If you really want to scare your neighbors this Halloween… dress up like a Treasury bond.

Right now, bonds—especially Treasuries issued by the U.S. government—are in a catastrophic bear market…

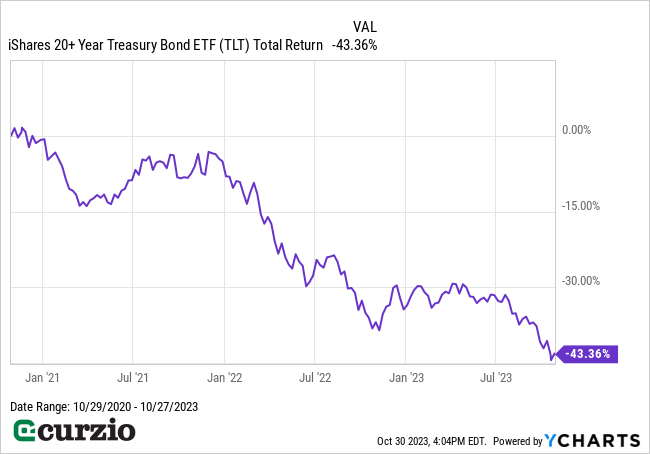

Even accounting for their interest income, long-term Treasuries are down more than 43% over the past three years, as you can see below.

Even if you don’t own any long-term Treasury bonds, this brutal selloff should alarm you…

For one thing, the carnage in bonds rivals some of the worst stock bear markets in history.

More importantly, it’s creating an incredibly dangerous situation for the stock market.

Today, I’ll explain why the bond market’s losses will translate into more downside for stocks… and give you an easy way to stay safe.

Let’s start with a look at how bonds help drive our economy…

How bond rates trickle down through the economy

One basic fact of bonds is that prices and yields have an inverse relationship. When bond prices go up, their yields go down… and vice versa.

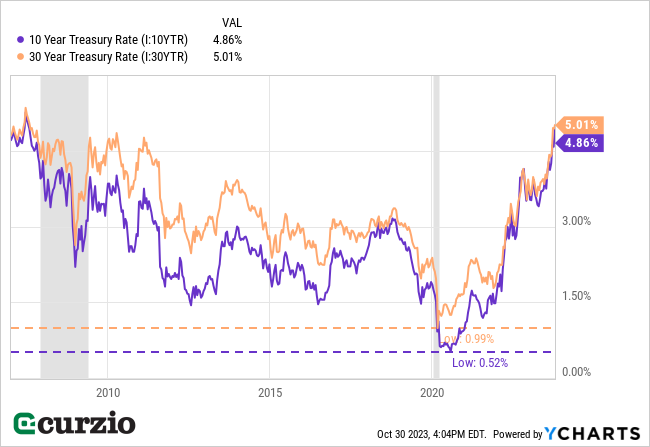

And the crash in bond prices means yields are surging like crazy…

Below, you can see the massive rise in long-dated Treasury yields since they bottomed back in 2020.

And this rise goes beyond the Treasury market…

You see, longer-term rates are the benchmark for every other type of debt, from credit cards to mortgages and auto loans… and a wide range of business debts (including corporate bonds and small-business loans).

In other words, Treasury yields have a direct impact on nearly every aspect of the economy.

And when these rates are rising, it typically leads to an economic slowdown.

For example, let’s take a look at the average fixed rate for a 30-year mortgage. As you can see from the chart below, mortgage rates are at a 20-year high after their recent surge.

As a result, the housing market is pretty much frozen, with new listings plunging more than 9% over the past 12 months (and 16% vs. the 2018–2019 average), according to the latest data from Zillow.

Housing is just one example of how rising interest rates are slowing down the economy. Retailers are being pinched as consumers pull back due to record-high rates on their credit cards… and sectors that rely heavily on debt—like utilities, industrials, and real estate—are also reeling.

Declining economic activity translates to a worsening profit outlook for businesses… which in turn translates to lower valuations and falling stock prices.

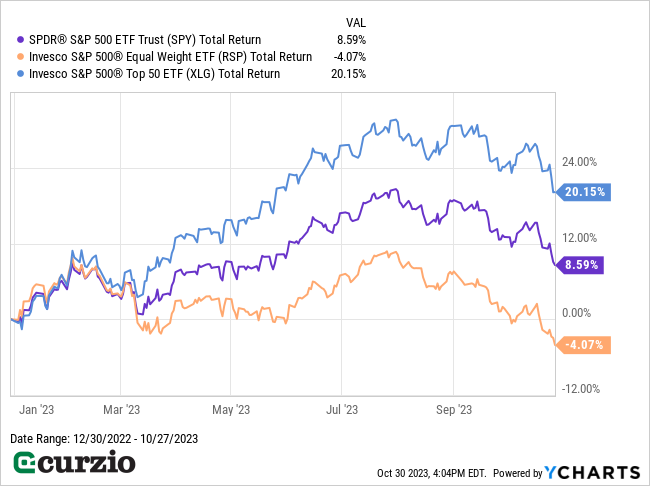

We can already see this playing out. While the S&P 500 is still up more than 8% since the start of the year… it’s down about 9% from its late-July highs.

Meanwhile, the average stock in the S&P 500 (the orange line on the chart below) is down more than 4% for the year. The strength in the largest companies (the blue line) is the only reason the market is still up in 2023. And as you can see, even this group is weakening.

Put simply, with interest rates—including Treasury rates—set to stay higher for longer, the market’s likeliest path is down… and investors need to prepare for more downside in stocks.

How to profit from the market’s inevitable decline

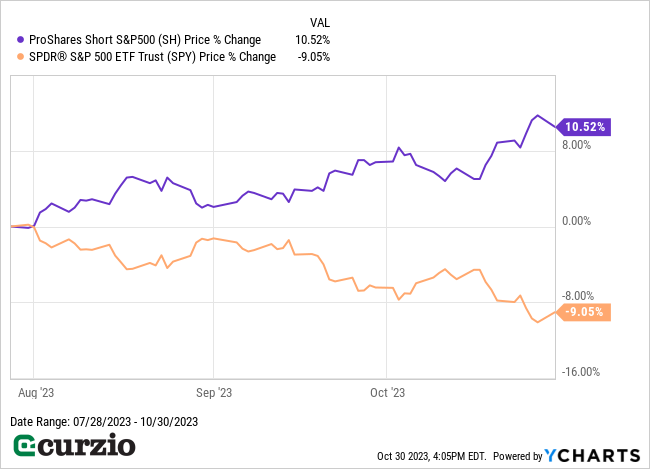

One of the simplest ways to profit from a selloff is with inverse ETFs. These exchange-traded funds are designed to deliver the opposite performance of their underlying securities (like a certain index or market sector).

Put simply, an inverse ETF goes up when its target index goes down.

For example, the Short S&P500 ETF (SH) is designed to deliver the opposite daily return of the S&P 500. If the S&P 500 goes up 1% in a day… SH should go down about 1% (and vice versa).

As you can see below, over the past three months, the market lost 9%… while SH gained more than 10%.

SH gives investors an easy way to profit as high interest rates put massive pressure on the S&P 500.

And for a higher-upside approach, you can buy put options.

Put options are our standard strategy in Moneyflow Trader… and many of our summer trades have already paid off big…

Last week, we locked in a 78% gain on a SPY put option we held for just over a week. And based on the downside ahead, we rolled the trade over into a new put option that could deliver even bigger gains. (Join us at Moneyflow Trader to get the trade.)

The bottom line: The recent action in the bond market is a major warning sign for stocks. The smart move is to position yourself to profit as the turmoil plays out over the coming months.