Editor’s note: Back in January 2021, Genia told you how the traditional 60/40 strategy was a thing of the past… and she was right on the money. Today, the market environment has changed… but this advice is as true today as it was back then. Below, Genia explains why… and shares a fresh strategy for today’s dangerous market.

For years, brokers and financial advisors recommended the 60/40 portfolio—a mix of 60% stocks and 40% bonds—for anyone with low risk tolerance (say, investors approaching retirement).

The logic behind this portfolio is simple: Stocks promise higher returns in exchange for greater risk… while bonds are less risky and deliver income rain or shine.

Plus, stock and bond prices historically move in opposite directions—so owning a combination reduces volatility without significantly reducing profit potential.

But that logic stopped working in the era of 0% yields… which I warned you about more than a year and a half ago.

With interest rates stuck near zero (resulting in minimal income), I expected bonds to become a much weaker hedge against falling stock prices. Plus, the rising correlation between bond and stock prices pointed to the end of the diversification benefits of the 60/40 split.

So with rates rising for the first time in years, does that mean the 60/40 portfolio is back?

In short: No.

While we’re in an entirely different market environment than we were at the beginning of 2021… the 60/40 portfolio is almost as poor a proposition as it was back then…

Let’s take a look at why… and an alternative strategy better suited to today’s violent markets.

Why bonds won’t protect you right now

2022 is on track to become the worst year for the 60/40 portfolio ever.

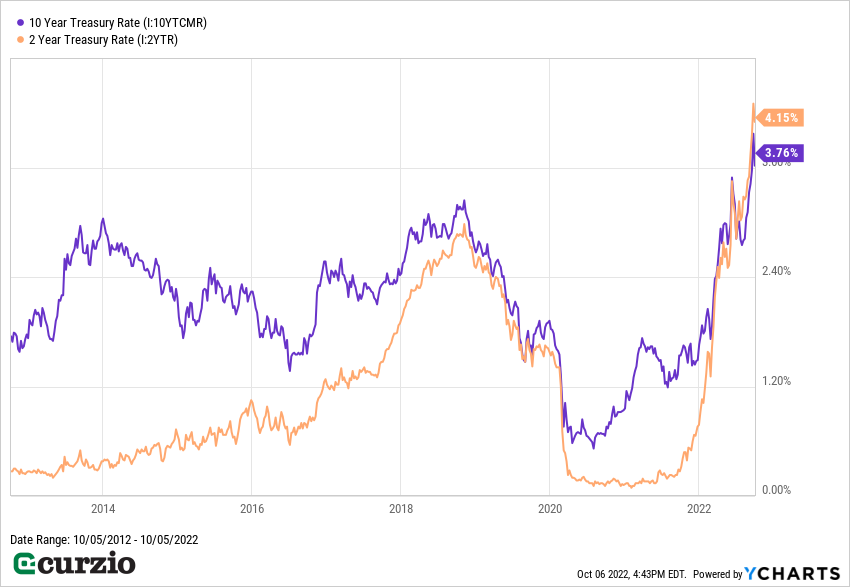

With the Fed firmly set on its rate-hiking path, yields have been rallying sharply, as you can see from the chart below.

