It looks like the stock market is poised to end the year on strong footing…

So far, the market has logged a 16.5% return for 2023.

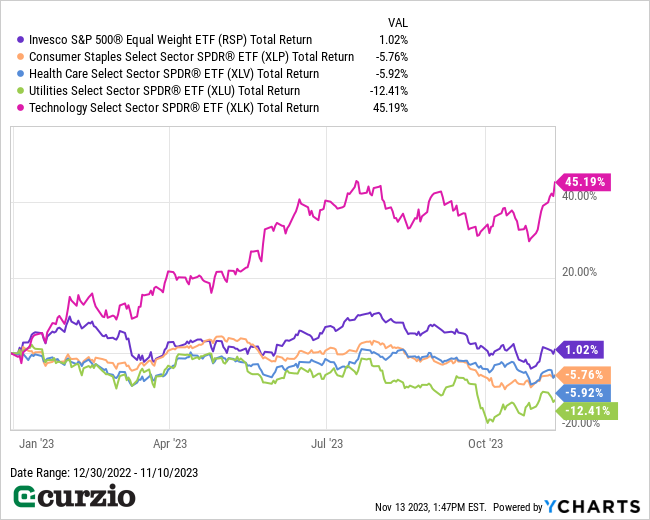

But a closer look tells us the picture isn’t as pretty as it appears…

While 2023 has been a great year for mega-cap tech stocks—represented by the Technology Select Sector ETF (XLK)… the average stock in the market—represented by the Invesco S&P 500 Equal Weight ETF (RSP)—is only up if you include their dividends. Meanwhile, typically safe sectors—like consumer staples (XLP), healthcare (XLV), and utilities (XLU)—are showing big declines.

The bottom line: While your portfolio might be sporting some nice gains overall… there’s a good chance you’re looking at losses in some of your individual positions.

Fortunately, there’s a simple way to mitigate some of the pain from these losses come tax time—if you understand the rules.

Here’s how it works…

Follow these steps to reduce your tax bill

Tax loss harvesting is the practice of selling a security at a loss… and using that loss to lower your taxes. It’s a great way to offset any gains you have, whether they’re capital gains or ordinary income made during the same year. (Bear in mind, this strategy can only be applied to your taxable accounts—not to your 401(k) or IRAs.)

It involves three simple steps:

1. Start by comparing your gains and losses for the year.

Be sure to separate them into two categories: Short-term gains—those made on investments held for one year or less—are netted against short-term losses. And long-term gains need to be matched with long-term losses.

The goal of this first step is to get a clear picture of your gains and losses for the year up to this point. It’s an important piece of info to help decide whether you should look to sell any additional positions before December 31.

2. Next, check your portfolio for candidates to harvest—both for gains and losses.

Once you know your existing gains and losses, it’s time to review your current portfolio.

As you go through your holdings, do you see any that aren’t suited to the “big picture” environment? For example, some stocks might be too economically sensitive for this high-interest-rate market. Those could be solid candidates for tax loss harvesting.

Or maybe you’ve held onto a few big winners for years—and the only reason you haven’t sold them is because your cost basis is low (and the taxes would be too high). If you have enough losses to offset the big gains, now might be a good time to lock in some profits.

Keep in mind, you should never sell a position solely for the sake of booking a loss or a gain. Your long-term results are much more important than any short-term tax savings… so your tax strategy should be secondary to your long-term investment strategy.

But if a few underperforming stocks are unlikely to deliver on your investment strategy, it may be worth cutting your losses—and using these positions for tax loss harvesting.

Bottom line: Hold onto your winners if you still like them… and research your sell candidates to make sure you’re willing to part with them.

3. Add everything up.

Once you’ve made your selling decisions, you can combine your short-term and long-term gains/losses into a single number.

If you have more losses than gains, you can use the net loss against up to $3,000 of ordinary income. In other words, you can reduce your overall taxable income by up to $3,000. And if your loss for the year is greater than $3,000, the excess can be carried forward to future years (to help offset capital gains).

No matter what you decide, always remember the “wash sale” rule…

Watch out for wash sales

Whenever possible, you should avoid wash sales.

Put simply, a wash sale is a loss that’s ineligible for tax loss harvesting.

The wash sale rule says that if you plan to deduct a loss, you can’t buy the same or a “substantially identical” security for 30 days before or after the sale (61 days in total).

In other words, if you take a loss on a stock, you can’t turn around and buy the same stock (or a “substantially identical” security) back before 30 days have passed (or purchase them preemptively within 30 days prior to the sale).

Examples of “substantially identical” positions include owning call options vs. shares… or two different funds that track the same index.

If a trade counts as a wash sale, the loss won’t be eligible for the deduction.

I also need to point out that these rules apply across different accounts, whether they’re taxable or tax-deferred. So you can’t sell one stock in your brokerage account and then buy a “substantially identical” one in your IRA. Also, one spouse can’t sell a stock while the other spouse buys it (within the 61-day window I mentioned above).

Time is of the essence

Keep an eye on the calendar. The last trading day of December is always your final chance to harvest losses for the year.

And be sure to consult your tax advisor before making any changes. Everyone’s situation is different, and you’ll be better off if you consult your accounting professional before making important tax-related decisions.

Following these simple steps will help you minimize the pain of any investment losses… and your tax bill.