Investors are getting crushed lately.

The Dow Jones Industrial Average, S&P 500, and Nasdaq are down 5.7%, 7.7%, and 12%, respectively, during the first three weeks of 2022.

And lots of investors are facing even bigger losses. It’s especially true for folks who went all in on tech and “meme” stocks.

Buying low-quality stocks and the latest “hot” tech plays can work for a little while. But—as the current downturn illustrates—it’s the wrong way to invest for the long term.

These market-wide pullbacks are like a gut punch for investors with concentrated portfolios. Some may have pulled out of the market already.

But if you’re a long-term investor, throwing in the towel is the worst possible reaction. History tells us stocks are one of the greatest vehicles for creating wealth over the long term.

Today, I’ll share the “right way” to invest for growth… a few tips to help cushion your portfolio during the tough times—and benefit during the good ones… and the two sectors most likely to outperform in 2022.

How to think about bear markets

Every experienced investor knows there are inevitable ups and downs in the stock market. I’ve experienced plenty of the “downs”: the financial crisis, the taper tantrum, Ebola, China fears, the housing market crash, COVID-19, and more.

Each of these bear markets was scary at the time. But I stayed invested.

Put simply, you need to have the right mindset and some fortitude to withstand these rough periods.

Start with one simple rule…

Diversify.

As I mentioned above, plenty of investors are getting crushed right now because they weren’t invested in anything outside of tech stocks.

Believe it or not, there’s plenty of growth outside of tech. And looking at the year ahead, a few sectors are poised for a lot of it.

Spread those wings… and follow the Big Money

Keep in mind, the market moves in cycles. In other words, markets fluctuate over time… Certain sectors outperform others for a while (months or even years)… But eventually, the cycle ends, a new one begins, and different sectors begin to outperform.

Institutional investors move money in and out of groups for a variety of reasons, like inflation or rising interest rates. As a result, last year’s winners can often turn into this year’s losers, and vice versa.

It’s happened countless times over history… just as there have been several bouts of inflation and interest rate fluctuations over the past century.

By understanding how money moves in and out of different sectors, we can take a logical approach toward long-term wealth generation.

But how do we know where to target? For me, it’s understanding where the Big Money is focused… and figuring out where it’s likely headed in the future.

In these pages, we use the term “Big Money” to describe the activity of institutional investors. Put simply, these are the guys and gals with billions of dollars… enough to have a big effect on stocks. For example, when a stock increases in value with big volumes, it’s almost always a sign these Big Money investors are buying.

I learned this in my trading days on Wall Street years ago.

It’s a critical idea… especially at a time like now, when we need to find which sectors are likely to outperform during the next cycle.

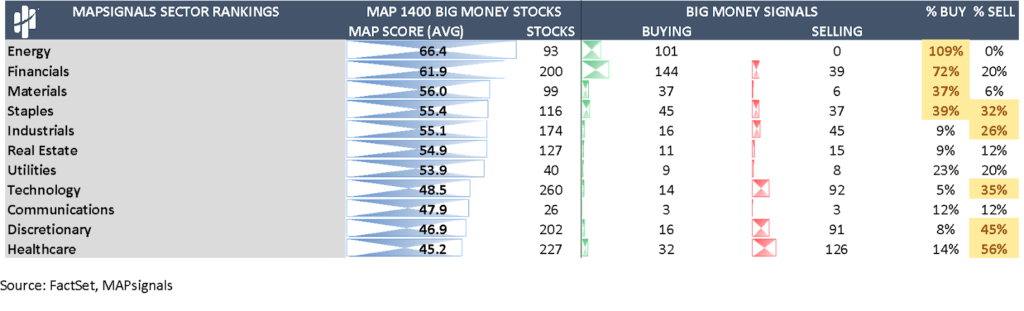

Below, I’ve shared a table showing the buying and selling across the major market sectors last week. It shows how institutional investors have been buying up stocks in four specific sectors… while selling five others.

Off to the right (the last two columns), you can see some yellow highlights. If more than 25% of an entire sector was bought or sold, it got a yellow flag. Not surprisingly, there’s been massive selling in the healthcare, discretionary, and technology sectors… along with staples and industrials.

