In America, inflation began with violence.

In the autumn of 1690, the Puritans of the Massachusetts Bay Colony launched a raid on their prosperous French Catholic neighbors to the north. Led by Sir William Phips, the colonists’ expeditionary force of 2,500 traveled to Quebec aboard 32 ships.

A sea captain and treasure hunter, Phips the previous spring with 700 soldiers had successfully seized Port Royal, in present-day Nova Scotia, on behalf of the British Crown.

Confident in their ability to plunder Quebec, they hired thousands of additional soldiers on credit—leveraging their winnings from Port Royal.

But the colonists’ attack was stymied. And when they returned to Boston, they were empty handed. The expedition was 5,000 pounds in debt (the equivalent of roughly 10,000 ounces of silver)—a fortune at the time.

Phips tried to borrow the money from Boston’s merchants to pay his men, but they doubted the Colony’s credit and declined to lend. So in December 1690, the colonial government printed 7,000 pounds worth of paper money to pay off the soldiers.

It was the first paper money ever issued in the New World.

To win people over to this new form of value, the Massachusetts Bay Colony promised that the notes would, in time, be redeemable for specie (silver or gold) at full face value. They also pledged that absolutely no more notes would be printed.

What happened next has been repeated, in one way or another, by every government that has printed money to pay its debts.

At first, the new paper money—free cash for everyone!—boosted the local economy.

But like the aftermath of a sugar high, two months later the economy stuttered to a halt, and gold and silver vanished from circulation. The exchange value of the notes plummeted, triggering an economic crisis.

To quell the panic, the government in February 1691 printed more notes (pledge? what pledge?). This issuance, because of the falling value of the notes, had to be much larger, at 40,000 pounds—to achieve the same economic impact as the first.

Before the Phips raid on Quebec, there was approximately 200,000 pounds of silver money in the colony.

By 1711, 740,000 pounds of paper money had been issued by various colonial governments—including a massive 500,000-pound issue by Massachusetts to pay (wait for it) for another failed expedition to sack Quebec.

Prices continued to rise. And, despite various efforts to control the money supply, by 1748, 2.5 million pounds worth of paper money had been printed in the colonies. Prices had increased 10-fold.

Sound familiar?

The blueprint is the same: Government takes on debt it cannot finance via legitimate means.

Government prints money, which provides a short-term economic boom. And Gresham’s Law ensues: The bad money forces out the good, as people wisely hoard bullion and spend paper. A crash follows. Then, still more money must be printed.

And each cycle causes more and more economic dislocation. The government is trapped: If they stop printing, the economy will collapse. If they keep printing, inflation will destroy civil society.

A short, sad primer on bad money

In the 1990s, “bad money” was emerging market bonds.

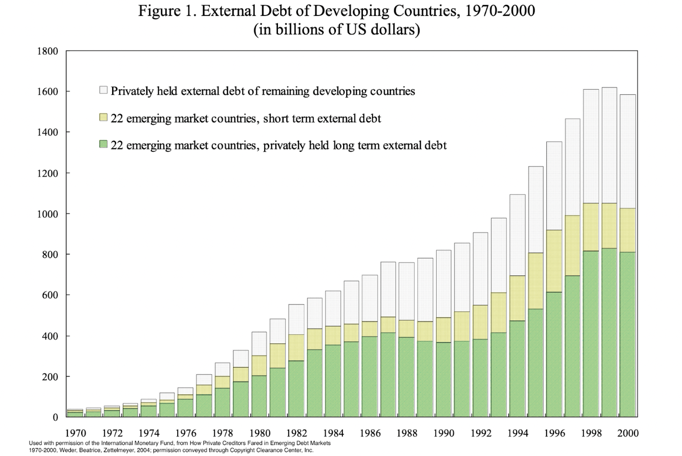

In the 25 years prior to 1998, the 22 countries known as “emerging” economies had seen their external debt loads grow 10-fold (see the figure below), far outpacing economic activity.

Beginning in 1995 with the Mexican peso crisis, virtually every emerging market in the world suffered a currency collapse, a debt default, or both.

It was an accident waiting to happen. A hedge fund called Long Term Capital Management (LCTM) held a highly leveraged position in Russian domestic government bonds—when the Kremlin defaulted in August 1998.

Similar to the colonial army returning to Boston, instead of suffering their losses, LTCM’s backers appealed to the government. And $3.6 billion in new money was created by a consortium of 14 banks, led by the Federal Reserve.

It was the first time the U.S. government had intervened directly to prevent credit losses by private investors since the creation of the world’s current monetary regime, the all-paper, U.S. dollar standard.

It wouldn’t be the last.

About ten years later, in 2008, the “bad money” was subprime mortgage bonds, on which Wall Street banks had gorged themselves, thereby creating an economic boom led by real estate prices.

The resulting bailout, including debt guarantees, mortgage purchases, and central bank swaps, was around 10,000 times bigger than that of LTCM.

Judging from history, we all should have known what would happen next.

The late 1990s (and the bailout of LTCM) marked the beginning of America’s “super bubble.” With each new cycle of boom, bad money, and bust, the resulting printing of new money would grow ever larger.

