The GameStop frenzy was fun while it lasted…

The stock is up 700%-plus for the year… although down 50% off its highs.

There will be plenty of other wild rides like GameStop… Such is the nature of stock trading: We all want to find undervalued (or overvalued) treasures.

Traders buy and sell with short-term goals in mind… but can easily get trapped in a bad stock or a difficult market.

Meanwhile, time—the only resource that cannot be recouped—will fly away.

This is why it’s essential that the Robinhood generation invest not just for short-term gains, but for long-term wealth accumulation.

I get it—when you’re young, it’s easy to think you’ve got all the time in the world to worry about retirement savings.

But what many of us wish we’d understood at 20 is time is the real key to wealth… and each day, a little of that invaluable resource slips away.

So I encourage you to share this article with a son or daughter, niece or nephew…

It will show you why nothing works as consistently to help you build wealth over time like dividends. But don’t worry—you don’t have to forego the excitement of trading… or the promise of big short-term gains.

As you’ll see, these different strategies can be easily combined—as long as you understand the potential impact of each component.

And one of these components is time.

In investing, the more time you have, the better off you are, all else equal.

If you find a great income stock, you can own it for years and your wealth will grow… especially if you reinvest dividends, or direct your broker to invest whatever income you earn from a stock back into that same stock. (Most brokerages will do this for you automatically.)

Dividend reinvestment helps you increase your core position over time without investing more of your capital… and enjoy higher dividends generated by holding increased shares.

Plus, reinvestment has a market-timing mechanism built in: When the stock is down, the same dollar amount in dividends will buy you more shares… and when the stock is up, they’ll pay for fewer new shares.

In sum… you invest, sit back, and watch your wealth grow. If you start at 20, you could easily become a millionaire by the time you’re 65.

Don’t believe me?

Let’s look at some numbers.

Over the past 10 years (March 2011–March 2021), the market returned 13.9% annually on average….

But let’s be conservative when it comes to expectations… and cut this number in half.

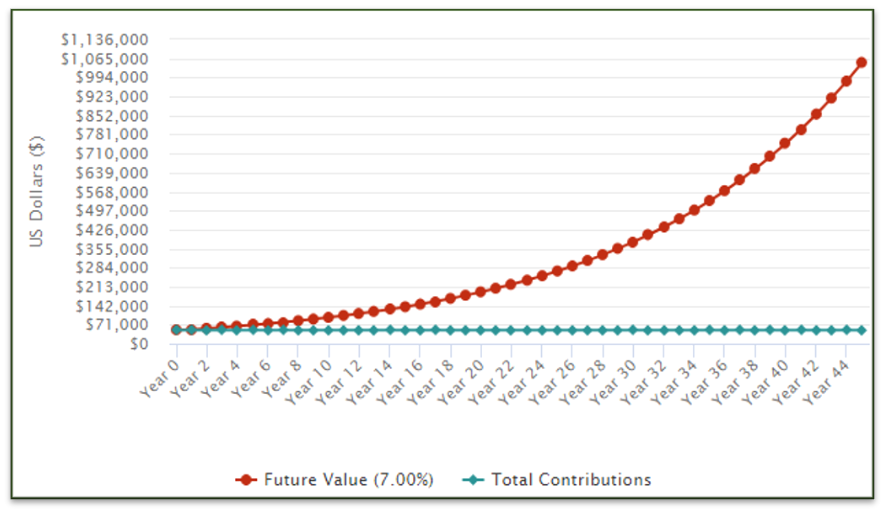

Now let’s see what a 7% annual return can do to a small initial investment over a long period of time.

On a graph below I charted such a scenario.

Let’s say at 20, you’re given $50,000 to invest… and this money earns a 7% return, compounded annually.

You let the money work for you in the market—and don’t add an extra penny to that initial $50,000 over the next 45 years.

In 45 years—by the age 65, when you’re ready to retire—you’ll have a cool $1 million in earnings (on top of the original $50,000).

This is what the red line on the chart below shows—the compounding effect of growing by 7% year after year.

And the longer you allow the compound interest to accumulate, the stronger the total result is.

For example, by year 40 (when you’re 60), you’d only have $748,000. But in another five years, this amount would grow by a third. That’s the power of compounding.