Meanwhile, there was big buying (70%-plus) in the energy and financial sectors… These areas are where we want to focus our research.

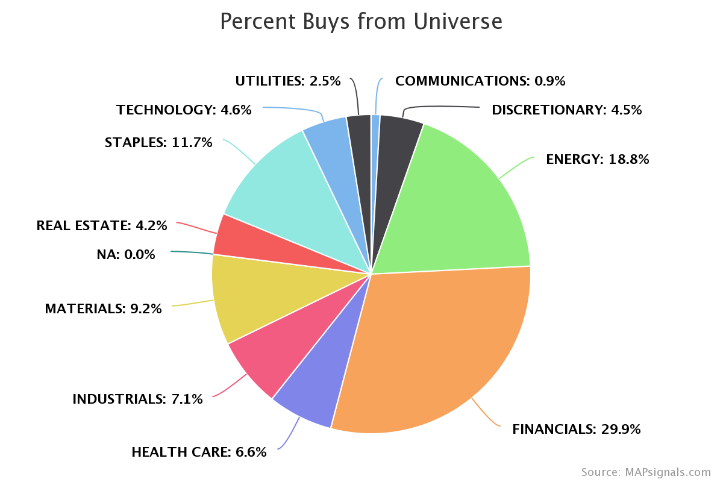

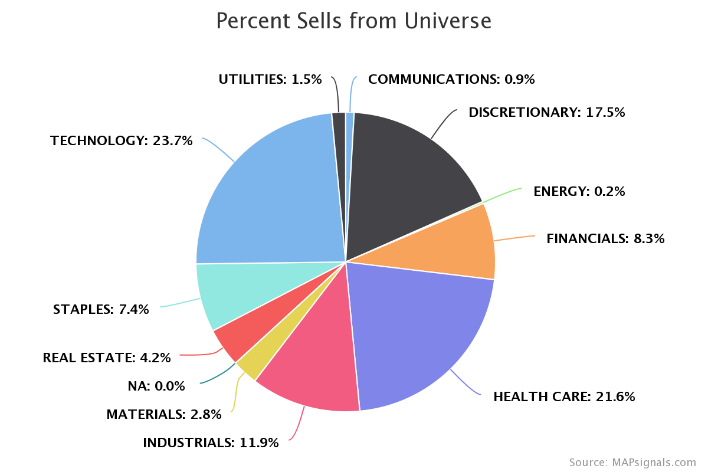

The data is confirmed by our next set of charts, which show year-to-date buying and selling by sector.

The top pie chart shows the buys. Notice nearly 50% of the buying has gone to energy and financials. And on the bottom one, you can see the sells, with 45% of all signals hitting technology and healthcare.

The takeaway here is clear: The Big Money data is telling us there’s added risk to sectors like tech and healthcare for now.

Now let’s take a closer look at the two sectors that institutional investors are buying: energy and financials.