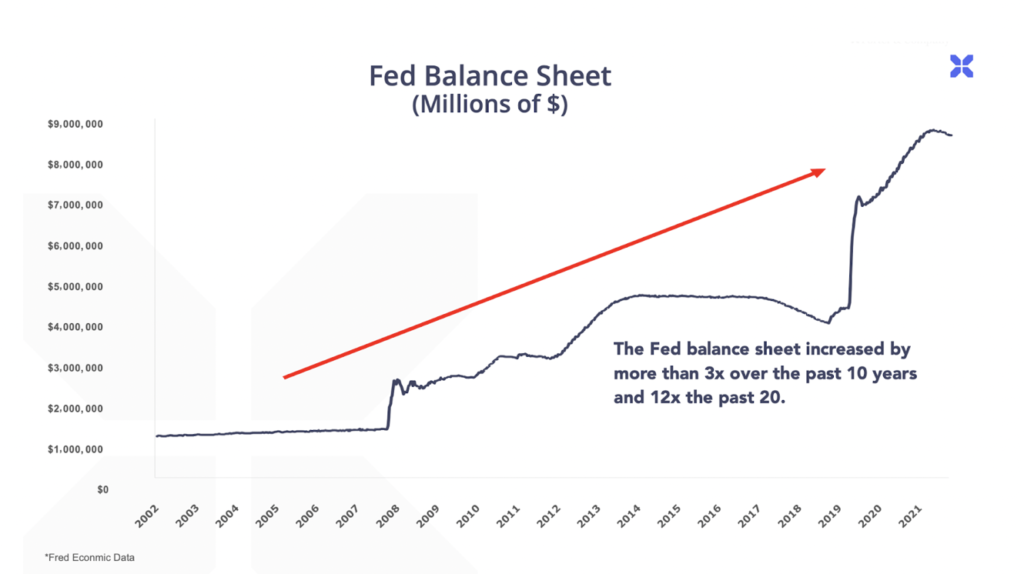

The scale of the printing is most apparent in the growth of the Federal Reserve’s balance sheet.

Our central bank printed trillions of dollars over the last 20 years to finance the bailout of Wall Street in 2009; and then again in 2011 to help solve the European debt crisis; and then, most recently, to finance the battle over Covid. Each successful wave of printing was bigger and bigger.

And following each expansion, the interest offered on government debt was lower and lower.

The result is a monetary system that bears little direct relationship to the allocation of real assets or services.

Deadly paper

Paper money has most hurt the middle class, whose wages have declined massively relative to the soaring value of assets. That’s extremely dangerous for civil society. It creates the very real impression in the general population that the economy (and therefore the government that controls it) is illegitimate.

This is why paper money and major inflations always presage the most violent forms of populism and revolution—from the era of Phips, to the rise of the Nazis, to the storming of the U.S. Capitol in 2021.

Perhaps the bigger problem, however, is that paper money is an enormous subsidy for the state. It sets the stage for virtually unlimited government budgets. That encourages people to use the government in all kinds of ways that are extremely destructive for civil society—like starting wars, whether that’s raiding Quebec or invading Iraq.

Paper money, and the lack of any fundamental limit to credit and money, also leads to unrealistic projects to reorder our domestic society—because no social benefit is unaffordable. The quixotic “war on poverty” and the “war on drugs” were both launched as the U.S. switched to a pure paper currency in the 1970s.

Money-printing insanity leads to a frightening place

But worst of all, as the monetary system becomes detached from economic reality, it can no longer fulfill its core function of guiding production in the most efficient way possible by determining fair prices.

This growing inefficiency of our economic engine is the greatest weakness of our “financialized” economy. Just as the availability of virtually unlimited credit leads governments to take on inherently destructive projects (like war and social experiments), virtually unlimited funding for corporations leads to malinvestment.

These are investments that are made despite the invisible hand of supply and demand, such as renewable energy investments that make our power grid both vastly more expensive and less reliable. How many billions have been lost already on solar power? Would these investments have been made in an environment of free market interest rates and sound money?

Of course not.

Who is behind it all?

Set against this backdrop of money-printing insanity, our country is being turned upside down as part of a deliberate plot to reset not just your personal wealth, but the entire U.S. economic system.

This is a plan that’s been meticulously engineered by two of the world’s most powerful men over the past 20 years. These are two unelected billionaires who exist outside the checks and balances of Washington, D.C., yet wield far more power than any politician or political party.

They have been pulling the puppet strings through both Republican and Democratic tenures.

And what they have planned next will terrify you…

It could result in tens of millions of Americans being wiped out financially. I believe it will be more devastating than the 2008 financial crisis. And for those who are unprepared, it could decimate their entire livelihoods.

Who are these two men? And why are they plotting against ordinary Americans?

I’ve put together a new documentary called The Two Men Destroying America, and you need to watch it as soon as possible in order to safeguard your wealth and survive the financial reset they have planned.

Click play to stream it now at no cost.

Porter Stansberry

P.S. In this video, I also reveal the one investment that will benefit from this attempted “reset” of the U.S economic system. If I’m right, you could be looking at potential returns of 10-50x in the coming years.