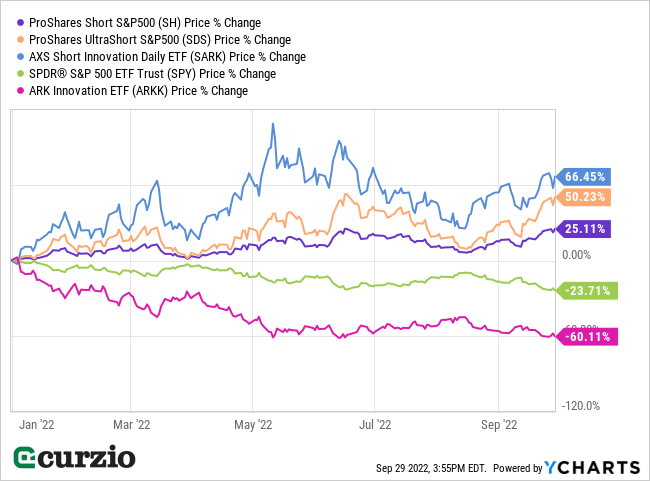

Inverse ETFs are designed to defend your portfolio from declining markets… which is exactly what they’ve been doing during the current bear market—as you can see in the chart below.

Some ETFs mirror the market by a factor of 2–3x.

As you can see above, the ProShares UltraShort S&P 500 (SDS) delivers double the inverse returns of the S&P 500. So when the market is down 1% in a day, SDS will be up 2%…

And the ProShares UltraPro Short S&P 500 (SPXU) is designed to deliver 3x the opposite return of the market.

More leverage means you can make big returns from just a small hedge—but a fund like SPXU is riskier than say, SH… as you’ll lose more if you’re wrong.

One thing to bear in mind with all leveraged/inverse ETFs: They reset their portfolios daily—basically, they’re designed to meet their specific goal (an inverse return) during each trading day.

In a sense, you’re tracking a set of one-day performances of a chosen sector (or the market)—not its overall returns.

That means the longer you hold them, the more their returns will vary from the market they’re tracking (thanks to volatility and the compounding process)…

And the higher the leverage—like the 2x SDS and 3x SPXU—the greater the difference in the total result.

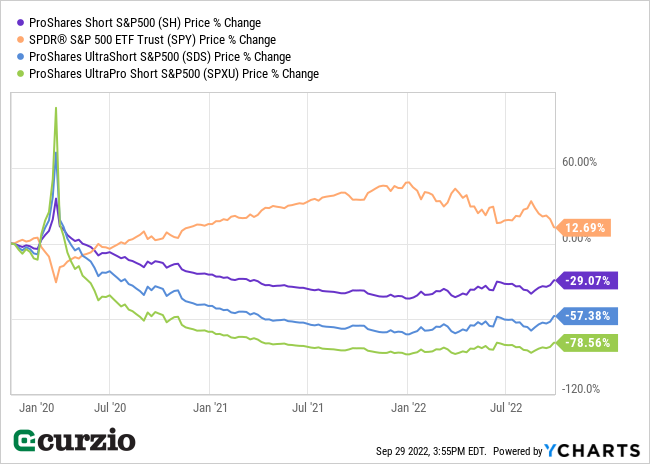

We can see this on the chart below, where I plotted the SH, SDS, and SPXU from the end of 2019 (right before the bear market of 2020) through today.

All of these funds performed well during the 2020 selloff—returning approximately their leveraged inverse of the market’s losses.

Looking at the longer-term picture, the S&P 500 was up 12.5% over this period… while SH lost 29% (more than twice as much)… SDS lost about 57%… and SPXU was down 78%.

In short, highly leveraged ETFs are better used as short-term hedges.

For longer-term hedges, stick with less risky 1x inverse ETFs like SH or SARK.

Remember to monitor inverse ETFs daily… and make sure you understand the risks and limitations involved with any leveraged fund.

If you’re already using inverse ETFs, and ready for next-level hedging, I recommend the bear market strategy we use at Moneyflow Trader… (where we just locked in our SEVENTH triple-digit winner of the year).

In the meantime, inverse ETFs can make a big difference for your portfolio health… especially when the outlook is set to get worse before it gets better—like the scenario we’re facing today.