The Federal Reserve hiked interest rates Wednesday by another 0.75%—the third such hike in a row—in its ongoing effort to fight inflation. Rates now sit at 3–3.25% (up from zero at the beginning of the year).

Although the decision was telegraphed well in advance, stocks went on a rollercoaster: They dipped… then rebounded… then plunged… and closed down 1.7% for the day.

But the Fed isn’t alone: Central banks across the globe are raising rates…

Earlier this month, the ECB—the central bank of Europe—raised its key rate by 0.75%.

Yesterday, the Bank of England hiked rates to 2.25%.

And in a truly historic move, the Swiss National Bank—the oldest central bank in the world— hiked rates from -0.25% to +0.5% (despite seeing relatively moderate inflation compared to the EU).

U.S. markets are digesting the Fed’s new “higher-for-longer” interest rate path…

Just a month ago, many fully expected the rate-hike pain to be short-lived… and for the Fed to start cutting rates early next year.

In the wake of Fed Chair Jerome Powell’s latest comments, this is no longer the case—it’s clear the Fed is firmly set on its current course. A hard landing is now more likely—and the market isn’t going to like it if that happens.

In other words, there’s more pain ahead for investors both at home and abroad.

So what can investors do to stay safe—and profit—in a high-inflation, rising-rate economy?

Here are 3 strategies I recommend for today’s markets…

No. 1: Cash

Cash is one of the safest instruments around: What doesn’t go up… doesn’t come down.

Because cash is essentially risk-free, it helps investors weather bouts of volatility… and serves as a source of funds when new opportunities arise.

It’s true that cash loses its purchasing power to inflation every day—and normally, that’s not acceptable…

But the current environment is far from normal.

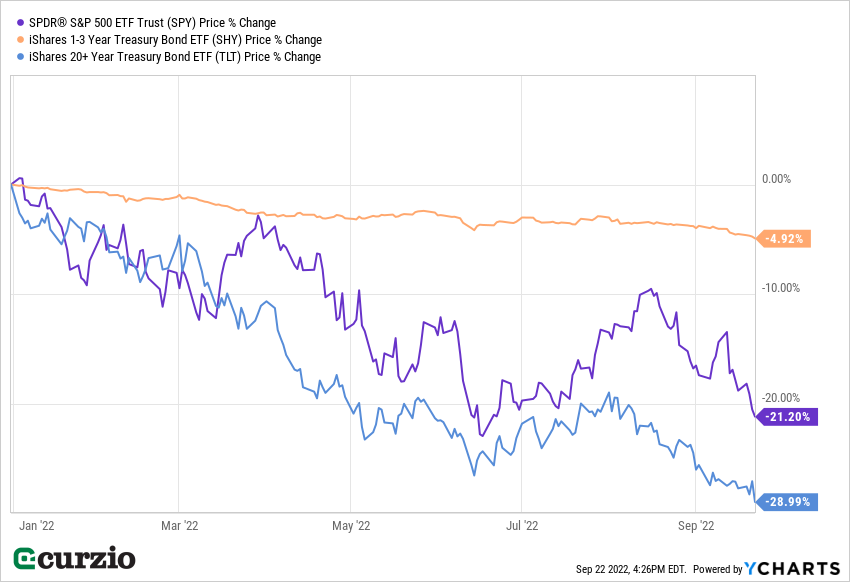

Both stocks and bonds are way down year to date…

The bottom line: There are very few places to hide in this market. So it’s best to keep some powder dry.

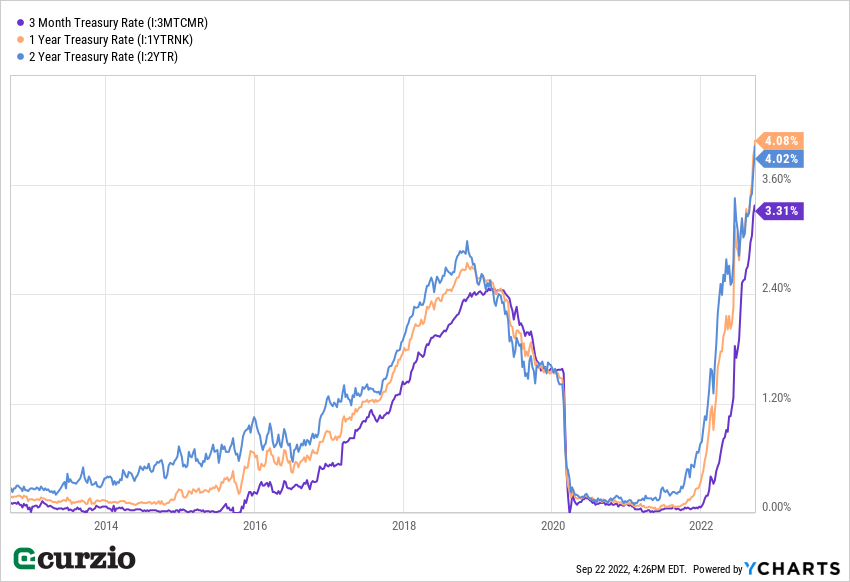

The good news is, there’s an inverse relationship between bond prices and yields. So if you want to earn returns on your cash, consider short-term bonds. These are liquid assets, so they act almost like cash… And thanks to the Fed’s rate hikes, they offer yields not seen in more than a decade.

