It’s hard to be an income investor in a zero interest-rate market.

Safe, reliable payouts aren’t easy to come by.

After a year-long rally, the S&P 500 yield has come down to just 1.4%. A year ago, the market index was yielding as much as 2.1%.

Last week, I told you about one popular strategy to boost your income: covered calls.

Today, I’ll tell you more about how covered calls work… and two funds that have been using them to juice up their dividends for years.

The covered call strategy involves two important steps.

Step one: Buy (if you don’t already own) at least 100 shares in a company (we’ll call it Acme).

Keep in mind, option contracts are quoted as if you’re only buying/selling them for a single share. But the contracts are only available in 100-share blocks. That’s why you’ll need to own at least 100 shares of Acme if you want to apply an option-based strategy.

Step two: Sell a call option against Acme. This premium helps boost your income from Acme. Or, if Acme doesn’t pay a dividend, selling a call option is like creating your own “dividend” from the stock.

Also known as “buy-write,” this method involves selling (writing) call options against stocks you own.

This is a good strategy for stocks with limited upside—like many old-school dividend stocks, and it can also help protect your portfolio against losses in case of a market downturn.

Trouble is, to get a higher premium (which you get to keep as a call seller), you typically need a call option with a strike price close to the current price… which increases the chance your shares will be “called” away.

Remember: as long as the stock price stays under the strike price, the option contract will expire worthless for the buyer… and the call seller (you) gets to keep both the premium and your shares of Acme.

Plus, you can collect premiums over and over by selling calls on the same shares. Many investors use this strategy on stocks with limited upside they plan to hold forever… and don’t mind if blocks are called away now and then. If this happens, they can buy more.

The drawback is, not all call contracts are created equal. The best-case scenario for a covered call seller is a relatively tame stock with a relatively high call option premium.

And finding the right opportunity takes time and effort… There’s a wide range (and variety) of option contracts for every stock—with different strikes and expirations. Typically, a contract will expire within a period ranging from a few days to several months… and option sellers must take the direction, timing, and size of a potential stock price move into consideration.

If you lack the time needed to go through all these details, the next best thing is to buy a fund with a built-in covered call strategy.

There are several covered-call funds, both exchange-traded (ETFs) and closed-end (CEFs), for you to choose from.

(In future articles, I’ll talk more about closed-end funds and how they’re different from mutual funds or ETFs.)

Most use the covered-call method to supplement more traditional income strategies.

Here are two great choices…

No. 1: Global X Nasdaq 100 Covered Call ETF (QYLD)

Covered-call ETFs aren’t common… but they do exist.

Consider QYLD, which follows a call-writing index based on the 100 largest Nasdaq stocks… and “writes” (or sells) a succession of one-month at-the-money covered call options on the index.

The Nasdaq 100 index tracks the hundred largest companies traded on the Nasdaq exchange. Historically, many tech companies list their shares on Nasdaq. As a result, the Nasdaq 100 index is tech- and biotech-heavy, having stocks ranging from Apple (AAPL) to Biogen (BIIB) and Gilead (GILD) as its members…

Income strategies based on the Nasdaq 100—like the one QYLD uses—are good for diversification. Many income-focused portfolios tend to underweight the tech sector. This fund helps to fix that issue.

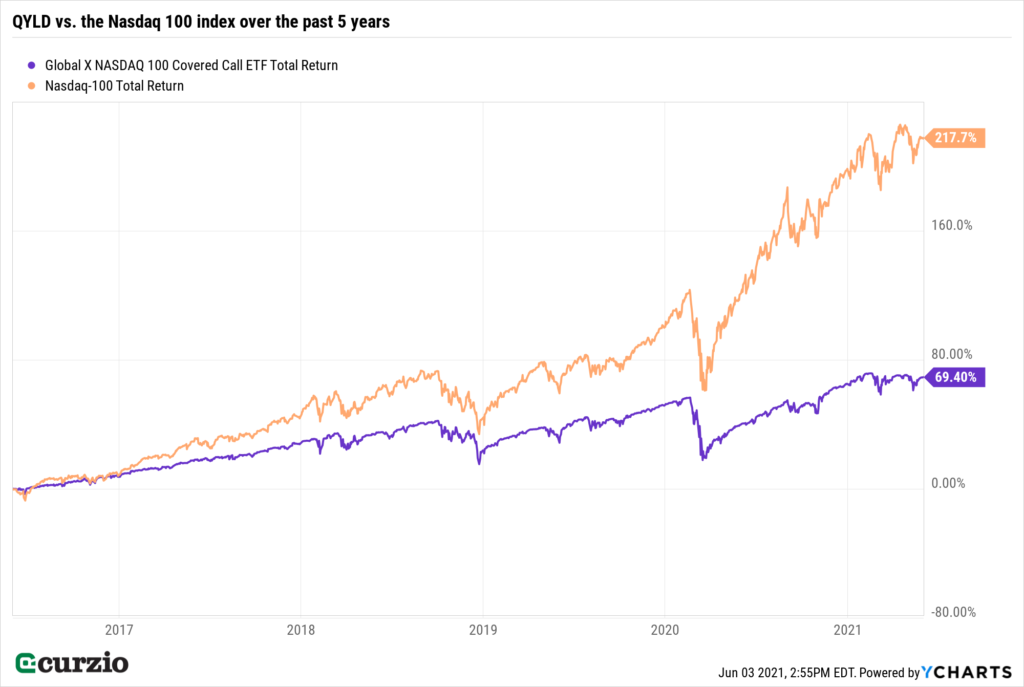

On the chart below, I plotted the total return for QYLD vs. the Nasdaq 100 over the past five years.

