Consult any broker about income investing, and they’ll likely recommend the so-called 60/40 portfolio—or a mix of 60% stocks and 40% bonds.

Years of empirical data and academic research have shown this simple recipe can generate some of the best risk-adjusted returns.

This method has also been popular because income investors tend to be less risk tolerant, with a shorter time horizon and the need to generate significant cash flow.

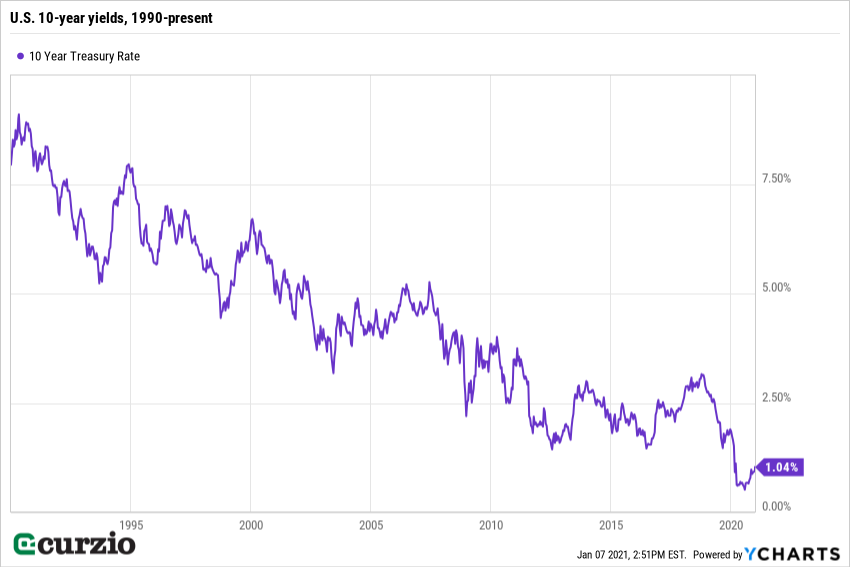

That is, until Treasury yields slid to near-zero levels.

While yields are off their worst levels of 2020, they’re still stuck around 1% for the benchmark 10-Year Treasury. This means investors are lending money to the U.S. government for 10 years at just 1% per year. We’ve never before seen money this cheap.

At such low yields, bonds are also a much weaker hedge against falling stock prices than they were, say, a decade or two ago.

Some bonds have a place in many portfolios… especially for investors whose risk tolerance or time horizon is limited.

Bonds can help increase your defensive standing. They won’t reward you if the market continues to rally… but during a stock selloff, bonds typically rise. This insurance isn’t perfect, but it adds stability and will help you weather the tough times.

But the 60/40 model has been criticized for short-changing its followers… especially during years equities rally—like 2020, when, against all odds, the S&P 500 returned more than 16% for the year.

When you add record-low rates to the mix, the 60/40 model is allocating too much to bonds for the average income investor.

But income investors are typically conditioned to avoid growth stocks… and reach for yields.

If you do that, you’re making a big mistake.

In stocks, the higher the yield, the greater the risk. By accepting a high yield (double what the S&P 500 pays or more), you’re likely buying more risk than your circumstances dictate.

You see, when it comes to equities, income investors often belong to the “value” category. They favor mature companies for their market-beating dividends.

Value investors expect these stocks to generate strong returns simply because of their low prices (measured by price-to-earnings or price-to-book metrics).

There’s one problem with this: A lot of “value” stocks are cheap for a reason.

These stocks, often called “value traps,” are cheap because they have no future. They’re at the end of their life cycle… or have company-specific long-term issues. Such companies can feature high cash flow and dividend payouts… but can be on the brink of sharply lower revenue and profits.

If you’re a bargain shopper, you must do your homework.

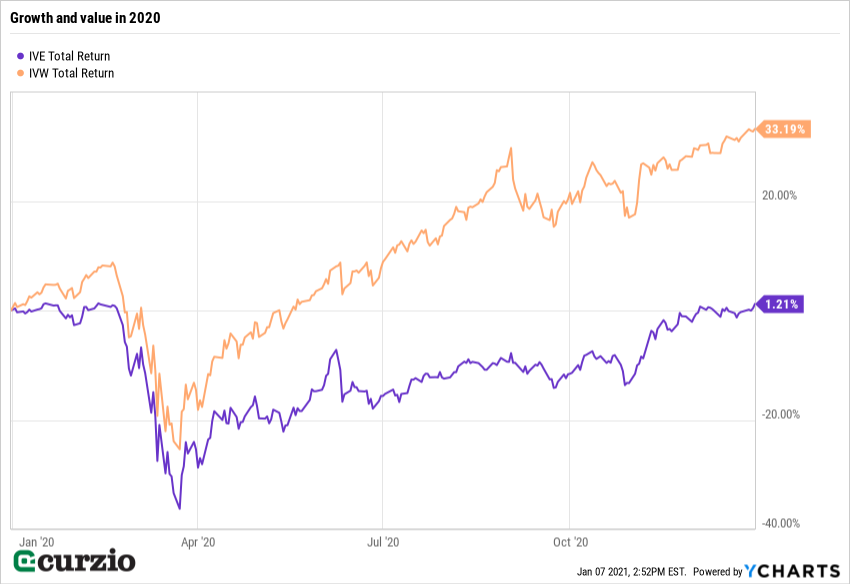

Value stocks as a group have been lagging their growth peers for more than a decade. And this value/growth differential further stretched in 2020.

Last year, value stocks, represented on the chart below by the iShares S&P 500 Value ETF (IVE), have barely broken even… while large-cap growth stocks, represented by the iShares S&P 500 Growth ETF (IVW) rallied more than 33%.

(Note that IVE and IVW don’t overlap; together, they make the S&P 500 Index.)

Missing out on such returns can be costly in the long run…

If income is your main goal, buy quality growth stocks that also pay dividends.

It’s a relatively safe way to be invested because it restricts the investment universe to only companies that generate enough profit to share with their investors via dividends… while maintaining significant growth exposure.

Stocks like Air Products and Chemicals (APD), NextEra Energy (NEE), or Ameriprise (AMP) all yield more than the market’s 1.6%—while growing profits and payouts.

In sum, look for mature companies able to sustain and even grow their dividends, rather than value traps.

Think about “growth” and “value” as the new 60/40 strategy: Together, these stocks are safer… can suit a wider range of markets… and can deliver a healthy, growing income.

Income investors have to adapt to this market… but the growth-with-value strategy will be rewarding regardless of which the investment style—growth or income—is set to reign in 2021.

Editor’s note:

Genia’s Unlimited Income subscribers are already taking advantage of the strategy she outlines today… with outstanding results. Genia just handed members their first double of the year.

If you’re ready to earn real income… without sacrificing growth… learn more about Unlimited Income.