It’s the question on every investor’s mind: Are we going into a recession?

And it’s an understandable concern, as bear markets and recessions often go hand in hand.

Whether we’re “technically” going into a recession depends on how you define it… But the short answer is yes, we’re facing an inevitable prolonged decline in the economy.

But don’t panic: If you prepare appropriately, you’ll avoid much of the damage a recession could bring to your portfolio… and even make money as the market suffers.

This is a big topic, so over the course of the next few articles, I’ll tell you how to prepare. But today, let’s examine why a recession over the next 12 months is pretty much a guarantee.

The destructive power of high inflation

Inflation is a well-known precursor to a recession.

That’s because as costs rise, millions of people—and thousands of businesses—are suddenly forced to cut down on spending.

As real spending declines, unemployment tends to rise… along with personal and corporate bankruptcies. Eventually, economic output declines… which leads to a recession.

As you undoubtedly know by now, we’ve been facing 40-year-high inflation.

That’s why the market celebrated in early January. We were told that U.S. inflation was slowing throughout the entire second half of 2022 (six months in a row)—and it even dropped in December.

The market responded by surging higher. Investors speculated that the Fed would soon wrap up its rate hikes—and even pivot (start lowering rates)—and that maybe we could avoid a recession after all.

But the celebration was premature…

Just a few weeks ago, the Bureau of Labor Statistics (BLS) announced that inflation had, in fact, not declined in December 2022… and was higher than was previously thought in both November and October 2022.

Plus, inflation got worse in January… increasing the pressure on the Fed to keep hiking rates.

The updated numbers change the economic (and market) picture dramatically. Put simply, the new CPI numbers tell us the inflation problem isn’t over.

How the Fed is forcing a recession

The Federal Reserve is mandated by the Congress to focus on two things: full employment and price stability.

Today, with unemployment at record lows, this dual mandate essentially demands that the Fed fights inflation by any means possible.

The only tool it has to combat high inflation is higher interest rates.

And because the Fed ignored rising inflation back in 2021, it had to embark on a record-fast series of hikes in 2022. From zero to 4.6% in less than a year… we’ve never seen interest rates rise this fast.

Never.

And the Fed is far from done.

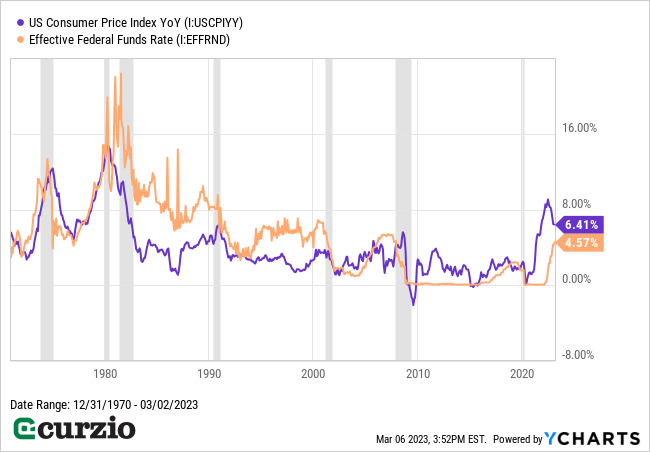

As you can see above, throughout history, we’ve only ever been able to beat back high inflation when the Fed funds rate (the orange line) was significantly higher than the rate of inflation (the purple line).

Right now, the former is at 4.6%… while the latter is at 6.4%.

And a spiking Fed funds rate historically precedes a recession (the gray shaded areas on the chart above).

In short, the current outlook for inflation calls for even more hikes from the Fed. And rising rates mean higher borrowing costs for things like homes and cars—which prevents consumers from spending more… and also ramps up the pressure on businesses of all kinds.

In other words, the Fed has backed itself into a corner and must now force a recession.

And this means big trouble for the market in the near future.

A contrarian indicator of economic decline

But not everything is bad, you might think. People are employed—and while they have jobs, they’ll continue to spend and support the economy.

Not so fast…

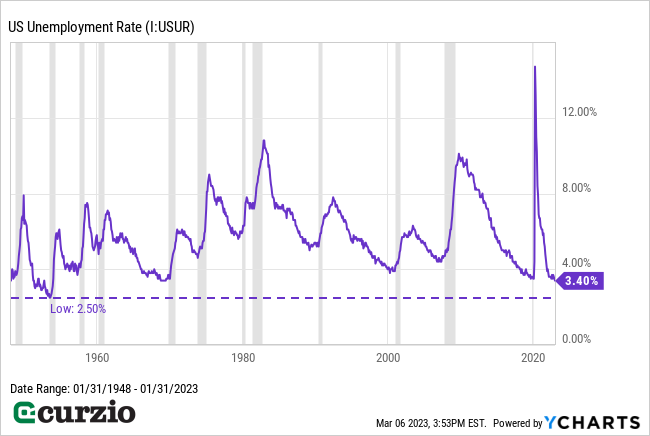

Record-low unemployment is actually a contrarian indicator that calls for a recession.

Historically, employment tends to bottom out right before the recession—as you can see from the below chart.

Unemployment set a record low 70 years ago, in June 1953… And a recession—caused by high inflation expectations and overzealous Fed raising interest rates—started the very next month.

In short, record-low unemployment isn’t necessarily good news—as it’s yet another sign that the economy is overheated… which means the Fed isn’t done hiking rates…

Which means a recession is inevitable.

Over the next two weeks, I’ll show you how to prepare your portfolio—including what to own, and what to avoid—to make the most of the market’s inevitable declines, and even profit on the turmoil ahead.