As I mentioned last week, stocks are your best long-term bet, even in a recessionary economy.

I showed you how to be a contrarian… and start taking advantage of today’s weak market.

Right now, contrarians are picking up bargains and positioning themselves for much higher profits than those who bought the same stocks at the top of the market. I said:

You’ll never get every single holding right… and you’re not likely to catch the very bottom either.

But being invested pays over time… despite periodic selloffs.

Today, we’ll review why staying away from the market is not an option… and why investing today is less risky than you think.

Inflation destroys our savings as the cost of living keeps climbing.

This alone is a reason to invest… both for capital appreciation and income. A portfolio of stocks growing faster than the cost of living is the only way to protect your financial security.

To be sure, cash is king this year… Virtually every type of financial asset—even U.S. Treasurys—sold off in 2022… and major equity indexes plummeted 20% and more.

But with inflation at 8.6%, cash is losing its purchasing power to inflation every day…

If you put your cash into new investments instead, it will create the foundation of your future wealth.

Yes, the economy is scary… The developed world even faces the specter of stagflation—a combination of inflation and slow growth.

But the U.S. investment outlook looks better than the world economic outlook for the rest of the year.

For one, the major indices declined 20–30% in the first half of the year… making them cheaper than they were at the end of 2021.

Plus, we’re in a much better shape than the rest of the world… where rising inflation and falling markets are accompanied by a war in Europe and a far worse energy crisis. In Germany, for example, energy prices are up an astounding 87% in just a year.

Stock valuations, which were significantly extended in the era of free money, have become more attractive.

The bottom line: Despite bad economic news and scary headlines, long-term equity risk is much lower than it was just six months ago.

We’re not “formally” in a recession. But often, recessions are known after the fact… and many data points indicate the recession might be already here.

Remember: While the financial markets decline in recession, they often sell off ahead of one, too… And begin rebounding before it becomes apparent the economy is improving.

The stock market is a great discounting mechanism. It predicts an economy worsening—and improving—long before economists can collect, review, and adjust all the relevant data.

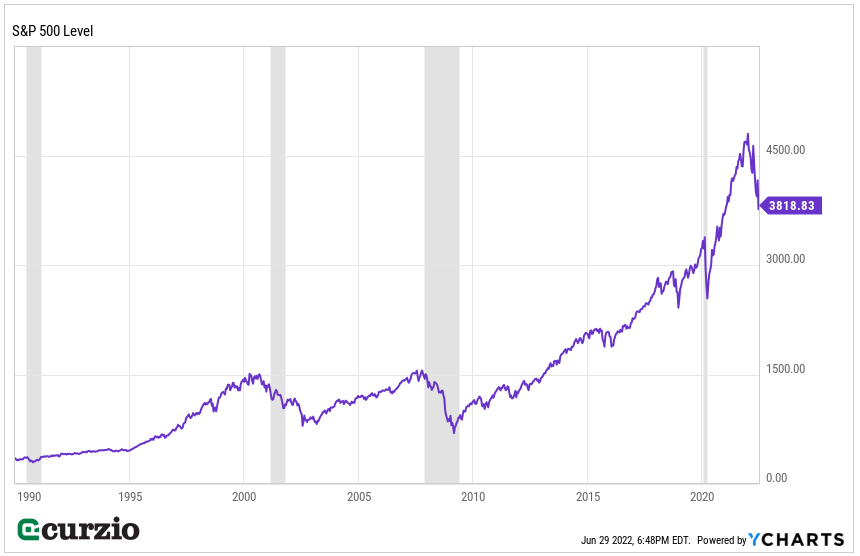

You can see this pattern on the chart below, where gray lines indicate recessions. Stocks often begin their rebound before the official “end” to a recession… especially when equities began a decline prior to the recession’s official “start.”

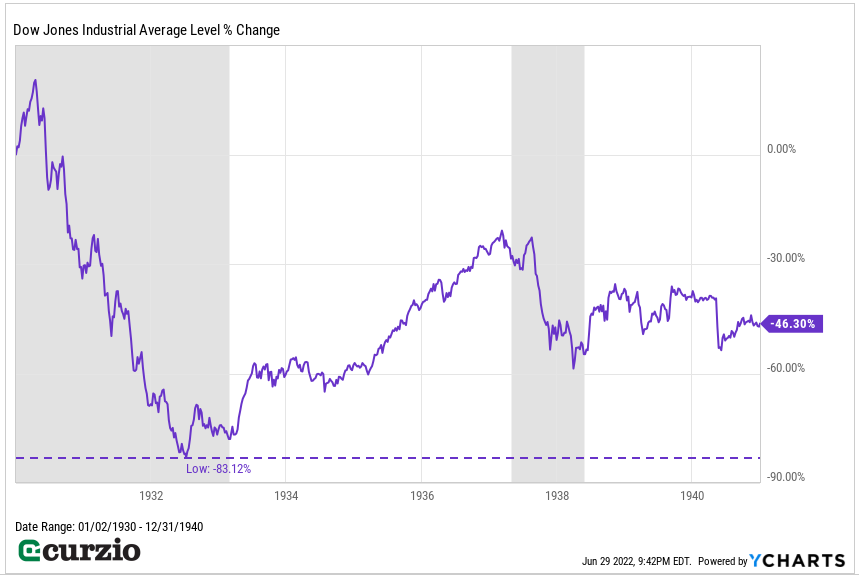

Even in the Great Depression—still the worst bear market on record—this pattern held.

The Dow Jones Industrial Average—the main index at the time—made its low in July 1932, as you can see on the chart below. But by the time Franklin Roosevelt took office in March 1933, stocks had rallied off their lows… and were higher by some 30%.

Stocks continued their recovery up until 1937… when another bout of economic weakness hit.

To be fair, those who bought at the height of the 1929 and 2000 bull markets had to wait many years to break even.

But those who bought lower profited much sooner…

By some measures, we’re already in recession today… and a sharp economic deterioration might send the market further down from here.

But unless the economy stays in a recession for years (as was the exceptional case during the Great Depression), stocks—sensing the upcoming economic improvement—are likely to begin their recovery soon…

Timing the market is impossible. If you wait for an “all clear” signal, you might lose out on much of the initial move… and the future profit potential.

Buying stocks when the economy is in a recession is counterintuitive… but no one will argue that buying cheaper stocks vs. more expensive stocks is a solid long-term investment strategy.

You won’t find many quality stocks on sale at the top of the bull market… But today, there are plenty of them. Next week, I’ll tell you about a few of my favorites…

P.S. Can’t wait for next week? Join us at Unlimited Income today, and get immediate access to a portfolio of the best high-growth income stocks for today’s tough market…

Many of these assets are now trading for ridiculously low prices. So I urge you to get in now… and lay a foundation of wealth for the future.