Some slogans are so catchy, they need to be trademarked.

That’s what happened with Apple’s “There’s an app for that” phrase.

Apple coined it to promote its app store… and the phrase was so successful the company trademarked it.

But I can’t help but think of this slogan every time I write about ETFs…

That’s because these days, there’s an ETF—or exchange-traded fund—for almost everything.

There are index ETFs… inverse ETFs… sector ETFs… country ETFs… bond ETFs… commodity ETFs… income ETFs… volatility ETFs… and even pot ETFs.

If you’d rather not follow an established index but invest in an active strategy, there is—or will be—an ETF for that, too.

Many actively managed ETFs, such as the ones managed by ARK or SoFi, invest in innovation, from fintech and genomic stocks (ARK) to the gig economy (SoFi).

These active ETFs are very popular today… but because they’re fairly young, there’s no way to tell how well (or badly) they’ll perform in a weaker market.

If you’re looking for income, stability, and safety, but still want a bit more flavor than a good ‘ol S&P 500 index fund provides, I suggest taking a middle road…

You can still invest in an older, more established ETF—but one that goes beyond a standard index strategy.

One of my old favorites, ALPS Sector Dividend Dogs ETF (SDOG), took the popular “Dogs of the Dow” strategy and put its own twist on it.

“Dogs of the Dow” became well known in the early 1990s, before the dot-com boom made dividends temporarily irrelevant. But as zero-rate policies took hold, the “dogs” staged a popularity comeback.

The strategy itself is quite simple: It calls for you to buy the 10 highest-yielding stocks in the Dow Jones Industrial Average on the last trading day of each calendar year. Hold for a year and then repeat.

Theoretically, these “dogs” of the Dow are the highest-yielding among their peers because they’ve underperformed… and are now oversold. Market forces will eventually bring the dogs’ dividend yields back into line with their peers—meaning their prices will rise. And you’d get the best of both worlds: stronger dividends plus higher prices.

SDOG applied this theory to the entire S&P 500 Index.

Once a year, the ETF selects the five highest-yielding stocks in 10 of the 11 S&P 500 sectors (excluding real estate stocks, or REITs)—50 in total—and weights them equally across its $1 billion portfolio.

The resulting portfolio, therefore, is distributed roughly equally among most of the S&P 500 industry-based sectors.

Over time, some sectors—and stocks—will grow in relative importance, simply because they’ve outperformed the rest.

Today, for example, the largest sector in the ETF is consumer discretionary stocks… and the smallest is industrials. (This reflects recent strength in the fund’s consumer stocks vs. relative weakness among its industrial holdings.)

SDOG sector weighting

Once a quarter, this allocation process repeats. The fund sells some of its best performers… and invests the proceeds in the underperforming but higher-yielding stocks.

As a result, SDOG has a healthy yield of 3.6%—and the potential to outperform in value-minded markets (like it did back in 2016–2017).

While SDOG’s 0.4% annual expense ratio might look high, it’s rather average for a non-index or specialty ETF… and much cheaper than most actively managed funds (the ARK ones will cost you as much as 0.75% annually—almost double SDOG’s cost).

SDOG isn’t without its own risks.

One is the risk of a dividend cut or cancellation. Many high-yielding stocks sport disproportionally high yields because they’re in financial or operational trouble. But, thanks to the diversification of the SDOG’s strategy, any such troubled company won’t impact the overall performance by much.

Still, SDOG can underperform the market significantly at a time when growth stocks are in favor, or—like a year ago—when dividend cancellations and suspensions are common.

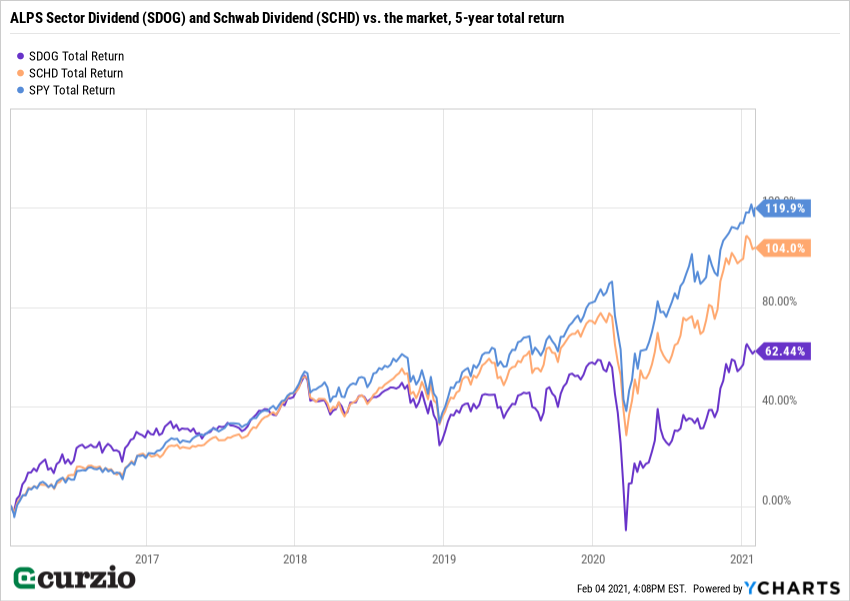

The chart below compares SDOG to the market… and to my other dividend favorite, Schwab U.S. Dividend Equity ETF (SCHD), a low-cost index fund with a focus on quality.

As you can see, while there was a period when SDOG outperformed both the market and the Schwab Dividend ETF, in the past few years the S&P 500 has outperformed both ETFs.

For contrarian investors, this means dividend strategies are overdue for a performance pickup.

But even if growth strategies continue to lead the market, high-quality dividends will still do very well.

Over the past year, in fact, the Schwab Dividend Equity Fund only underperformed the market by less than two points… while yielding a more attractive 3.2%.

How did it achieve this?

With a simple focus on quality.

SCHD is designed to replicate the Dow Jones U.S. Dividend 100 Index. To be eligible for the index, a company should have a record of having paid dividends in each of the past 10 years… and be fundamentally strong relative to its peers (based on cash-flow and dividend growth metrics).

This clear emphasis on quality makes SCHD less risky than the overall market.

But this can come at the expense of diversification. Most recently, SCHD had a massive (25.7%) allocation to financial stocks… and only 3.5% of its portfolio was dedicated to health care.

If you’re nervous about this market and expect, like I do, an imminent changeover from purely growth-oriented strategies to more value, consider these two ETFs.

- SDOG gives you a nice 3.6% yield… market-wide diversification… and a “value” portfolio with appreciation potential, all based on a simple time-tested strategy.

- SCHD complements it by adding a collection of high-quality, financially strong stocks that also pay a market-beating 3.2% dividend.

Together, they provide a strong income allocation for the buy-and-forget portion of your portfolio.

P.S. Frank just released a rare, 10–20x opportunity for the growth-oriented portion of your portfolio… a small gold miner with the most resource-dense property he’s ever seen.

He visited the site in person, and was blown away…

We’re talking gold and copper visible on the surface.

Several catalysts are in place to push this undervalued miner much, much higher in the coming weeks…

Frank’s personally taken a huge position in this name—and he urges you to do the same.