Attendees of the Nova Festival planned to enjoy an all-night concert to celebrate the Jewish holiday of Sukkot…

Instead, they became victims of a massacre… as gunfire rained down and soldiers stormed the open field. People ran for cover, but there was none to be had. They tried to escape in cars, but the roads soon became clogged, forcing people to abandon their vehicles to keep running.

Early Saturday morning, the Palestinian militant group Hamas waged shocking attacks at 22 locations across Israel… killing hundreds of civilians and parading hostages through the streets. Countless people remain unaccounted for.

Israel officially declared war on Sunday… leaving the rest of the world watching to see how far the violence will escalate.

The barbaric attack has wide-ranging implications across the global economy, especially the oil sector—where oil prices spiked more than 4% this morning.

Today, I’ll explain why the tragic violence in the Middle East will lead to higher-for-longer oil prices… and which companies are poised to pick up the slack as the war disrupts the global oil market.

But first, let’s look at the multiple factors behind surging oil prices…

Why oil prices are poised to keep rising

As you probably know, the world has been dealing with higher oil prices for a while.

The post-COVID economic recovery caused a massive rebound in oil consumption. Last month, I noted that demand is hitting levels we’ve never seen before. And today, OPEC released its latest forecasts, which point to another 20 years of rising oil demand.

This soaring demand is happening while oil supplies are limited. This summer, Saudi Arabia cut its oil production by a massive one million barrels per day (mbd)—which caused prices to rally above $90 per barrel a few days ago.

Last week, officials confirmed the cuts would continue through year-end.

As you can guess, when supply fails to satisfy demand, it leads to higher prices.

Oil has pulled back recently, thanks in part to growing concerns about a near-term recession. Normally, a recession crushes oil demand and helps knock down the price of oil.

But the turmoil in the Middle East will put a lot more pressure on the supply side of the market.

For one thing, the region is critical to the world’s energy supply. Any interruption in oil production or transport will translate into higher prices. Already, the outbreak of war has resulted in a major offshore gas field being shut down. And other key energy projects—including Chevron’s pipeline from Israel to Egypt—could also be impacted.

Plus, it’s too early to know how far the trouble will spread outside Israel’s borders. If Iran becomes embroiled in the conflict (which is likely), it could cut off a major oil transportation artery—the Strait of Hormuz. And we could see further supply disruptions if developed nations (including the U.S.) impose additional sanctions on Iran’s oil exports.

In short, the unfolding crisis in Israel could have massive implications for global energy markets.

But it’s likely to create a new tailwind for U.S. oil producers…

How the Permian could save the global oil market

The United States is the world’s largest oil producer—contributing nearly 15% of the world’s oil supply.

And that’s largely thanks to a chunk of land in Texas and eastern New Mexico called the Permian Basin—our nation’s largest oil field. The Permian accounts for over 42% of U.S. oil output… and has an estimated 147 billion barrels of technically recoverable crude oil and 17.8 billion barrels of proven reserves.

Put simply, the Permian is one of our nation’s greatest energy assets. And it’s an even bigger deal given the turmoil in the Middle East.

Unlike producers in Saudi Arabia and Iran, the companies that operate out of the Permian aren’t subject to strategic oil alliances or political sanctions. In other words, political unrest won’t impact these companies’ output.

Plus, the Permian Basin’s infrastructure is already in place… making it far more economical to produce oil here than to explore and develop new reserves.

I broke down the situation a few months ago—it’s why we’re already seeing signs of a Big Oil “landgrab” across the Permian Basin.

Exxon Mobil (XOM) is currently in advanced talks to buy Pioneer Natural Resources (PXD), the biggest independent player in the Permian. And other oil giants are likely to follow suit…

You see, finding new oil has always been an uncertain endeavor. And that’s especially true today, when new reserves are harder and more expensive to find. In fact, it’s not uncommon for major oil companies to call it quits on a big exploration project, even after spending billions of dollars over many years.

In short, it’s easier—and cheaper—for oil giants like XOM to grow reserves and boost production by buying independent producers like PXD.

That means mid-tier producers with quality assets are attractive acquisition targets.

And the Middle East turmoil gives investors another reason to focus on these stocks…

These oil producers have major stakes in the Permian Basin

Three of my favorite domestic energy plays are Pioneer (PXD), Diamondback Energy (FANG), and EOG Resources (EOG). These oil & gas producers all have massive stakes in the Permian Basin (and other oil-rich U.S. shale regions), making them attractive acquisition targets.

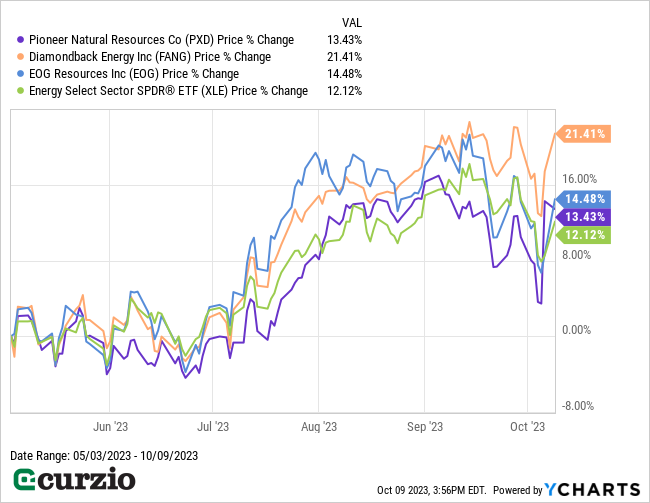

That’s why all three companies have outperformed the Energy Select Sector SPDR ETF (XLE) since early May, when the price of oil set its 2023 low (as you can see from the chart below).

In addition to being well-run, asset-rich companies, these stocks offer market-beating dividend yields of 2.7% (EOG), 4.6% (FANG), and 6.9% (PXD).

The bottom line: These three companies are profit and cash-flow machines… and they look even more attractive as the world braces for even higher oil prices amid the unrest in the Middle East.