Many U.S. states are now reopening businesses, parks, and beaches.

But COVID-19, the virus that stopped much of the world economy cold and tanked the stock market, isn’t gone…

The vaccine is at least a year away… There’s no cure… Possible treatments are still being studied… No universally accepted COVID-specific drug is available yet.

And one company after another warns about uncertain earnings for the rest of the year.

Yet the market is rallying…

Last week, I explained the primary driver of this rally… along with a great way to protect your portfolio AND profit in these uncertain times.

Today, I’ll explain an important secondary driver—and what I expect in the near- to mid-term. But first, a quick summary of this unusual year so far…

May 19 marked three months since all-time market highs. Three months ago, the S&P 500 was already 4.8% higher for the year… And the tech-heavy Nasdaq Composite was up as much as 9.4% year to date.

But looking back, all was not rosy…

The market mood was so positive, it flat out ignored the many signs of a slowing economy—even before the COVID-19 disruption.

For instance, the year started with negative manufacturing data.

On January 3, the Institute for Supply Management released the December results for its Purchasing Managers’ Index (PMI), marking the fifth month in a row of economic declines… and the eighth decline in nine months.

The PMI fell to 47.2 in December—the worst showing since June 2009, the end of the Great Recession. (Readings under 50 indicate an economic decline, while readings above 50 indicate expansion.)

Foreshadowing today’s economy, 15 of the 18 manufacturing industries shrunk in December 2019. The largest contraction was reported by apparel and wood product industries.

With manufacturing contracting, poor profit outlooks were likely to follow…

So why did stocks keep going up through February?

The simplest answer is low interest rates.

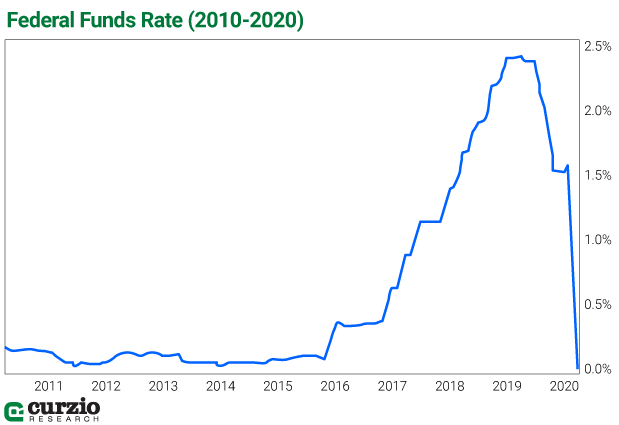

As you might remember, the Federal Open Market Committee (FOMC)—the policy-setting arm of the Fed—cut its benchmark interest rate three times in 2019. And the market was betting on more cuts for 2020.

Little did we know that these expected cuts—and much more—would come in record time.

At the end of February, as the markets began to sell off, Federal Reserve Chairman Jerome Powell issued a special statement that the novel coronavirus (COVID-19, as it’s known today), posed evolving risks to U.S. economic growth.

From February 20 to March 23, the market plunged 33.9%.

On March 15, in an emergency move, FOMC cut interest rates for the second time in just two weeks—this time to zero.

Only then did investors return to the market. Reluctantly at first, but later with force…

From March 16, the worst day of the crisis, through today (May 21), the markets rallied 23.6%.

The S&P 500 now stands only 12.9% below its all-time highs.

But the economy, which was already weakening in 2019, is likely to get much weaker. Even as we reopen, it will be a slow and careful process full of trial and error… and likely with many setbacks.

Some businesses will win, but many will lose. And consumers, who are responsible for 3/4 of the U.S. economy, will be reluctant to spend. On average, corporate profits are sure to suffer.

Judging by the market action, zero rates were a precursor to the rally.

Plus, of course, there was the promise (by the Fed) to buy bonds.

On March 23, the Fed announced that, for the first time ever, it would buy corporate bonds… in addition to removing all limits from Treasury and mortgage-backed securities buying. This was the other “all-clear” signal the market needed. (For good measure, the Fed has now added low-quality junk bonds to its list of buys. The debt-market backstopping is now complete.)

These actions—targeted at the economy, not the market—helped recreate investor optimism, and a rally followed.

But with the Fed to thank for the stock market recovery… how long can it last?

This is when FOMO, or “fear of missing out,” comes into play.

You see, the Fed can cut rates to zero and buy all the bonds it wants… but for stocks to move higher, the stock market needs more buyers than sellers. And those buyers need to actually show up with cash in hand.

FOMO is a powerful thing—especially when the money is free.

Typically, Wall Street traders operate on the assumption that when a trend is well established, it should be followed. Meanwhile, investors have been rewarded by buying on dips over the past 11 years.

As a result, investors first showed up in March, buying stocks off oversold levels. They were followed by even more buyers who feared the bargains would soon be gone… and then more, and more. And smart-money traders, once again, are riding the trend.

For the FOMO crowd, the more the stocks rise, the more attractive they become. After all, there’s nothing more bullish than a bull market.

Don’t get me wrong—there’s nothing wrong with following a trend or buying a dip.

But if I’m right, and much of the market rally is now powered by FOMO, this trend could reverse as fast as it started.

To last, stock rallies should be supported by fundamentals. Stocks represent company ownership and profit-sharing. If there’s no profit in sight, or if smaller profits demand higher valuations, investing turns into betting. Some bets may pay off, but many will not—and the less we understand about future profits, the likelier we are to make a wrong bet.

Thanks to the Fed, the odds of this bet have improved. But it’s still a chance game at this time.

Enjoy the gains—but be on the alert… They may not last.

Note from Frank: I’ve never seen a market like this in my 25-plus-year career… it’s absolutely crazy. Sooner or later, the reality of our economy is going to catch up to it. And as investors, we need to protect ourselves.

This is why I personally follow Genia’s Moneyflow Trader strategy. I’ve put together a short video explaining the best way to capitalize on a volatile market.