It’s a quiet time for the market. The days heading into Election Day usually have money managers running a lean portfolio.

With the outcome of the election so close, it makes sense for Big Money accounts to be nimble. And while this may seem like unusual positioning, it actually lines up very well with the election trade I discussed weeks ago.

As a quick reminder: Large investors tend to sell stocks prior to the election, and buy afterwards. Will that be the case this year? Only time will tell.

This leads to something I’m noticing under the surface of the market: Two sectors are quietly seeing chunky buying. It’s as if the train is starting to leave the station.

Before we get to that, let’s check out what the overall market is showing…

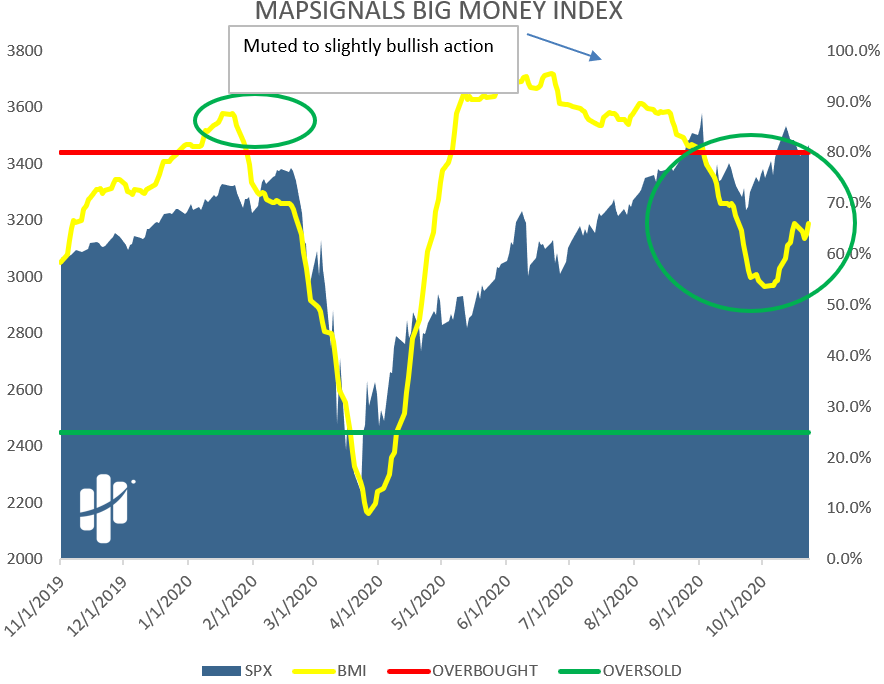

The Big Money Index is muted

The best way I’ve found to track Big Money is the trusty Big Money Index (BMI). It’s been a wonderful indicator in a very tumultuous 2020. In fact, we just released a white paper on it.

I believe all investors should have this market barometer on their radar. Here’s where it stands today:

The BMI is quietly humming along as markets trade on low volumes. Again, I think this lines up with the election study… There’s no need to plant your foot down with so much uncertainty coming our way.

But, what you can’t see above are the sector movements. I’ll show you what’s sticking out at me.

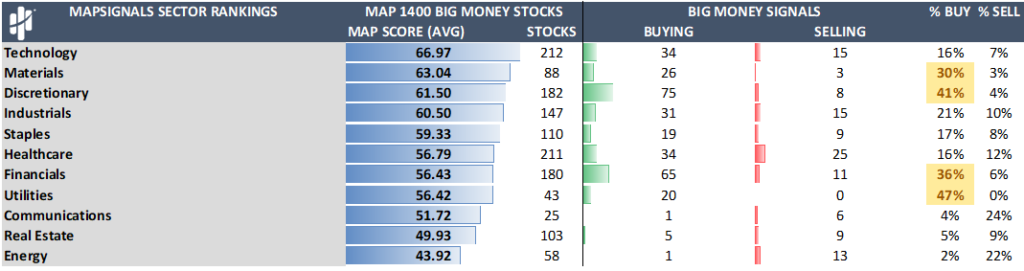

Buying in financials and discretionary stocks

Each morning, I look over my data for anything that seems unusual. The last couple of days have been just that—with a decent number of retail and financial names powering higher.

Below is last week’s sector buying and selling activity from my firm, MAPsignals. We highlight in yellow any of the sectors that show >25% of buying in the universe.

Clearly you can see that discretionary and financials saw the juice last week. Utilities and materials also saw a lot of green. Typically, that’s a bullish signal—buying begets more buying, and so forth.

The logical question you may be asking yourself is, why? Likely, higher rates can make financial companies more attractive. The 10-year Treasury yield is at its highest levels since early June.

And discretionary names could be benefiting from a better earnings season than most have feared. The pandemic has caused many retailers to focus on growing their digital footprint.

Other things to consider would be the stimulus package on Capitol Hill and the election results. If either of those are seen as benefiting these groups, look out.

Regardless, the real reason for any movement in stocks is simply supply and demand. As an investor/trader, you certainly want to be on the right side of that train.

The bottom line is this: Markets are eerily quiet right now, but there are some green shoots to pay attention to. If history is any guide, we could see money rush into stocks shortly after the election.

Keep these sectors on your radar because it looks like they’re getting a headstart.

When the train eventually leaves the station, make sure you have a seat. If you’re looking for exposure to these sectors, consider the S&P Regional Banking ETF (KRE) or the S&P Retail ETF (XRT).

P.S. My colleague Genia Turanova has noticed another sector Big Money has been quietly pouring into… unusual, income-producing investments known as LIAs.

In a zero-rate environment, these assets have the potential to make hundreds—perhaps thousands—of percent in capital gains… while handing you regular cash payouts. Learn all about them right here.