But bond yields and prices have an inverse relationship…

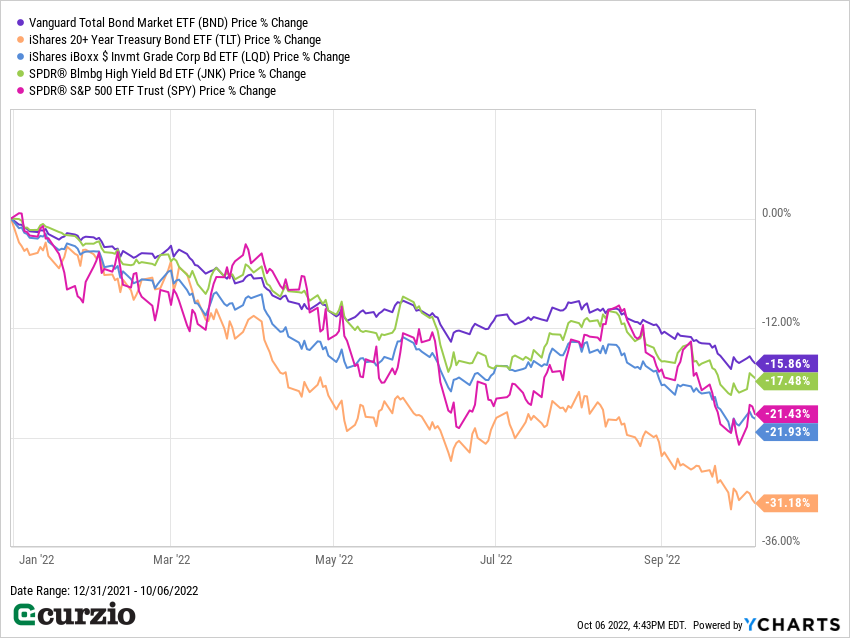

The chart below shows how bonds are plunging just as much as stocks. In fact, U.S. long-term Treasurys (the orange line) and high-quality bonds (the blue line) are actually doing worse than the S&P 500 (the pink line) since the start of 2022.

So what happened? What is the bloodbath in bonds telling us? And what can investors do to replace the failed promise of the 60/40 allocation?

First, let’s start with a simple breakdown of bonds:

Bond yields represent the levels at which old debt is traded… and new debt is issued. The higher the yields, the more expensive the debt. In early 2021, for example, yields for the benchmark 10-year Treasury were around 1%. This means investors were lending money to the U.S. government for 10 years at just 1% per year. We’d never before seen debt so cheap.

Now, at higher yields, some bonds (especially high-quality, shorter-term bonds) deserve a place in many portfolios.

However, even as bond yields rise, the 60/40 model still doesn’t work.

Remember: The main benefit of the 60/40 portfolio was the negative correlation between stocks and bonds—when one moved up, the other went down…

But that hasn’t been the case at least since the zero rate environment of 2021… and rising yields haven’t changed that. That’s why bonds have been plunging alongside stocks since the start of 2022.

And as interest rates keep rising, bond prices are set to decline even further.

In other words, bonds won’t protect you in the current environment. As long as rates are going up, bonds will likely fall along with the stock market.

And, unlike stocks, bonds don’t offer much potential for capital gains.

So what are we to do?

The new 60/40 strategy

Income investors are conditioned to reach for the safety of yields—and avoid the risk of growth stocks.

That’s why, when it comes to equities, income investors typically flock to the “value” section of the market.

For one, value stocks are known for paying dividends. Second, their cheap valuations (measured by price-to-earnings or price-to-book metrics) can look incredibly appealing—after all, what better way to generate strong returns than with a discounted stock?

While that’s often the case… there’s a glaring problem with applying this logic to the entire “value” section of the market:

A lot of “value” stocks are cheap for a reason.

These stocks, often called “value traps,” are cheap because they have no future: They’re at the end of their life cycle… or have company-specific long-term issues. While they might look good on paper thanks to their high cash flow and dividend payouts… they’re on the brink of sharply lower revenue and profits.

And just as not all value stocks are inherently risk-free, not all growth stocks are inherently risky. By avoiding the growth side of the market, you could be locking yourself out of major gains. Plus, a lot of these stocks also pay excellent dividends.

If income and capital gains are your goals, focus on quality growth stocks that also pay dividends, like those I recommend in Unlimited Income.

Stocks like Chevron (CVX), Merck (MRK), Analog Devices (ADI), and CVS Health (CVS) are classified as growth stocks. But they’re also established players in their respective industries. Their stocks offer dividend yields that are higher than the market average (1.8%)… and they’ve all outperformed the S&P 500 so far in 2022.

I like to think of companies like these as having a 60/40 split of growth and value qualities.

By building a portfolio of these stocks, you’ll get plenty of income in the form of growing dividends… while maximizing your potential for capital gains.

This “growth + value stock” strategy gives you the benefits of the original 60/40 concept: a portfolio that will deliver profits, even in a weaker market… while paying you a growing income, too.

Editor’s note:

In today’s devastating market, Unlimited Income members are collecting consistent cash payments from investments yielding as high as 8%.

Start collecting income from potentially explosive growth positions when you join today, completely risk-free.