It’s easy to panic during a stock market pullback.

Everyone thinks they can keep their cool when volatility ramps up… but even the most experienced investors get a little emotional when they’re drowning in a sea of red.

If you’ve been investing for any amount of time, you know it’s not always balloons and bubblegum. Sometimes it’s downright gut-wrenching to be an investor, especially when markets pull back like they did around Thanksgiving a few weeks ago.

When the market hits you with a gut punch, you have a choice. You can either be reactive or proactive…

Today, I want to focus on the second choice: being proactive.

Keep reading… and I’ll give you the game plan I use whenever the market takes a nosedive.

What’s happening under the market surface

The major indices are at or near all-time highs right now. In fact, the S&P 500 hit a new record closing high on December 10 when it closed at 4,712.02. It’s up more than 25% so far in 2021.

But, while big indices like the S&P 500 and Nasdaq get all the headlines, the picture changes when you look below the surface…

Smaller stocks have been struggling. The Russell 2000 small-cap index is up just 12% this year. While that’s nothing to shake a stick at, it’s less than half the return of the S&P 500. And in the last month, the Russell index is down more than 8%.

Just looking at the last few weeks, we see three days when the iShares Russell 2000 ETF (IWM) was down 2% or more: November 26 (down 3.67%), December 1 (down 2.34%), and December 9 (down 2.27%).

Below you can see those them circled:

Those arrows signal the kind of days for the strategy I’m going to tell you about. And while the S&P 500 has rallied back near its all-time highs… The small-cap space is fertile territory for finding bargains right now.

4 steps to profit from a market meltdown

We can boil the strategy down to four simple steps:

- Look for days when markets are down 3% or more. These volatile days are rare… but trust me, they’re worth waiting for.

- Make your buy list. Over time, you should be adding stocks you love—but missed out on. Maybe they rose too far too fast… or you never pulled the trigger for some other reason. Write your list down. You want to be able to quickly pull up this list when the market pulls back.

- Pick “silly” buy levels—prices that haven’t been hit in months. They should be levels where you’d love to own a particular stock or fund. For individual stocks, I typically pick a price at least 20% below the current price. For ETFs (which don’t move as much as individual stocks), I look for a pullback around 10%. Again, you want to pick a price you would be ecstatic to buy at.

- When the market takes a nosedive, log into your brokerage and put in limit orders at the buy levels you identified.

Let’s look at an example…

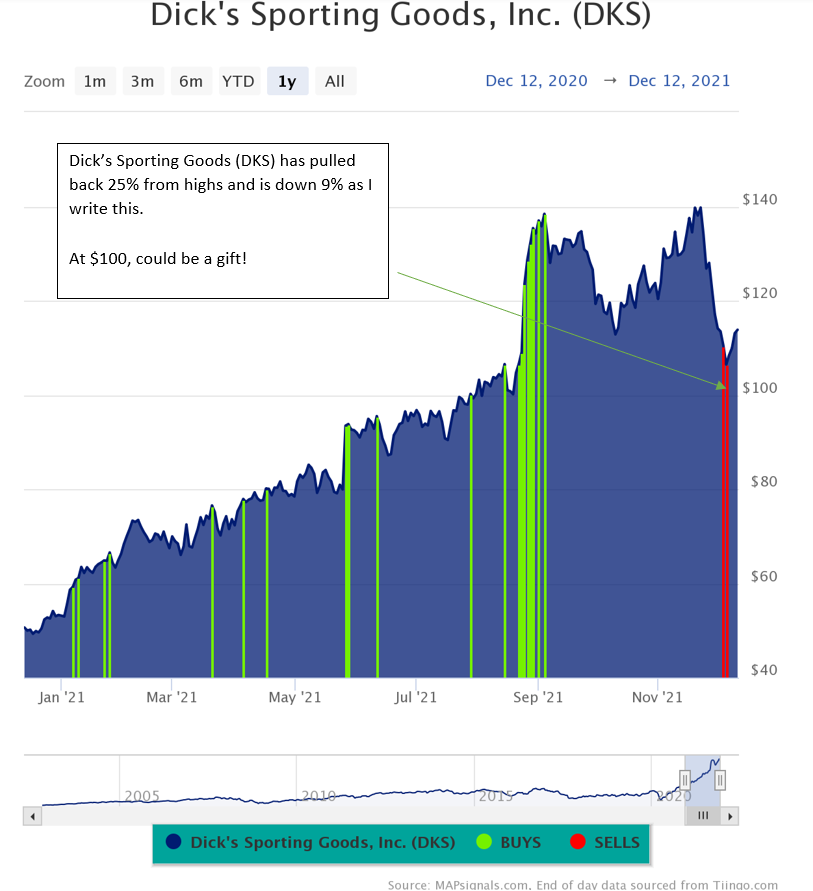

Dick Sporting Goods (DKS) has been a leading consumer retailer for years. And the stock exploded during the first eight months of 2021 (going from $64 to over $140). But Dick’s is getting swept up in the current small-cap selloff—it’s 25% from its recent highs.

This isn’t a big surprise—when there’s a broad pullback in a group of stocks (like small caps), individual names can fall sharply as investors run from the entire sector.

Here’s the one-year chart of DKS. It reached $140 weeks ago. Looking at where it’s been the past year, I’d love to buy it at around $100 (see the setup below).

That level represents where the stock sat less than six months ago. I consider it a great entry point for a solid stock getting unfairly punished. Keep in mind, when you do this strategy, make sure to only target great companies or solid ETFs.

If DKS keeps sinking and my order is executed, awesome! If it doesn’t, that’s fine, too.

The most important thing is to have a solid strategy ahead of time… before the volatility hits and knocks the market lower. When it happens, you want to be ready to pounce. That’s how you win. For more details, check out my latest video outlining this very strategy.

The bottom line

It’s easy to freeze up—or stop paying attention—when volatility hits the market. But that’s not a winning strategy. I’ve found it’s much more profitable to be proactive. When a selloff happens, place those limit orders… and the market could give you a gift.

P.S. These are exactly the kind of setups we capitalize on in my Big Money Trader newsletter…

When high-growth stocks are getting unfairly punished… We can make big, quick gains as they bounce back.

I put together a short presentation to explain how this strategy works—and why it’s so successful.