It’s Thanksgiving week already… which means Christmas and New Year’s are right around the corner.

And before you know it, it’ll be time to start on your 2023 taxes.

As I explained last week, you have until December 31 to harvest any portfolio losers to help reduce your tax bill.

But if you own mutual funds, closed-end funds, or ETFs, there’s another factor you need to watch as the end of the year approaches…

Why you must watch your funds at the end of each year

Just like stocks, any funds you own can be sold to lock in gains or losses at the end of the year.

But there’s an extra “feature” fund investors need to account for before making any year-end tax moves…

You see, many funds need to distribute their net capital gains to shareholders at the end of the year. In some cases, these distributions get paid out in cash. And in other cases, they get reinvested in the fund (meaning you automatically buy more shares).

If you own one of these funds in a taxable account, these distributions count as a taxable event, regardless of how you receive them.

This year, distributions are expected to be on the low side, as many fund managers still have substantial tax losses from 2022 to offset this year’s gains… For example, ARK Invest just published a white paper bragging that its ETFs have accumulated so many losses that they’re not likely to pay out a capital gain distribution through at least 2025.

In short, it’s always a good idea to check the websites of any funds you own… and look for the fund manager’s estimated year-end distribution (as well as the expected date it will happen).

These details will help you plan your tax loss harvesting strategy. If you know one of your funds will distribute some big gains, you might want to take some additional losses elsewhere to offset the gains. Or, if the fund no longer meets your investment strategy, you can sell it before the distribution hits.

One last note: Don’t panic if you see a big, single-day price drop in one or more of your funds…

Assuming it’s in December, there’s a good chance it’s simply the fund making a large capital-gain distribution.

Whenever a fund makes a distribution, it gets subtracted from the fund’s net asset value. You haven’t lost any money… since you’re getting that value paid to you either in cash or in additional shares.

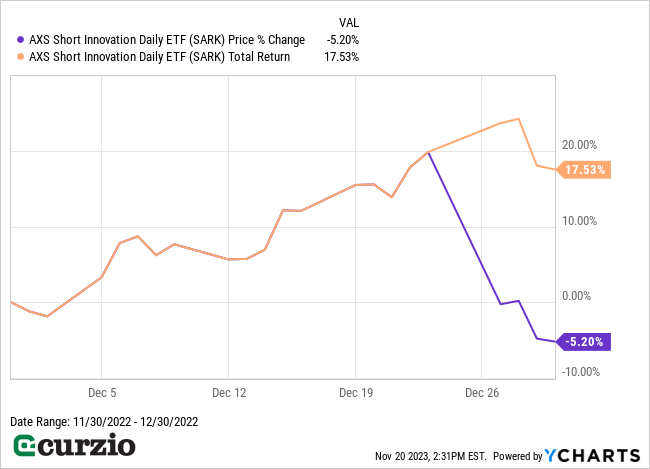

For example, a year ago, the AXS Short Innovation ETF (SARK), a popular inverse ETF, “lost” 17% in a single day, plunging from $68.90 to $55.15. But if you look closer, you’ll see that SARK paid out a $13.748 distribution the day before the drop. And if you add the distribution back into the new (lower) share price, you’ll see investors didn’t lose a penny… even though the price dropped.

$55.15 + $13.748 = $68.898

In other words, even though the chart below shows a big decline (in blue)… the orange line is what investors actually experienced, in terms of SARK’s value before and after the distribution.

Conclusion

If you own any mutual funds, closed-end funds, or ETFs, you need to pay extra attention as you plan your tax loss harvesting strategy.

These funds often make capital gains distributions at the end of the year, which can add complications to any tax moves you make.

Always check with your fund companies for their year-end distribution estimates… and factor these numbers into your gains for the year. It’s an important “extra” factor to watch for as you look for losses to offset taxes.

Many funds will make their distributions fairly soon—and you only have until December 31 to harvest your losses—so be sure to take action before it’s too late.

And, as always, make sure your tax strategy is secondary to your long-term investment plan, and check with your tax professional if you have any questions about your particular situation.