Last week, I discussed how inverse ETFs can help your portfolio in dire times.

This week, we’ll look at how well these ETFs, as well as some other hedges, have handled the volatility of the past two weeks—and see if they’ve done their job in these challenging conditions.

As the coronavirus continues to spread, it’s becoming more and more apparent that reining it in will require a concerted global effort.

Part or all of some countries—like China and Italy—are completely shut down… and there could still be more pain ahead. And without containment, it could well cause significant macroeconomic impact.

Regardless, it’s clear the virus isn’t going away quickly… and my focus is helping you find shelter from a volatile market.

And one of my favorite shelters is the inverse ETF.

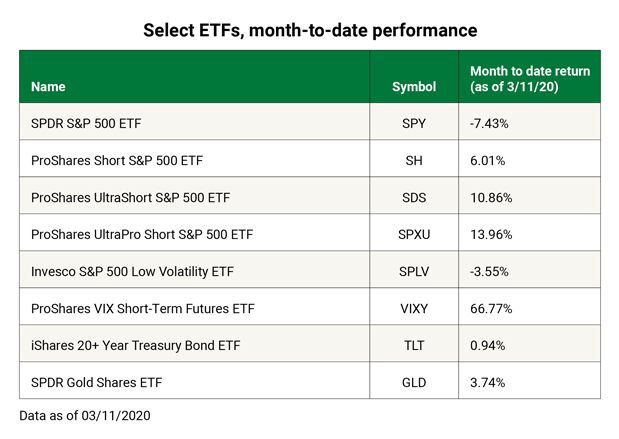

For instance, month-to-date as of yesterday’s close, had you owned the ProShares Short S&P 500 ETF (SH), you’d have a positive return of 6%. Meanwhile, the S&P 500 declined 7.2% over the same time frame.

The ProShares UltraShort S&P 500 (SDS) and ProShares UltraPro Short S&P 500 (SPXU)—double- and triple-inverse S&P 500 ETFs—have also done their job, with positive returns of 10.1% and 14%, respectively.

As you can see, though, SDS and SPXU—which are more leveraged—fell a bit short of delivering 2 times (2x) and 3x inverse returns on the S&P 500.

That’s because of the intense volatility we’ve seen in the first eight trading days of March.

Let’s have a quick look at other hedges and how well (or badly) they did their job over this time frame.

U.S. Treasuries are a traditional market hedge. Represented in the table above by the iShares 20+ Year Treasury Bond ETF (TLT), they’ve played their calming role well: up 1% vs. a 7.5% drop in the SPDR S&P 500 ETF (SPY).

So, over the eight trading days we’ve had so far this month, TLT would have helped stabilize returns for investors with diversified portfolios.

It’s important to note that even this hedge doesn’t always move counter to the market. Yesterday, for example, TLT declined with the S&P 500 (although by much less). Still, U.S. Treasuries are not to be ignored when you consider hedging your equity exposure.

Gold—one of the most traditional hedges—can also be easily traded via ETFs. The SPDR Gold Shares ETF (GLD)—the most popular and largest physical gold ETF—was actually up 3.7% over the past few days. As of Wednesday’s close, it’s up 7.7% in 2020—much better than a nearly 15% decline for SPY.

But the best-performing ETF in the example above is the ProShares VIX Short-Term Futures ETF (VIXY)—which consists of short-term futures on the Volatility Index (VIX). VIXY is up more than 60% in March.

That’s because it’s designed to capitalize on increased volatility of the S&P 500. Historically, increases in the Volatility Index have been correlated to declines in the S&P 500.

A word of warning, though: Because VIXY is based on the futures (which can be very volatile), this ETF will decline sharply as market volatility drops.

Over the past year, before its surge that started on February 19, VIXY had been down as much as 55% (before rallying some 182%).

Trade VIXY wisely, and know its limitations. It can be a good hedge—if you time it well. (You can learn more about this ETF here.)

Finally, I want to turn your attention to the Invesco S&P 500 Low Volatility ETF (SPLV). Not leveraged, this ETF has managed to lose less than SPY—a 3.6% decline vs. 7.4% for the latter.

This ETF is based on the S&P 500Low Volatility Index, which consists of the 100 S&P 500 stocks with the lowest past-year volatility.

But SPLV isn’t fool-proof…

The ETF is very heavily weighted in utilities (28% of the funds) and real estate (18%). So if the utilities and the real estate companies decline disproportionally, this ETF would underperform the market.

But if you’re a long-term investor looking for a utility or REIT fund, SPLV is something to consider. (You can review the fund holdings and learn more here.)

To help keep yourself safe in today’s crazy market, consider a variety of ETFs, both leveraged and unleveraged.

And remember—when the market is highly volatile, liquidity matters. Utilize the most liquid ETFs you can find… especially if your intention is to trade, not to invest for long term. If you do find a less liquid ETF you want to trade in this volatile market, consider using limit orders to ensure proper pricing.

Diversify your hedges… Keep a close eye on your ETFs’ leverage… And understand how your ETFs work in certain market conditions. This way, you can take advantage of their best characteristics and avoid unnecessary risks.

As always, don’t risk more than you can afford to lose… and remember that during market stresses, cash can be the safest hedge.

Editor’s note: The market is in a panic right now—and as Frank’s been reporting, it’s going to get worse before it gets better. In fact, Frank predicts we may be in the early stages of total a market meltdown. To help you prepare for what’s coming, he’s compiled a completely free report with all of his research on the coronavirus… as well as some very real strategies to help you avoid getting crushed in the weeks to come… And even come out on top.