Markets have a tendency to overshoot both on the upside and the downside…

That means while bull markets can keep shooting higher than fundamentals warrant (as we’d been witnessing up until recently)… bear markets, too, can go deeper than expected.

Just look at the Great Recession of 2007–2009… the dot-com bubble bust from 2000… or the panic-selling from just two years ago, when COVID disruptions sent the S&P down 34% in just over a month.

While it’s hard to swim against the tide and stay bullish when the markets are falling… periodic selloffs are par for the course—but over time, markets tend to go up. And ultimately, these bear markets turned out to be great long-term buying opportunities.

You just need to keep your cool during selloffs to take advantage of them.

Here are some practical steps you can take in a downturn… and one time-tested way to make money from declining stocks.

1. Don’t get swallowed up by day-to-day noise

While financial media can be a great source for timely information, don’t stay glued to your TV or computer screen.

Following every tick of the tape—especially during heightened volatility—can easily take you off your long-term course… and prompt you to buy or sell on a whim, without researching a stock in-depth or taking your personal circumstances into consideration.

Do your homework on the stocks you want to buy… and follow these 3 simple rules for knowing when to sell.

2. Look for quality in a bargain

Just because a stock is down 50% off its recent highs doesn’t mean it’s bottomed.

And if a stock has bottomed, that doesn’t mean it’s about to shoot sharply higher.

One lesson we can take away from the dot-com bubble: Even quality stocks can take years (if not decades) to reclaim their previous highs… and some never do.

And, more importantly, a lot of stocks don’t survive a worsening economy and tougher markets. (I cover how to spot stocks like these in the article mentioned above.)

That said, for many stocks, pullbacks can mean a bargain… and an opportunity for long-term profits.

If a stock is selling off alongside the market, but nothing substantial has changed in its story and fundamentals, a weaker market environment is often a perfect opportunity to open a new position… or to increase your existing stake (and lower your cost basis).

To separate true bargains from dead-money investments, stay proactive: Often, the assets that underperform during the good times are your best bet in tougher times…

For example, precious metals and oil are just a few of the assets set to benefit if high inflation takes hold of our economy.

And right now, many of these stocks are undervalued.

Nobody wanted gold when inflation was low and money was cheap… despite its safe-haven and monetary properties. But in times of geopolitical turmoil (like today)—when central banks aren’t in a position to effectively fight rising inflation—precious metals become the asset almost everyone needs… rallying to new records.

From a market pariah to its champion, oil and energy-related securities have been benefiting from the stronger economic growth, beating the market (and every single major market sector) over the past year. Nevertheless, oil stocks are still underperforming the market longer-term.

Remember: Valuation discrepancies might last a long time. At extremes, they can get totally disconnected from economic reality. And playing such disconnects can be a very effective tool to profit as the circumstances around us change.

3. Invest in portfolio insurance

Similar to life insurance, portfolio insurance protects an investor against an adverse event.

One time-tested way to bulk up your portfolio defense is with put options.

Owning a put option gives you the right, but not the obligation, to sell a specific stock or ETF at a specific (strike) price before a certain date (expiration).

Just like insurance, buying a put costs money…

But here’s the good part: This initial outlay (think of it as an insurance premium) is the maximum you can lose if the underlying asset is healthier than you thought… and doesn’t decline below your strike price by expiration.

But—like insurance—it pays up when things go sideways (in this case, for the underlying asset).

That’s because, all else equal, the value of a put option will move higher when the price of the underlying stock moves lower.

In other words, if you own a put on a specific security, you’re positioned to benefit from a decline in the security’s value… And the faster and sharper that decline, the more you can potentially make on your put trade.

Understanding the potential upside and downside is critical when playing an anticipated decline in an individual stock (or the entire market). When you’re right, your profits can be significant.

Let’s take a Big Data and cloud monitoring company: New Relic (NEWR), which I’ve been watching for years, as an example.

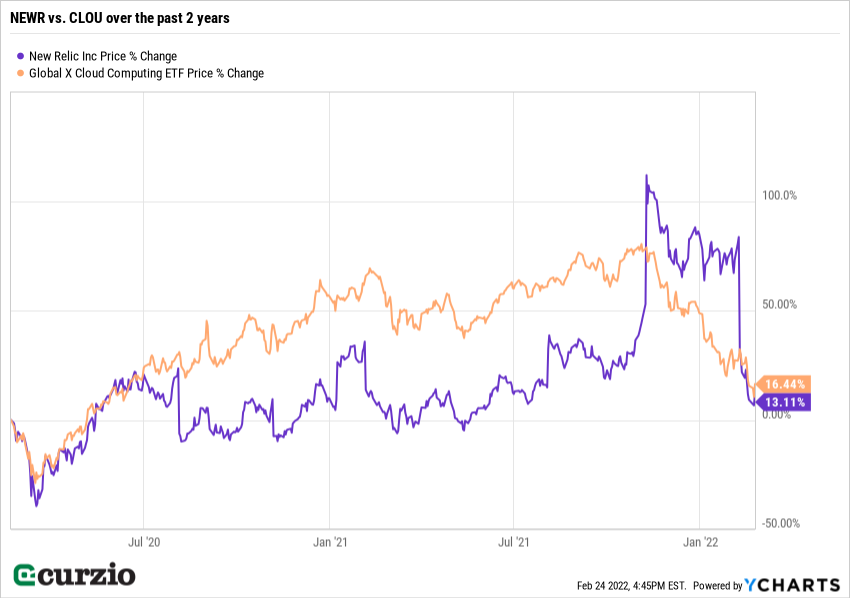

Early in 2022, this stock was holding up relatively well—especially compared to many of its cloud peers—represented on the chart below by the Global X Cloud Computing ETF (CLOU).

But if you were skeptical in January of its growth prospects, buying a put could have been a way to profit from the potential decline (with risks limited to the original investment).

If you had, you’d have been in a winning position on February 9, right after NEWR reported a disappointing quarter… just like we were at Moneyflow Trader.

When the stock plunged 28% in just one day, the option we owned gained as much as 165%.

Puts should be used carefully. After all, if you’re wrong, your put could end up expiring worthless. But if you understand the risks and limitations… a put can be a great hedge against a falling market.

Wrapping it up

You should always be prepared for a downturn. By understanding the investment tools at your disposal—including put options and the other steps I discussed today—you’ll be positioned to benefit from shifts in the market that send most buy-and-hold investors running for the exits.

Having an extra hedge or two will position you to profit from the market’s downside… and, more importantly, will help you sleep at night when volatility ramps up.

Editor’s note:

To take full advantage of Genia’s options expertise, make sure to check out Moneyflow Trader.

Since taking over as editor two years ago, she’s closed, on average, one triple-digit winner every 10 weeks.

Learn why Genia’s Moneyflow Trader strategy is the best way to capitalize on a weak market.