Just a year ago, a U.S. Treasury 2-year note was yielding a measly 0.2%.

Today, it yields about 4%. And a 3-month Treasury now yields a massive 3.3%, almost double the S&P 500’s 1.7% dividend yield.

The price of bonds could decline further. But this risk is minimal for short-term bonds… and you’re getting sizeable income.

Plus, you don’t have to buy Treasuries to take advantage of these rates. You might need to shop around… but short-term yields have already translated into higher rates on savings accounts and CDs.

This will allow you to keep some easily accessible cash on the sidelines during the worst of the market storm… and maintain your purchasing power.

No. 2: U.S. stocks

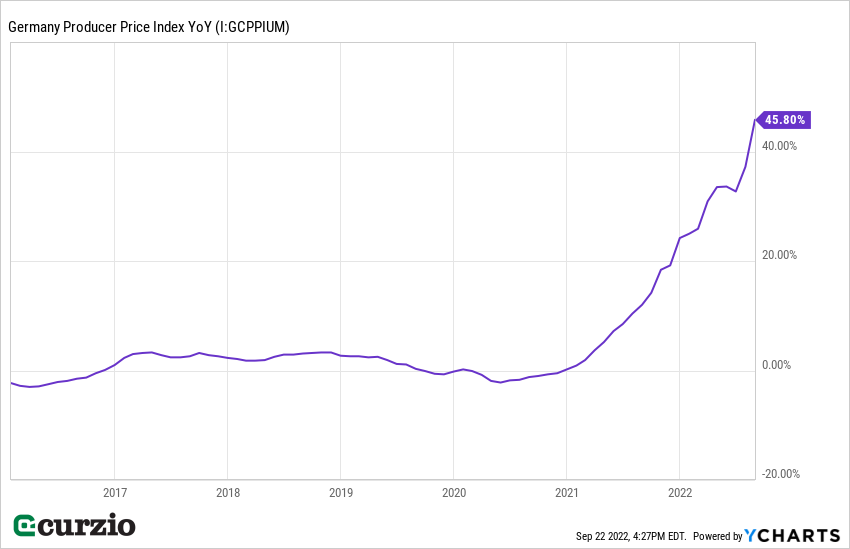

Inflation has been particularly out of control in Europe—especially as it faces a massive energy crisis.

We don’t need to look further than Germany, the industrial heart of Europe, to see the evidence.

While consumer inflation looks relatively tame, prices for producers (PPI inflation) are up 7.9% over the past month and almost 46% year over year. Energy is up 139%… and electricity has risen 175% vs. a year ago.

Europe has already embarked on the rate-hiking path, but it can’t beat down this level of inflation with interest rate hikes—which means a deep recession is inevitable across the EU.

In short, while the near-term outlook for U.S. stocks has deteriorated, European equities are set to suffer even more.

Energy independence, and the power of the dollar as the world’s leading reserve currency, are just a couple of competitive forces that make the U.S. your best long-term bet for stocks.

Already, we’re seeing some of the best stocks in the market selling at prices not seen in years…

As painful as bear markers are, they offer some of the best buying opportunities.

No. 3: Hedges

When the markets are as volatile as they are now, one of the keys to staying safe—and profiting—is to position yourself for every kind of market.

If you only own long positions, it’s hard to make money in a sideways market—and nearly impossible when everything is selling off.

Put options or inverse ETFs can help balance out your long positions. Think of your hedges as insurance against a falling market.

An inverse ETF will move in the opposite direction of the associated ETF.

For instance, let’s say that at the end of 2021, you were confident the market was due for a selloff.

To benefit, you could have bought the ProShares Short S&P 500 ETF (SH), which promises to deliver the opposite of the market return. In other words, if the S&P 500 goes down 2%… SH will go up 2% over the same timeframe.

Alternatively, you could’ve bought a put option.

And all else equal, the value of a put option will move higher when the price of the underlying stock moves lower.

For example, Big Data and cloud stock New Relic (NEWR) was holding up relatively well in early 2022—especially compared to many of its cloud peers…

But if you were skeptical in January of its growth prospects, buying a put could have been a way to profit from the potential decline (with risks limited to the original investment).

If you had, you’d have been in a winning position on February 9, right after NEWR reported a disappointing quarter…

When the stock plunged 28% in just one day, the option we owned in Moneyflow Trader gained as much as 165%.

Options are a tool to be used carefully… If you’re wrong, your put could expire worthless. So only invest what you can afford to lose on the “insurance premium.”

But if you plan carefully and understand the risks… a put can provide great protection against a falling market… exactly when you need it most.

If you’re holding cash in a higher-yield account along with hedges, you’re in a strong position to pick up great stocks at a bargain. Long-term, the U.S. market is where you want to be.

P.S. In Moneyflow Trader, I just shared a great hedge against Europe’s struggling economy. And 2 more hedges to play a potential 2008-level housing crisis…

Join us today to find out what they are—and get a full year of membership free.