With the U.S. presidential election right around the corner, you can bet we’re going to see some market-moving headlines leading up to Election Day.

Historically, the markets tend to get volatile leading up to a typical presidential election (and it’s safe to say this one has been anything but typical).

Scary headlines can catch novice investors off guard… but don’t let this shake your game plan. Remember, media companies rely on your views and clicks—so they’re using scare tactics to grab your attention.

The smart thing to do is ignore the headlines.

Will markets most likely bounce around for the next few months? Yes.

Can investors use this volatility to their advantage? They can…

Set a price that makes sense for you

We’ve all seen stocks race higher at one time or another. But chasing a stock with a lot of momentum can be costly if you buy at the wrong level.

There’s no secret formula to win all of the time. But it helps new and experienced investors alike to set price targets…

A price target helps reduce some of the emotional reactions that a volatile stock market can create. Here’s an example:

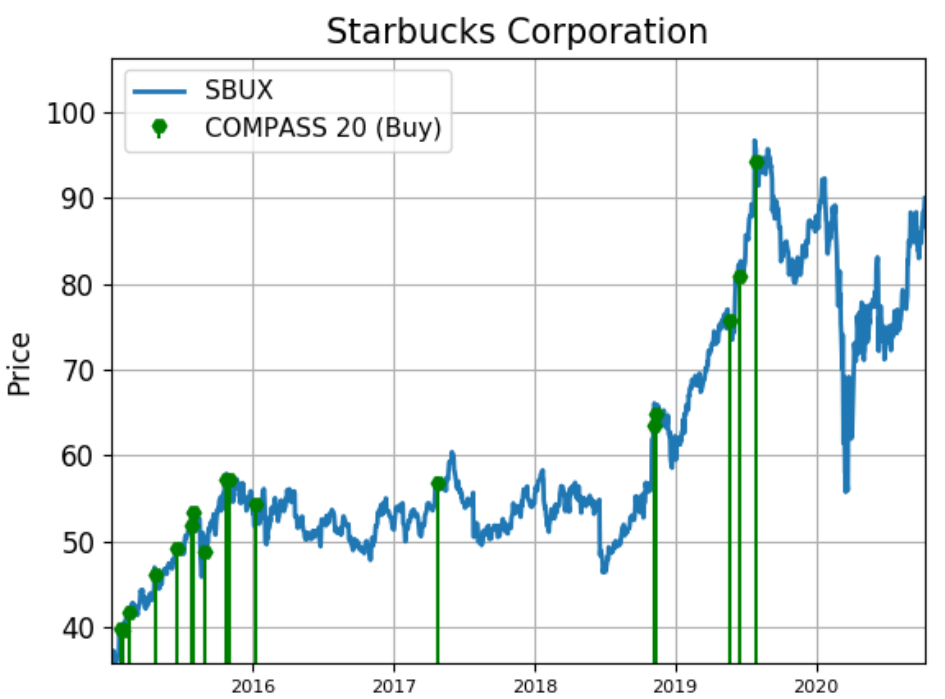

Let’s say that I have my eye on Starbucks Corp. (SBUX). (I’ve actually owned it for years.) For this exercise, let’s assume I’ve done my homework and I love the long-term chart and story.

As most of you know, I look at Big Money for my edge. Here are all of the top Big Money signals that SBUX has made since 2015:

This chart only shows the times that Starbucks was a top pick based on my research. But I know that the stock is more volatile than this long-term chart shows.

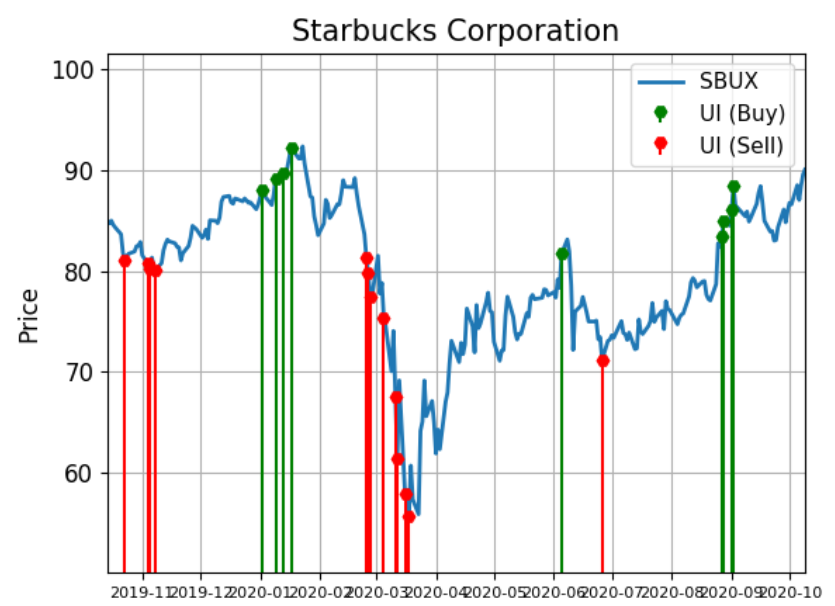

So, my next step is to look at the one-year chart of all Big Money signals (not just the top ones):

Red indicates selling in the stock, while green indicates buying. I’ll bet there were scary headlines during many of those red areas… and that’s where the opportunity lies.

So, back to my example. Rather than hopping onboard when markets are “high,” let’s pick a level that makes sense based on my hypothetical framework above. Looking at the last chart, I see that red signals actually look like good areas to dip my toes… i.e., buy.

I’ll set my target at $75. Keep in mind, we may never get there. But imagine doing this process on a handful of stocks. The odds of me getting into a stock at a better level is that much greater.

The fact is the markets are going to bob and weave in the near term. But don’t let it throw you off balance. Make a game plan.

And be careful with headlines. It’s only scary if you let your emotions win.

Sincerely,

Editor’s note: The coming election may be the most important of our lifetime… and there’s a BIG piece of the story the media isn’t telling you. Everyone is focused on Trump vs. Biden… but nobody’s talking about the “third option”—the one virtually guaranteed to be the real winner of this election.

If this plays out, you need to be prepared. Download Frank’s FREE, urgent report.