Over the weekend, Treasury Secretary Janet Yellen confirmed that the U.S. could run out of cash as early as June.

You’ve probably heard by now that the country is, once again, approaching the limit of what it can legally borrow (the debt ceiling).

Congress wants to set a strict limit on government spending… while the White House insists that any deal that preserves tax breaks for the wealthy while cutting healthcare and education spending is a no-go.

As I write this, the country is careening toward the unthinkable: a default on its debt. The only way to prevent this is for Congress to raise or suspend the federal debt limit by June 1.

The market is watching with bated breath as Congress and the White House try to negotiate a last-minute deal… and investors are understandably nervous. In recent days, the market has gone up when a deal seems possible (McCarthy’s positive comments sent the S&P 500 to a nine-month high on May 18)… and down when talks break down, as they did on May 19 (when the S&P 500 lost 0.8% at its worst point).

It’s true that Congress has raised the debt ceiling every time the issue has come up (78 times since the 1960s).

But even if the government reaches a deal, it would mean a significant compromise and a big cut in spending, which could accelerate the approaching recession and send the market into a decline.

We saw this the last time we faced a debt ceiling crisis in 2011… which was resolved with only two days to spare before default (and resulted in substantial spending cuts).

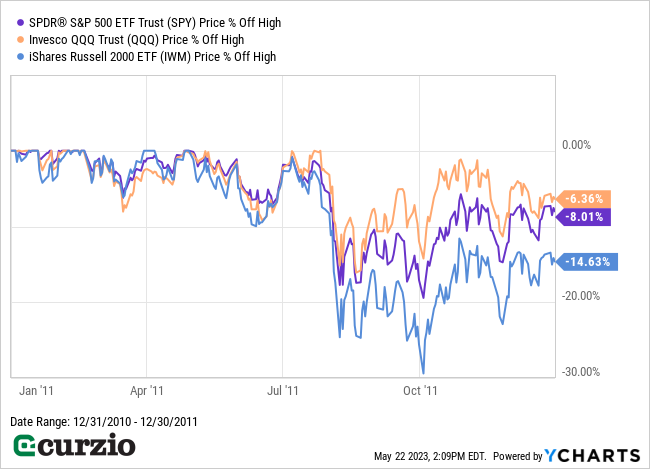

On the chart below, you can see how the major market indices—the S&P 500, the tech-heavy Nasdaq 100, and the small-cap Russell 2000—reacted. Note the big drop in July, when the drama was playing out.

As you can see from the chart, the declines were massive. At their worst levels, the S&P 500 lost 19.4% and the Nasdaq fell 16.1%. Small caps suffered the worst, with the Russell 2000 dropping 29.4% from its highs.

The bottom line: No matter how it pans out, this debt ceiling standoff will be bad for the stock market.

The good news is that there’s a simple way to protect yourself—and profit—if we see a repeat of 2011: inverse ETFs.

Here are two excellent choices to play the debt ceiling crisis…

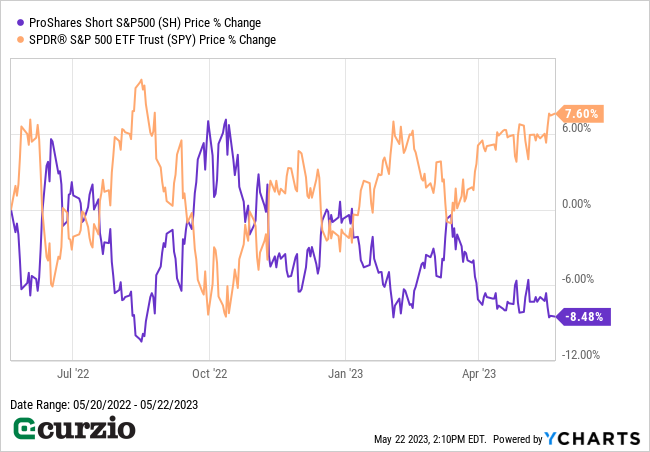

ProShares Short S&P500 ETF (SH)

The ProShares Short S&P500 (SH) is an inverse ETF designed to deliver the opposite of the market’s daily returns. In other words, when the S&P 500 declines, SH moves higher by the same amount—and vice versa.

As you can see, SH (the purple line) goes down when the S&P 500 (the orange line) rises. And the ETF goes up when the index falls.

This feature makes SH a great tool for betting on a coming market decline.

The best part of using an inverse ETF—as opposed to put options or short positions—is that you don’t have to actively trade it…

By buying it once (and selling as the turmoil unfolds), you can profit as the S&P 500 plunges. These gains will help protect your portfolio from the worst of the debt-ceiling crisis.

In short, SH will be your lifeline if the entire market drops sharply, like it did in 2011.

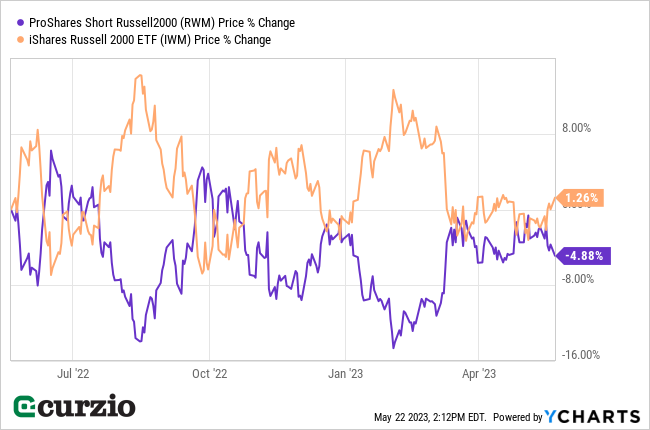

ProShares Russell 2000 (RWM)

If the debt ceiling crisis spins out of control, the smallest stocks are most at risk.

You see, smaller companies are very economically sensitive. For one thing, they’re typically less financially stable and often have to borrow money at higher rates than their larger competitors. They also have minimal pricing power, lower profit margins, and fewer resources to weather a downturn.

And a downturn is very likely… The economy is already flirting with a recession… which will get much more severe if the federal government is forced to sharply cut its spending.

In short, regardless of how the debt ceiling negotiations play out, we could see a very dramatic selloff in small caps.

And that means the ProShares Russell 2000 ETF (RWM)—an inverse ETF that delivers the opposite day-to-day performance of the Russell 2000 Index—would rally hard.

Similar to SH, RWM can become your profit center if the debt ceiling negotiations don’t immediately succeed… go down to the wire… or result in long-term spending cuts that will hurt the economy.

In short, RWM is a great way to protect yourself—and make money—if the market repeats its 2011 pattern and declines sharply.

Conclusion

As the U.S. rapidly approaches the debt ceiling, there’s a distinct possibility we’re at the beginning of a major crisis… that could trigger a market-wide decline.

By investing in the two inverse ETFs mentioned above, you can protect yourself from the worst of the selloff… and even profit as the market plunges.

P.S. In last week’s issue of Moneyflow Trader, I shared why this market rally won’t last… the sector that will be hit the hardest by the economy’s collapse… and a trade set to deliver triple-digit gains as the situation plays out.

Get immediate access to this trade when you join Moneyflow Trader today.