The selling in the market is off the charts right now.

We’re seeing the most selling in stocks we’ve seen since the pandemic broke out in March 2020. And there’s a good chance it isn’t over.

That’s the bad news. The good news: One of my key indicators is telling us the market is nearing oversold levels.

And when it hits them, you’ll want to buy stocks… in a big way.

The biggest selling since March 2020

As you probably know, the stock market hit a rough patch around Thanksgiving. There were a few news items scaring investors: the new COVID variant (Omicron), inflation, and Fed tapering.

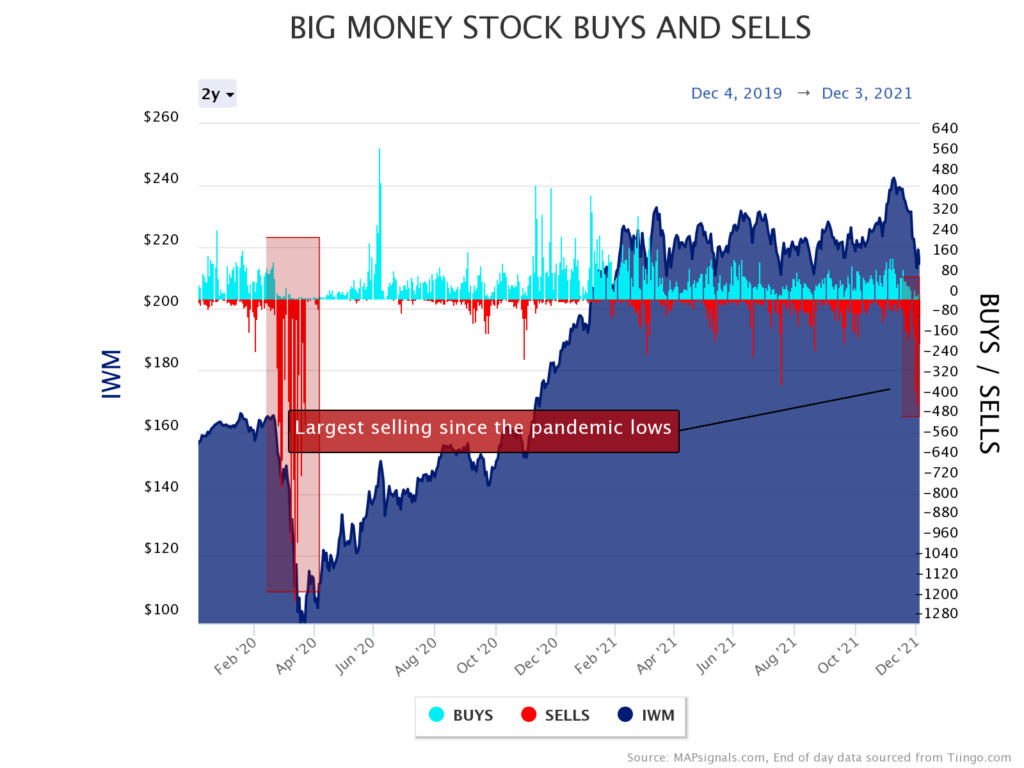

We can see the results on the chart below.

The blue bars represent Big Money buying. The bigger they are, the bigger the buying on a given day. The red lines indicate selling. When they spike, it means there’s a massive amount of money moving out of the market.

The red bars haven’t been this deep since March 2020—when COVID ramped up and terrified investors.

On the bright side, it’s nowhere as bad this time. As you can see on the chart, the Big Money data shows about 500 sell signals last Friday… less than half the 1,200 sell signals we saw during the worst of the March 2020 selling.

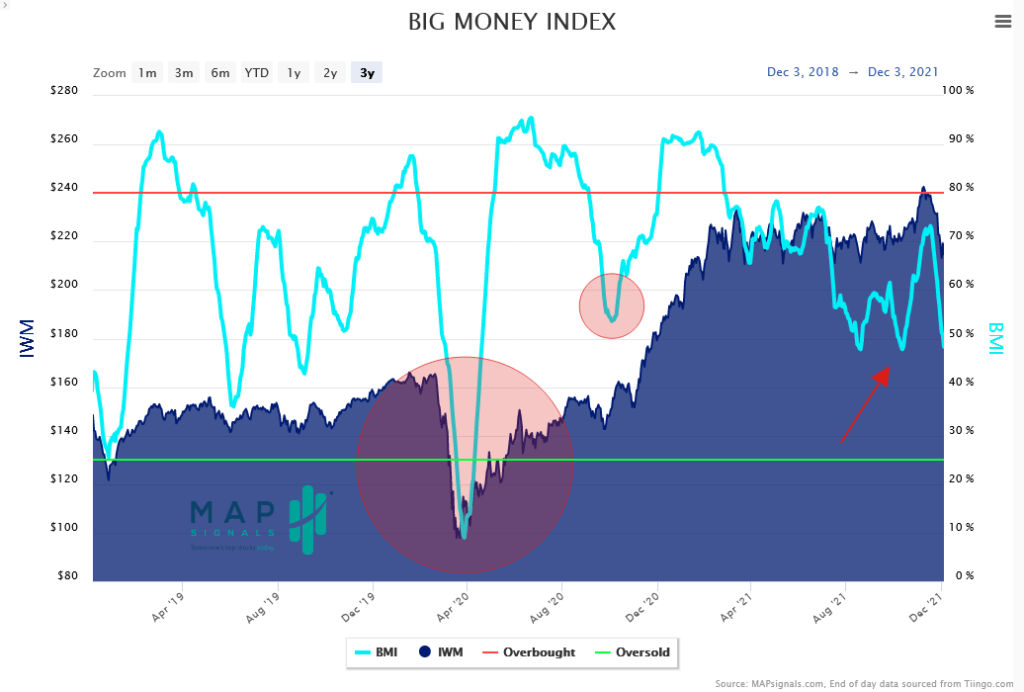

Now let’s look at the Big Money Index (BMI). It tracks the daily buys and sells of stocks, but in a moving average format. The Russell 2000 Index, the benchmark for 2000 small-cap stocks, is highly correlated to the BMI.

