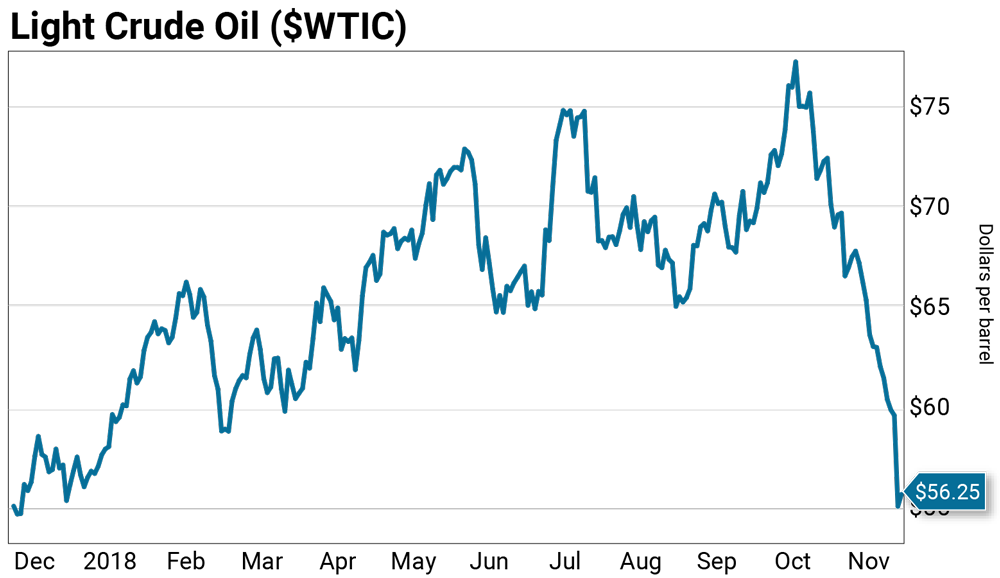

A year’s worth of gains… wiped out in just over a month.

Since the beginning of October, the price of oil has plunged more than 25%. That includes a record 12 days of declining prices through the beginning of November. It finally broke its losing steak on November 14, closing with a gain of 0.84%.

What’s behind the massive drop in oil prices? It’s simple: Basic economics—in other words, supply and demand.

The markets are forward-looking. They don’t care about what happened yesterday. They care about what could happen tomorrow, next month, next year.

But as I’ll show you today, there’s a smart way to take advantage of the recent plunge…

| Recommended Link | ||

| ||

| – |

Saudi Arabia is forecasting that production increases will outpace global oil demand for 2019.

The Organization of the Petroleum Exporting Countries (OPEC) has lowered global oil demand for 2019 for four consecutive months. And non-OPEC members (mainly the U.S.) are increasing production and will continue to do so for at least another year.

In June, Saudi Arabia increased oil production by over 120,000 barrels per day (bpd). This seemed to be in effort to offset U.S. sanctions against Iran, which went into effect on November 5.

But the Trump administration granted waivers to Iran’s sanctions. Countries like China, Greece, Italy, and Japan are allowed to import oil from Iran.

OPEC is now considering production cuts in an effort to stabilize oil prices.

The U.S. is currently producing a record 11 million barrels a day—which will increase to over 12 million next year.

American oil producers aren’t going to stop pumping oil anytime soon. In fact, some producers are hedging production (locking in prices to sell oil) all the way out to 2021. About 50% of 2019 production is hedged near $57 per barrel.

If you’re invested in oil companies, or you’re thinking about investing in the space, it’s important to know how much oil production is hedged. Producers that are hedged at higher prices can continue to produce and make massive profits. Those that aren’t hedged will see their share prices continue to fall alongside oil.

Some companies to put on your watchlist are Devon Energy (DVN), Noble Energy (NBL), and Occidental Petroleum Corporation (OXY). These companies are hedged and thus can continue increasing production.

Some companies to avoid include Anadarko (APC), EOG Resources (EOG), and Continental Resources (CLR)—these are at the mercy of fluctuating oil prices.

(In yesterday’s episode of my podcast Wall Street Unplugged, I name several other oil companies that are set to reap massive profits… and those set to fall 20% or more. If you missed it, check it out here.)

Note: Last week, we recommended another resource company with an outstanding upside potential to All-Star Portfolio subscribers. This company has a great management team and access to one of the best natural gas assets in the country. Right now, you can access this name—and many other fantastic ideas from my insider network—for only $1. To learn more, click here.