Consumers are suffering right now…

High inflation has pushed up prices for everything from food to cars to rent.

Meanwhile, the Fed’s only means of fighting inflation—by hiking interest rates—adds another headwind for consumers. As interest rates rise, the cost of holding debt is becoming uncomfortably high.

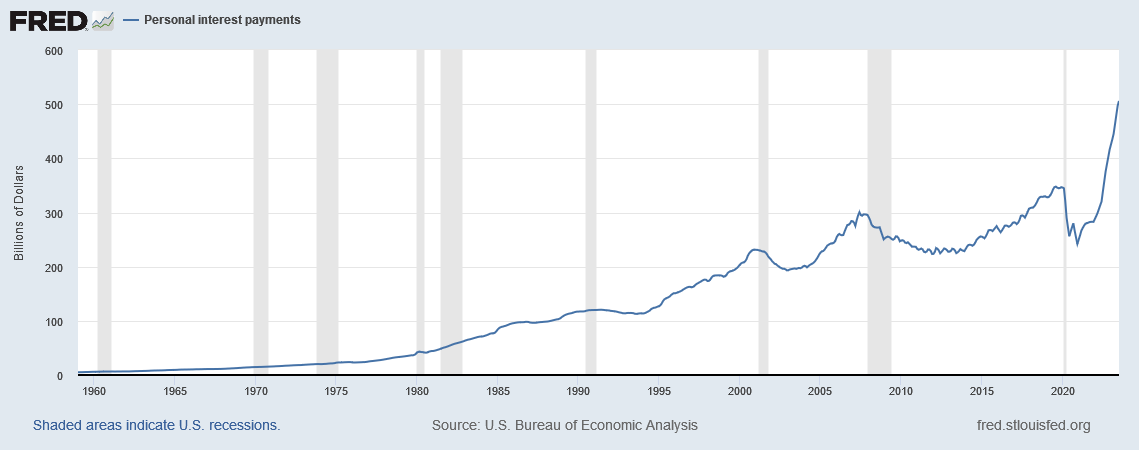

Mortgages, for instance, are more expensive than they’ve been in more than 20 years. And when you add together all U.S. consumer debt (including mortgages), Americans are spending more on interest payments than ever before (as you can see below).

Put simply, while inflation was already putting the squeeze on consumers… the Fed’s interest rate hikes have exacerbated the situation.

But there’s good news…

Investors can actually use the Fed’s own policies to fight back… and collect steady, relatively high yields while taking minimal risk.

Here’s how…

Why short-term bonds are a “no-brainer” investment right now

Normally, long-term bonds offer higher yields than shorter-term bonds. In other words, the longer the bond’s lifespan, the higher its yield. This makes sense, since investors need to be compensated for the risk of lending money over a longer period.

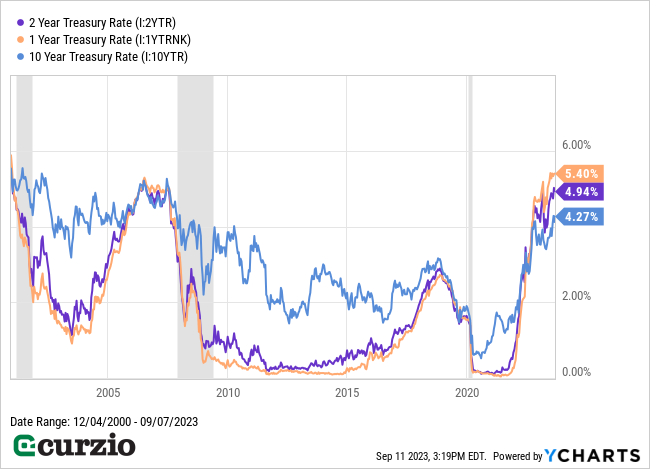

But today, this “normal” relationship between long- and short-term bonds has been flipped on its head.

That’s because the Fed’s interest rate policies only affect the shortest end of the “yield curve” (the yields offered across the entire spectrum of short- and long-term Treasurys).

As you can see on the chart below, shorter-term bonds currently offer higher yields than their longer-term counterparts. Specifically, one-year U.S. Treasury notes are paying around 5.4%… while two-year notes offer a yield above 4.9%. By comparison, 10-year Treasurys will pay you less than 4.3% annually (if you buy today).

Put simply, the Fed’s interest rate hikes are making short-term bonds a “no-brainer” investment right now. They offer a bigger payout vs. longer-term bonds… with less risk.

And there’s another factor that makes short-term bonds even more attractive…

Shorter-term bonds will benefit once interest rates stop rising. When the Fed stops hiking interest rates, bond yields will likely fall… which will cause prices to bounce as the market realizes future yields won’t be any higher than current ones.

The bottom line: It’s a great time to be a short-term bond investor.

The easiest way to get your share of the growing income from short-term bonds is with a bond-focused exchange-traded fund.

Here’s one of my favorite plays…

A low-risk fund with a high—and growing—yield

The iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) is an exchange-traded fund (ETF) that focuses on short-term bonds. As its name suggests, the fund tracks an index of U.S. investment-grade corporate bonds with remaining maturities between one and five years.

Altogether, IGSB owns more than 3,000 corporate bonds from various companies… all with investment-grade credit ratings (which means they have strong balance sheets and minimal risk of default).

Its top holdings include financial companies like Bank of America and JPMorgan Chase… Big Tech names like Apple and Microsoft… and plenty of other blue-chip companies like Boeing and Amgen.

Most importantly, the average maturity of the fund’s holdings is about three years. As IGSB’s existing bonds mature, the fund’s managers get to reinvest the proceeds at today’s higher yields. In other words, we can expect the fund to consistently grow its income—thanks to the Fed’s high-interest rate policies.

In fact, this yield growth is already playing out. Over the past year, ISGB’s monthly payout has increased from $0.09 per share to $0.147. That’s an increase of more than 60% over the past 12 months.

Currently, the ETF yields 3% (double the yield of the S&P 500). And this payout will keep going higher as the fund’s managers replace maturing debt with bonds that pay higher yields.

And because the ETF’s fees are a rock-bottom 0.04%, most of this yield will go straight into investors’ pockets.

Conclusion

As interest rates rise, corporations are forced to issue new bonds at higher rates… which means higher coupon payments for bond investors. That’s particularly true for short-term bonds, which offer higher yields than long-term bonds right now.

And IGSB—which invests in extremely low-risk, short-term corporate bonds—is a great way to take advantage of the situation.