Simply put, if the BMI rises, Big Money is buying. If it’s declining, it means institutional investors are dumping more and buying less.

Not surprisingly, the recent selling triggered a freefall in the BMI. The index is sitting at levels we haven’t seen since March of last year (the big red circle below). Take a look:

See the green line around the 25% level? That’s the threshold for determining when stocks are hitting oversold territory. (I wrote about this indicator in March of 2020 too.)

Simply put, when the BMI reaches the green line, it’s a powerful bullish signal.

The only drawback is it doesn’t happen often. In other words, the stock market rarely dips into oversold territory. It happened once in 2016, twice in 2018, and once in 2020. That’s not too often.

Looking back, it’s clear these were great times to buy stocks. If you bought the SPDR S&P 500 ETF (SPY) each time the BMI hit the 25% line over the past 5 years, your average one-year return was more than 35%.

Obviously, you want to buy when the stock market enters into oversold territory. We’re not there yet. But according to my calculations, if this deterioration continues, we could reach that area in two or three weeks.

In short, there’s a good chance we’ll have a massive buying opportunity just in time for Christmas.

So, how do you play this situation?

You’re going to want to make a buy list. These are a handful of stocks you’ve been eyeing, but which haven’t yet reached your extremely discounted “Christmas” price.

And you can expect some fantastic bargains in this rare oversold period.

At the top of my list are amazing tech companies… the ones that dominate their field and make lots of profits. Many of them are household names I’ll mention in a moment.

And I’m prepping now because tech stocks have gotten killed in the current selloff. One reason is growth fears over the Omicron variant. But tech stocks have been one of the best-performing sectors for years.

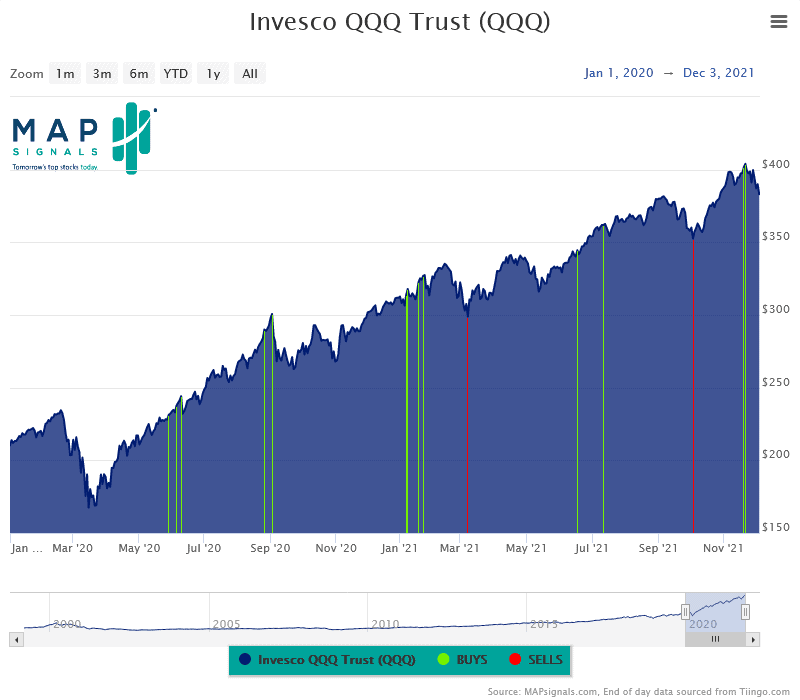

I expect that theme to continue in the years ahead. When the market becomes oversold, a great way to play a big bounce is the Invesco QQQ Trust (QQQ). It holds the best tech stocks out there… names like Apple (AAPL), Amazon (AMZN), NVIDIA (NVDA), and more.

Big Money likes QQQ. Here’s a 1-year chart showing the Big Money buy signals (green bars) and sell signals (red bars):

Notice how the chart is clearly in a long-term uptrend. Also, it tends to bounce soon after each red signal. An oversold market will certainly bring more red bars… potentially just in time for Christmas.

Here’s the bottom line: There’s big selling happening in the stock market. In fact, it’s the most selling we’ve seen since March 2020. If it continues, we’ll hit oversold levels within a few weeks… and that’s a gift.

As I mentioned above, buying at oversold levels is a great way to boost your returns (remember, the S&P 500 averages a 35%-plus return over the next year if you buy when the BMI hits 25).

In other words, stocks tend to bounce hard and fast when this rare signal fires. I’ll keep you posted… and give you a heads up when the stock market officially hits oversold territory.

P.S. Big Money Trader members: This market is lining up incredible trading opportunities for us… So keep an eye on your inbox.

Later this week, I’ll send you my favorite of these opportunities. If you’re not yet a member, I urge you to take advantage of the rare market situation we’re in… and start scooping up quick gains on fantastic stocks.