“Buy when there’s blood in the streets.”

This famous quote is attributed to Nathan Meyer Rothschild, a powerful European banker/investor in the early 1800s. He’s also a member of one of the most famous families in the history of finance.

The quote highlights a timeless idea for investors… Specifically, how to profit during troubled times.

If you’ve been watching the news, you’ve probably heard about the trucker blockades and protests in Canada against COVID restrictions. The story has dominated the recent news cycle… and added a major bottleneck to the U.S.-Canada transportation network.

In short, a major supply line from Canada to the U.S has been shut off… creating a domino effect in the shipping/freight market… and wreaking further havoc on supply chains.

It’s a troubling situation. But as the Rothschild quote reminds us… A crisis can mean opportunity for investors.

You see, the bottleneck is prompting companies to find alternative transportation options. For example, General Motors (GM) is one of the major companies impacted by the supply chain disruption. It’s looking for solutions… like flying parts from over the border to keep U.S. production going.

According to the Big Money data, not only is air transport benefitting… so is the sea. The following stocks jumped out last week… even as the overall market continued to sell off.

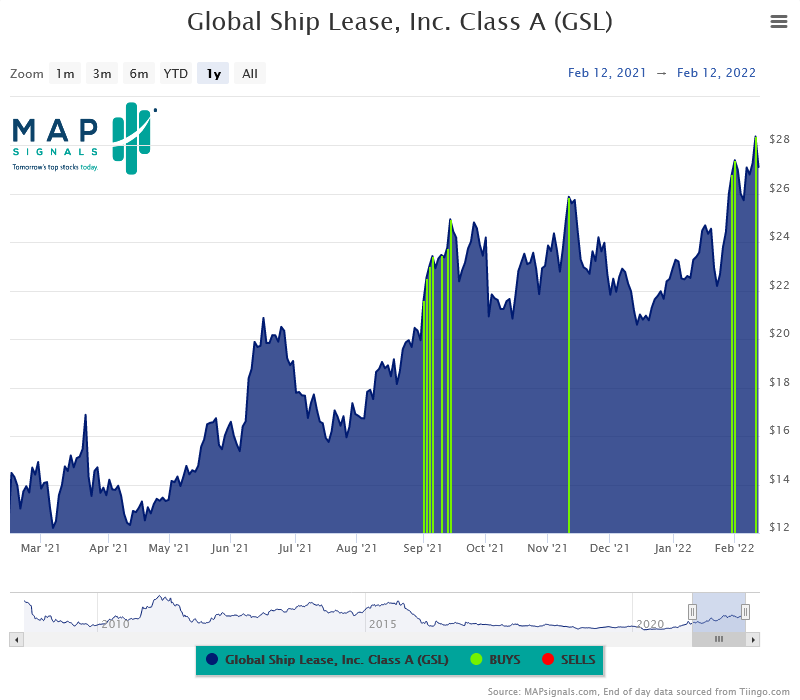

Global Ship Lease, Inc. (GSL) is a London-based company that owns and charters containerships to shipping companies. It currently pays a 3.52% dividend. The company started getting Big Money attention last September… but look how it saw fresh buying last week (the green bars in the charts below represent days when Big Money was heavily buying the stocks… while the few red bars represent Big Money selling):

It’s one thing to see a single company surge higher, but when similar stocks are attracting big buying… investors should take notice…

