The annual shareholder meeting for Berkshire Hathaway (BRK-B) has been called “Woodstock for capitalists.”

Every year, tens of thousands of investors from all over the world gather in Omaha, Nebraska—Warren Buffett’s hometown—to hear the latest wisdom from the Oracle of Omaha. Attendees look forward to this event all year.

But since 2020, the event has been on hiatus, and the shareholder meetings have been conducted virtually.

However, this Saturday, Berkshire—and Warren Buffett himself—will host this meeting in front of a live audience for the first time since COVID.

There’s a reason thousands of people flock to attend these meetings in person… It’s the same reason so many investors follow Buffett’s every move: There’s simply no other person with a better (documented) long-term investment record.

Buffett makes it a point to explain his investment strategy in the annual meetings and in his famous letters to shareholders… so his moves can be easily understood and even replicated.

Thanks to his letters, not to mention multiple interviews in the financial press, we’ve come to understand what Buffett looks for in an investment.

In a nutshell, it’s value…

Buffett normally likes companies with long track records of success… excellent reputations for quality… well-respected management teams… strong financials (like return on equity and low levels of debt)… and growing profits. And he likes to get a low share price.

But not just any “value” stock will do.

He prefers industry leaders with pricing power…

A look at Berkshire’s portfolio shows examples like Coca-Cola (KO)… Apple (AAPL)… American Express (AXP)… and more.

All of these companies dominate their respective sectors.

Warren Buffett calls these companies “franchises.”

In most cases, “franchise” refers to a company that licenses its name to other businesses. But Buffett has redefined this term for his own purposes…

By his definition, a “franchise” is a company that’s much less vulnerable to outside forces than its competitors… making it a better long-term investment.

Having a strong, well-respected brand name is a must for a company to become a franchise in the Buffett sense…

Such companies are relatively inflation-proof because they lack any real competition… or because they compete on quality (and can therefore demand premium prices). And while no company is completely immune from larger market forces, sector leaders survive recessions more easily than their middle-of-the-road counterparts. And they usually recover faster.

Put simply, these are the investments you want to own forever.

Case in point: Coca-Cola, which Buffett has owned since 1988.

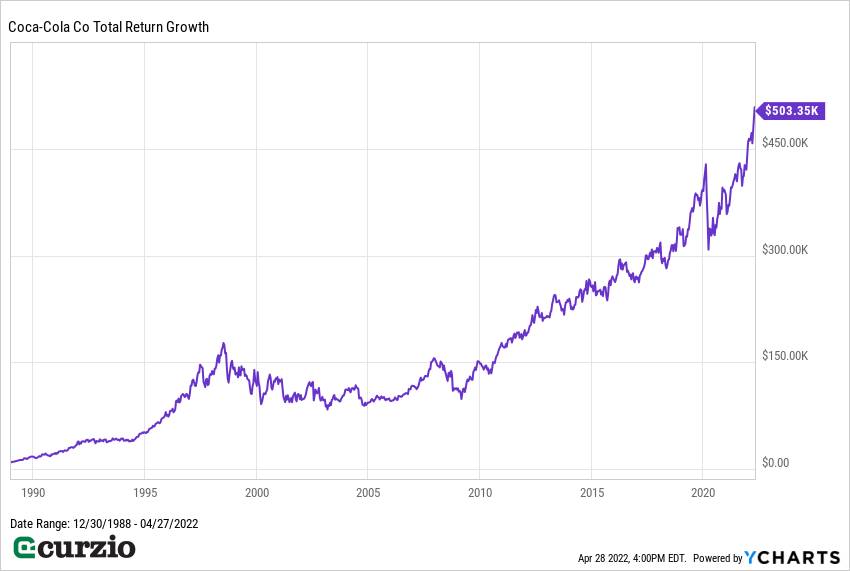

To put Buffett’s Coke investment into perspective, $10,000 invested in KO back in 1988 would be worth more than $500,000 today (with reinvested dividends). You can see its growth over time in the chart below.

(Of course, Buffett’s initial investment was much bigger: He originally bought 14 million shares worth nearly $600 million. Today, he owns 9.2% of the entire company… a stake worth $26 billion.)

Today, KO is as strong as ever.

Just a few days ago (April 25), the company reported its quarterly results. Its 16% revenue growth and 25% growth in operating income clearly show the company can handle inflation much better than many other consumer staples companies… and that it has no trouble passing cost increases onto its customers.

No wonder the stock trades less than 1% below its all-time highs… while the market is down 12% year-to-date.

There’s only one negative: KO is no longer cheap.

Even though it’s paying a nice 2.7% yield, the price-to-earnings (P/E) ratio for the stock is now beyond what Buffett would consider value: Today, KO trades at 26.7 times (26.7x) expected earnings. That’s above the market’s 24.9x P/E ratio. (We’ll go more into the whys and the hows of value in a future article.)

Of course, the power of Coke’s franchise is well worth the premium… and Buffett isn’t selling.

But KO isn’t the only stock with franchising power.

I told you about one such stock back in October, when I highlighted the power behind the Corona brand (and a safe way to play the cannabis craze), Constellation Brands (STZ).

Besides its “wide moat” power of premium beers and spirit brands, Constellation checks another important box on the “franchises must-have” list: The quality of its management team. It’s thanks to the visionary and competent leadership that STZ has avoided many of the missteps of its peers… leading the stock to outperform most of them.

In the six months since then, STZ has outperformed the market by a wide margin (up 17% vs. the market’s 6% decline)… as well as the majority of its beer peers.

Trading at 22x expected profits, Constellation is more attractively valued than Coca-Cola. Its expected growth rate is a bit higher, too, at 9% vs. 7% for KO. Plus, Constellation Brands recently hiked its dividend by 5%… for a market-matching 1.3% yield.

Coca-Cola and Constellation Brands are franchises in the best sense of the word. The power of their brands makes them suitable as investments for good times and bad… in bull and bear markets… and for fighting the high inflation we’re seeing today.

Editor’s note:

Buffett’s favorite stocks are the ones he can buy… and forget.

And Genia’s Unlimited Income advisory is one of the best “buy-it-and-forget-it” portfolios on the market.

It’s full of high-yield, high-growth assets set to beat inflation in a variety of sectors, including energy… real estate… industrials… precious metals… and more.