An important market shift is taking place under the surface right now…

For the past month, the markets have gone nowhere. Indices aren’t giving us all the facts. And the sellers have started showing up.

I’ve been talking about this for weeks now…

Since June 8 (when I told buyers to beware), the S&P 500 (SPY) has returned -2.97%. Compare that to the prior two months:

- May 8–June 8: +10.52%

- April 8–May 8: +6.72%

Drilling down even further, there have been three days of ugly selling in the month of June.

- June 11: -5.76%

- June 23: -2.55%

- June 25: -2.38%

The influx of Big Money into stocks—and the subsequent rally—began to slow…

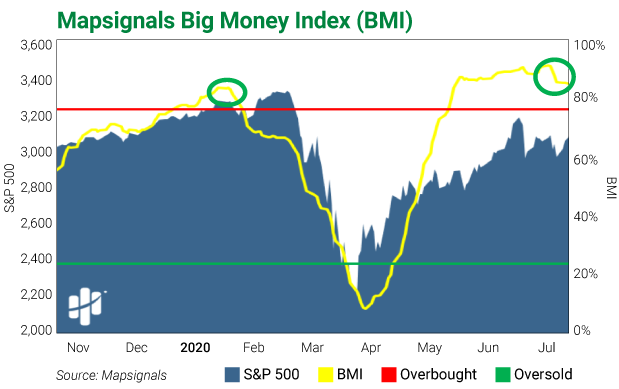

Below is the Mapsignals Big Money Index. It tracks about 1,500 stocks to identify where the Big Money players are buying and selling.

When the index is racing higher, like it was April–June, that means Big Money is pouring into stocks. When it’s falling, that indicates sellers are beginning to show up. This is my favorite indicator on the temperature of the market.

You can see the yellow line has started its fall, correlating with the choppy market of the last few weeks.

And the green circle on the left points to the last time the BMI started to fall in late January…

Big Money is tapping the brakes

Before jumping to a conclusion, it’s always best to have the odds in your favor.

It’s one thing to have one indicator flashing red, but it’s another entirely when multiple data points are supporting the same narrative.

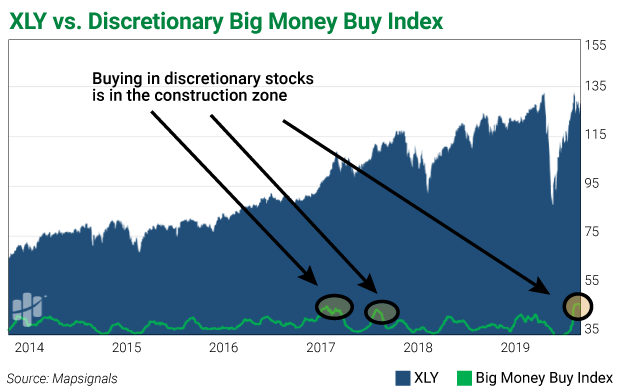

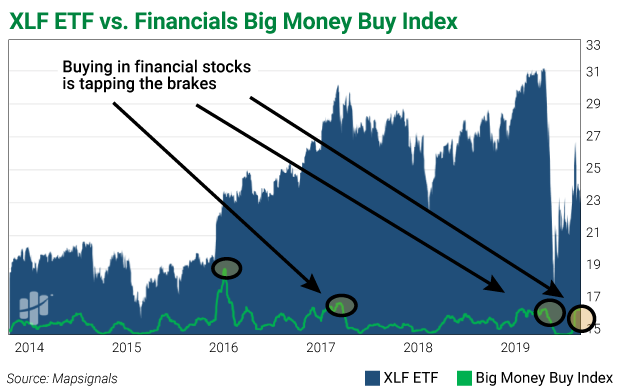

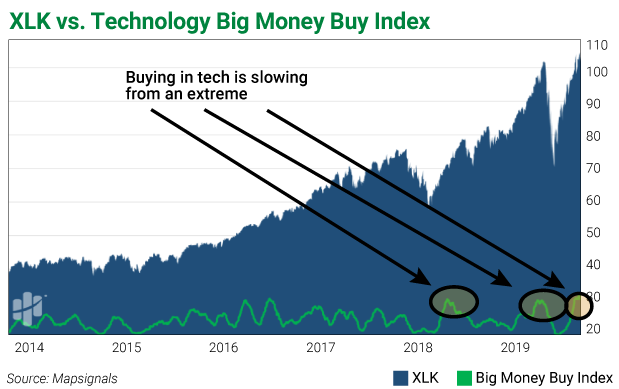

Three sectors show a slowdown in big buying: discretionary, financials, and technology.

The Mapsignals Big Money Sector Indexes follow the velocity of buying in stocks. If the green line is increasing, big buying is speeding up. If it’s falling, big buying is tapping the brakes.

Clearly, the green line is falling for all three sectors.

This is a good thing.

The markets have been overbought for some time and are likely going to pull back. I’m not beating the bear drum here—I’m getting my “buy” list ready.

I’ve learned to buy aggressively when others are fearful (like in March) and wait patiently when exuberance is bubbling over.

Based on data, opportunity is around the corner. I’m happy to wait.

Editor’s note:The next buying opportunity could be right around the corner… And Frank has created a detailed list of stocks that could skyrocket once that happens. It’s all in his special COVID-19 report, “How to prepare for what’s coming next…”—available exclusively to members of Curzio Research Advisory. Get immediate access to this list with a trial membership today.