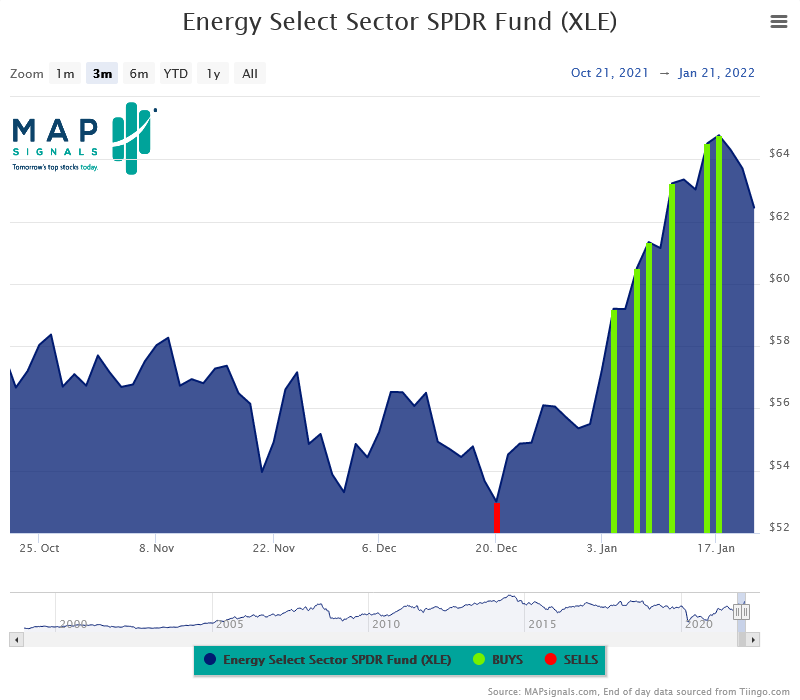

Below, you can see the recent activity for the Energy Select Sector SPDR Fund (XLE), an exchange-traded fund (ETF) benchmark for energy stocks.

Those green bars are Big Money buy signals… which show how the energy sector was attracting huge amounts of buying over the past few weeks.

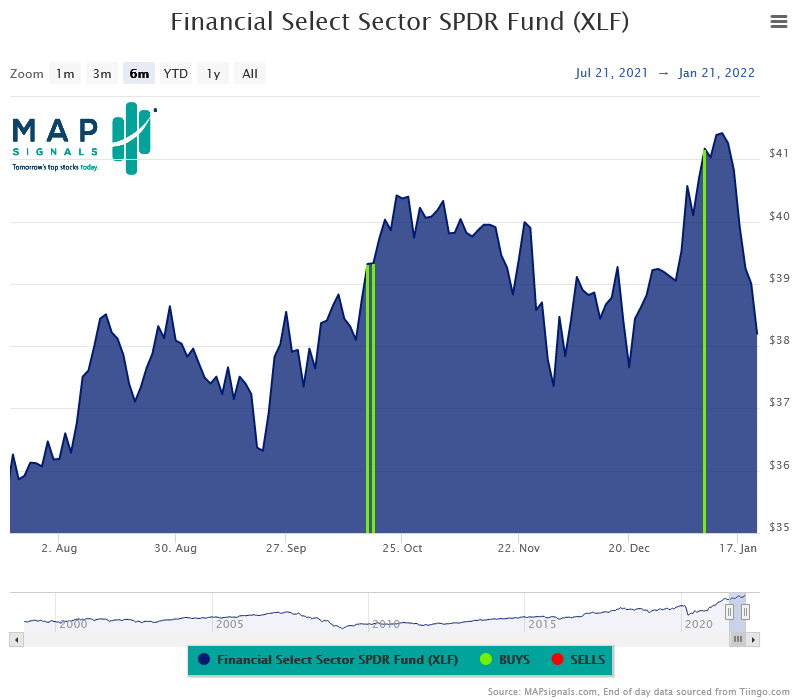

Next, let’s take a look at the Financial Select Sector SPDR fund (XLF), a benchmark for financial stocks.

This ETF was up on the year until a few days ago. It pulled back with the overall market last week, but as you can see in the chart below, the trend of Big Money has been on the buy side…

Remember, the stock market goes through plenty of short-term pullbacks. There’s no escaping the wild swings in the market right now. But it’s a lot easier to handle if you own a diversified portfolio.

Long-term growth investors need to expect some ups and downs in the markets.

But knowing this, we can invest the right way by diversifying… especially when looking for growth across multiple sectors.

And as the Big Money sector data shows us, there are growth opportunities outside tech. Specifically, financials and energy stocks could be the ticket for 2022.

Tech is obviously down, as is healthcare. But remember, these downtrodden sectors will eventually become attractive, since high-quality companies often get caught in the slaughter. That means there will be opportunities to get great stocks at sale prices.

But for now, don’t miss what’s happening in energy and financials. History has shown that those who diversify and stick with it are the ones who emerge as winners.

Stay strong!

P.S. Tomorrow in The Big Money Report, I’m recommending one of my favorite energy stocks…

It was a big winner years ago… and I’m betting it’ll be a big winner again this year as the market rotation into energy plays out.

Join today and get immediate access to this stock as soon as it’s released—as well as a diverse portfolio full of growth companies to help you build long-term wealth.