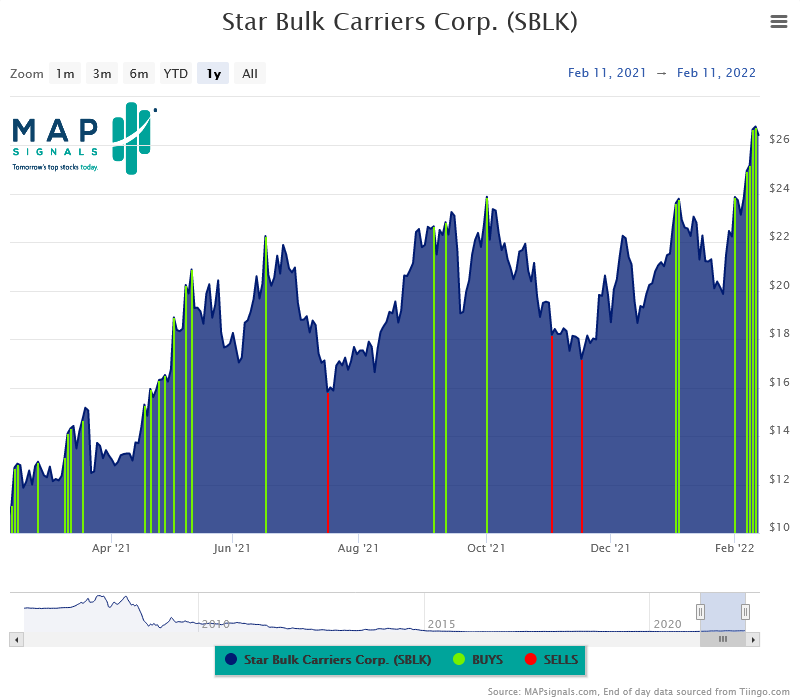

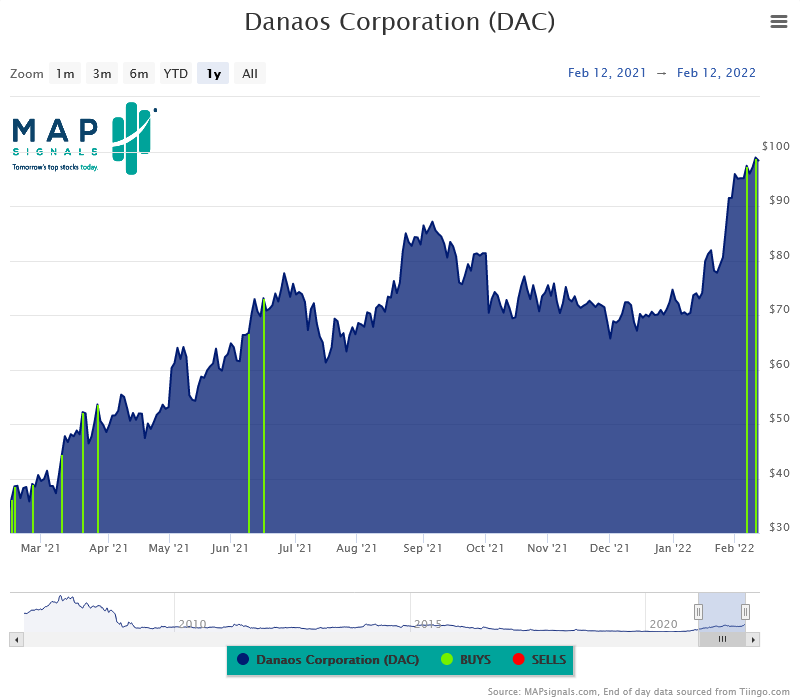

Star Bulk Carriers Corp. (SBLK), a bulk materials shipping company, and Danaos Corporation (DAC), which owns and operates containerships, also saw a Big Money lift last week:

Both Star Bulk and Danaos are based in Greece and operate globally. They also currently pay sizable dividends (18.92% and 3.05%, respectively). Plus, DAC had strong recent earnings and SBLK, which reports this week, is expected to show growth too.

To play this supply disruption theme over the near term, you can take a closer look at the three stocks I’ve highlighted. Keep in mind, this is a very small subsector in the transportation space, so think of this as more of a trading opportunity than an investment. These stocks are very volatile… especially as they go through boom and bust cycles.

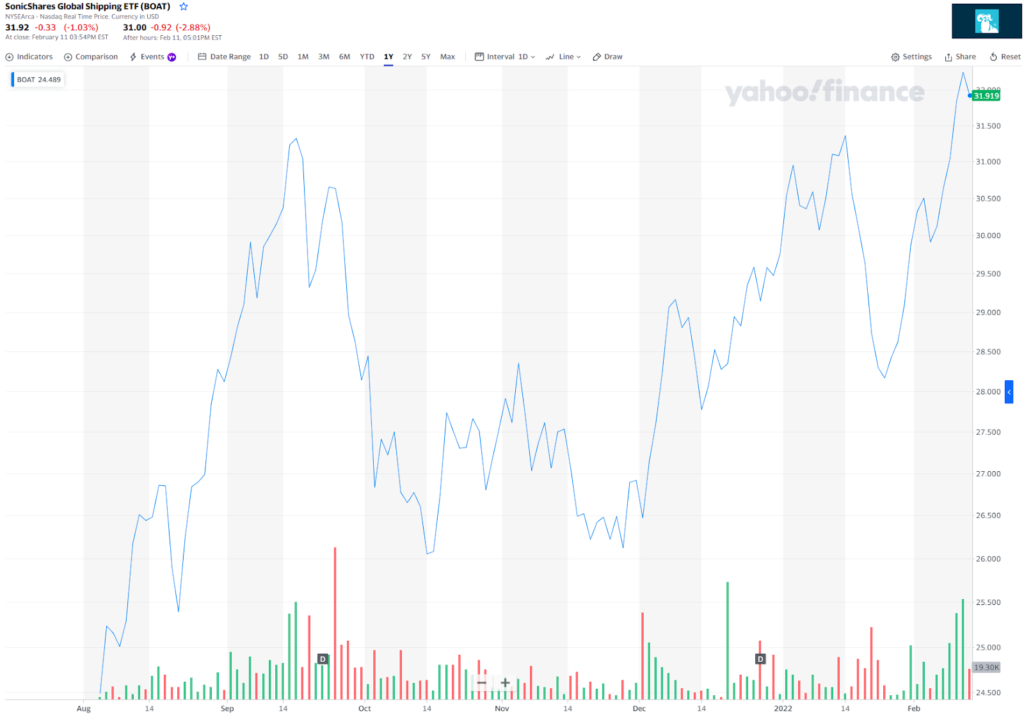

Another way to play the sector as a whole is via an exchange-traded fund (ETF) like the SonicShares Global Shipping ETF (BOAT).

This fund provides exposure to a global portfolio of ocean-based shipping stocks. GSL, SBLK, and DAC are among its 50 current holdings.

BOAT just began trading last August, so it’s a thinly traded fund. That means you should expect this ETF to trade with a wider bid/ask spread compared to bigger, established ETFs (that have more assets under management).

But take a look at BOAT’s trajectory since inception:

After a very volatile few months, the fund has been ramping up…

With commodities and other supplies in high demand, companies are looking at different ways to get their materials… particularly containerships on the world’s waterways.

For traders, this can be an opportunity to take part in a potentially broadening transportation market. Big Money is honing in on a few shipping-related firms in particular. If the Canadian border situation isn’t resolved soon, this group could keep rising…

If you’re a Big Money Report member, keep an eye on your inbox… Next week, I’ll update you on what’s happening in today’s market… and reveal my favorite materials stock, which is starting a new uptrend on a fresh wave of Big Money buying.