As you can see, the ETF has underperformed the index.

This is to be expected.

Remember: the biggest risk in a buy-write strategy is the opportunity loss—when your stock rallies and you must sell it to the call-buyer at the predetermined “strike” price.

So in a bull market, call-writing strategies underperform the broader market.

On the plus side, covered call strategies deliver income regardless of market conditions… and QYLD can potentially outperform when the Nasdaq 100 trades sideways or even declines a bit.

The exact amount of income generated from call-selling strategies can vary. But today’s QYLD yield sits around 12%, paid monthly… making it a great fit for many income-oriented portfolios.

No. 2: Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX).

Many closed-end funds (CEFs) utilize the buy-write strategies. I like QQQX because—like QYLD—it’s built around the Nasdaq 100… and so it should nicely complement your income portfolio.

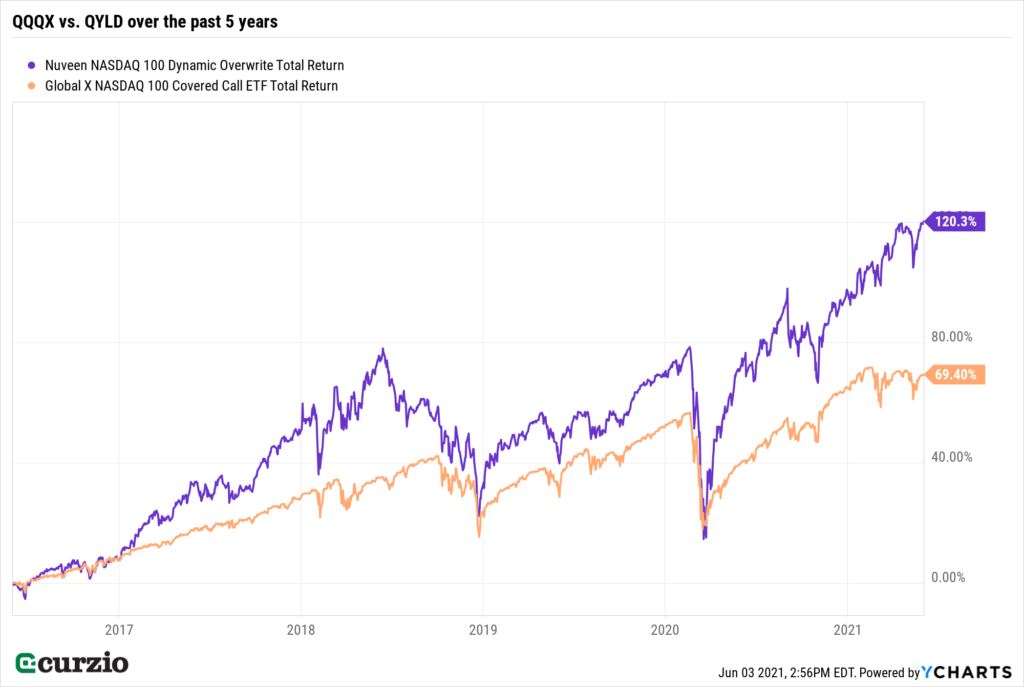

But the Nuveen fund is actively managed, and its strategy is different from QYLD’s.

QQQX invests in an equity portfolio that tracks the Nasdaq 100. And it sells call options on some stocks it owns, typically 35%-75% of the notional value of the fund (with a 55% long-term target).

This strategy is more flexible and resulted in a much higher long-term return than QYLD. QQQX has generated a 120% total return over the past 5 years… vs. a 70% gain for QYLD.

Not surprisingly (because it’s following the Nasdaq 100), QQQX’s top 10 holdings include Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN)—with more than 10% of its assets invested in each of these three stocks.

Most recently, the fund had calls written against 57% of its holdings, with a weighted average of just 16 days until expiration.

QQQX pays its distributions quarterly, for an annual yield of around 6.1%.

These two funds are worthwhile investments on their own. But I especially like that both provide significant exposure to the Nasdaq 100, or tech stocks—which income investors often need more of in their portfolios.

If you’re an income investor looking for more tech exposure, check these two funds out.

P.S. Dividend stocks offer great protection against a high-inflation environment… especially those that can increase their payouts.

And my Unlimited Income advisory gives you access to the best dividend-growers in the market… without sacrificing growth.

Learn why this service is your ticket to safe, steady income.