“The world has changed,” said Janet Yellen in her Senate testimony on Tuesday.

Yellen, the Biden Administration’s new Treasury Secretary, was referring to COVID… to the new interest rate regime… and to the massive stimulus still needed to defeat the virus and help the economy.

But has the investing world changed enough for us to stop worrying?

Let’s look at where we stand…

Today, January 21, marks the anniversary of the first travel-related COVID case in the U.S.

The disease at that time didn’t even have an official name yet; that was bestowed on February 11.

Based on previous experience with SARS and other, less contagious, viruses, the market shrugged off the new infection completely—and kept rallying for another week or so, setting a new market high on February 19.

A few days later, the bottom fell out… and we entered what now looks like the shortest bear market on record… followed by the swiftest recovery: From the March 23 bottom through today, the market rallied more than 72%.

Both S&P 500 and the Dow Industrials started 2021 at new all-time highs… and the market continued strong from that point on, setting yet another all-time high record today.

It’s no wonder most hedges—insurance-like instruments designed to protect investors from the falling market—have done poorly.

But hedging a difficult (and historically unprecedented) market is the right thing to do. And if you don’t have portfolio protection now, I’ll explain some ways to get it…

Hedges play the important role of insurance against another market shock… while giving risk-sensitive investors the confidence to participate in the big rally.

But the higher the market, the more investors feel invincible… and the less they’re inclined to keep up with insurance.

Stocks are now very expensive… on par with bubble valuations of 1999/2000…

More than ever, some portfolio protection is needed.

Consider the two main reasons behind the market rally…

1) Monetary policies have been unbelievably accommodating: Interest rates have been taken down to zero, and money spigots have been opened.

2) Investors have largely written off 2020 with all its troubles… and have been looking ahead to 2021 and beyond.

We now pay 24.2 times (24.2x) estimated next-year earnings for the S&P 500, much more (30.5x) for the Nasdaq, and three times that (75.6x) for the Russell 2000 small cap index.

Even if there’s a swift and sharp economic rebound, these are high prices to pay for a unit of profits. While expensive markets don’t sell off simply because of high valuations, they’re especially vulnerable to shocks—which can lead to large declines.

Anything can happen… We learned this a year ago, as well as in 2008 and 2000.

Fortunately, there are many ways to own market insurance…

The most traditional hedge—gold—is a store of value that protects against inflation. But in a bull market, it normally doesn’t provide much upside. That hasn’t been the case in the COVID environment.

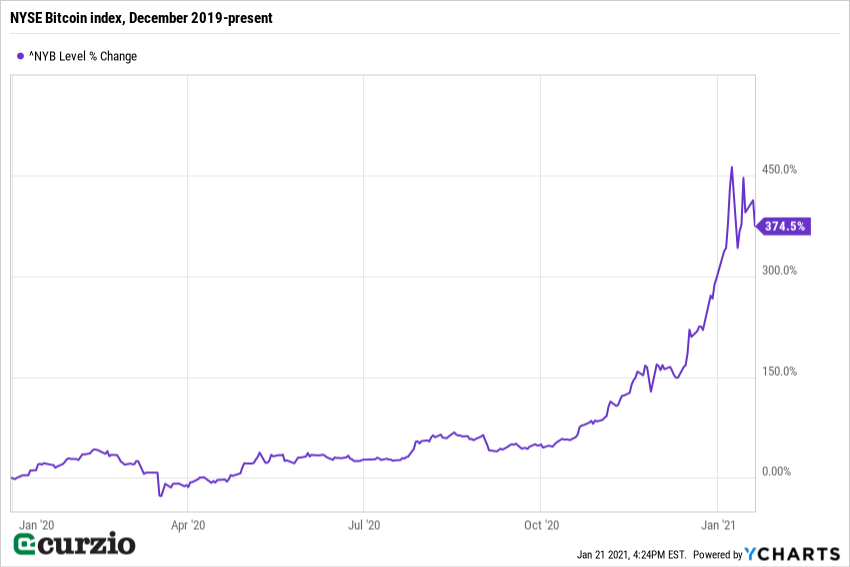

Gold outperformed the market over the past year… but it was outshone by bitcoin, another hedge-like instrument, which added some 400% to its price since the start of 2020.

In a sense, bitcoin is like gold: It’s “mined” at ever-higher costs, and its supply is limited.

But unlike gold, which served as money for millennia, bitcoin is a very new phenomenon… which explains its price volatility.

Both gold and bitcoin offer a degree of protection from future inflation and market downturns…

But my favorite way to hedge is through put options.

Put options are financial instruments tied to an underlying security. The price of a put option moves higher when the underlying security moves lower (and vise versa). Owning a put is an easy and relatively inexpensive way to benefit directly from a market selloff. And, unlike with short positions, where your downside is unlimited if a stock or the market melts up, the risk on a put option is strictly limited to your initial outlay (purchase price of the contract).

In a market such as today, put-based insurance is a good choice. And, just like any other insurance, its purpose is to help when things go really wrong.

The higher the market climbs in a still-weak economy, the higher the chances of a sharp correction… And when that happens, your hedges will shine. Just one winning put position can be enough to offset major portfolio losses.

As many of you know, put options are the strategy behind Moneyflow Trader, my market hedge advisory. With put-based protection, you can be long this market and enjoy the ride… knowing you’re poised to profit on the downside too.

Editor’s note:

If you’d like some piece of mind in these volatile times, Frank urges readers to follow Genia’s Moneyflow Trader advice. Here’s why.