$50k initial investment, no additional contributions,

7% annual return

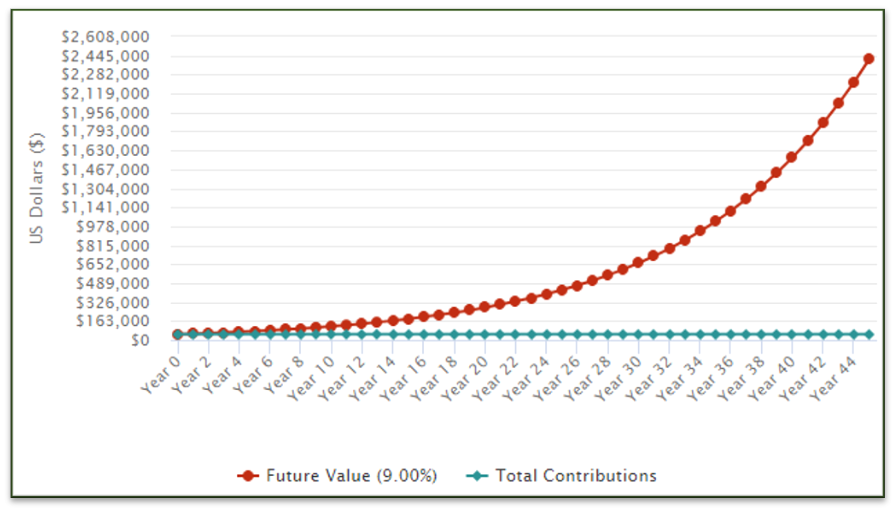

Upping the expected annual return to just 9% will change the picture dramatically: In this case, as you can see on the chart below, you’d accumulate your first million by year 35… and would have more than $2.4 million by year 45.

$50k initial investment, no additional contributions,

9% annual return

Keep in mind, these are ideal scenarios to illustrate the power of compounding… and the younger you start, the wealthier you can become with little effort.

Of course, not many of us have a lump sum to invest and forget.

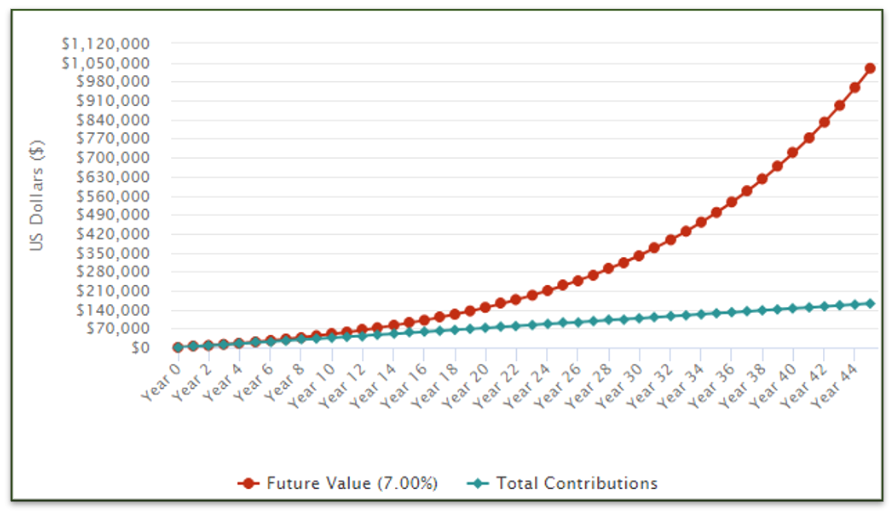

More realistically, we start small… and, more often than not, we use monthly contributions—such as 401(k)s—to grow wealth.

In such cases, time also works wonders.

Here’s a likely scenario…

At 20, you have no nest egg for an initial investment, but you manage to squirrel away $300 each month. This monthly contribution becomes a habit… and continues for the next 45 years.

Congratulations! Given our conservative assumption (your investment portfolio returns 7% annually), you still retire a millionaire. In 45 years, you’ll have $1,028,697 in assets—and you’ll have contributed just $162,000 (the green line on the chart below).

$0 initial investment, $300 monthly contributions,

7% annual return

I encourage you to test a variety of scenarios and play with this calculator or similar ones—you’ll get a much better feeling of how compounding works… and of just how big a role in your wealth building it can play over time.

If you buy the right income stocks, you can basically “buy it and forget it.” There are countless stories of people throwing $1,000 in a stock in year one… and discovering it’s worth many times that in a few years’ time.

But you don’t need to own all your stocks forever to benefit from the power of income strategies and compounding. And you don’t have to commit all your investments to income-focused strategies.

If you enjoy the excitement of trading, a good solution is to invest a healthy portion of your money in quality stocks for long-term wealth accumulation, and the rest in riskier sectors or shorter-term goals.

In many cases, your 401(k) investments will account for a significant part of your long-term wealth-building strategies. If you haven’t started a 401(k) account but have this option through your employer, don’t delay: In addition to the power of time, you’ll benefit from its tax-deferred nature… and from the built-in discipline of automatic investments. (See: The simplest way to time the market… and you’re probably already doing it.)

In most cases, growth stocks that also pay dividends are your best long-term bet…

Such stocks can appreciate in price and grow dividends over time, creating a huge boost for the long-term portion of your portfolio. These are the kinds of stocks we buy in my advisory, Unlimited Income.

But whatever type of income stocks you choose, the key is to pick companies with strong long-term prospects… The power of compounding will take care of the rest.

Editor’s note:

To jumpstart your way to becoming a millionaire, check out Unlimited Income, where Genia shares stocks that deliver market-beating dividends AND quick capital gains as high as 104%.

Become a member today and you’ll not only receive a 66% OFF discount…

You’ll also receive Genia’s urgent special report, Income Stocks to Buy & Avoid Today… so you can begin compounding wealth immediately.