Time is the best friend and biggest asset for any investor. Through bull and bear markets alike, the longer you’re in the market, the better the outcome.

But what if your time horizon is relatively short?

What if you’re about to retire (or already in retirement) and can’t wait out all of the market fluctuations?

The traditional answer if you’re looking for near-term security is to stick with the stock market but also own bonds…

But right now, bonds are a losing proposition as inflation soars.

For one, even if the principal is returned to you at maturity, it will be worth less in real terms because inflation will have taken a big bite out of its purchasing power.

Second, in today’s market, bonds aren’t delivering much income: The 10-year Treasury yields around 2.7% currently.

But most importantly: The standard 60/40 portfolio—a mix of 60% stocks and 40% bonds—is no longer safe in today’s market.

Today, I’ll explain what to do instead if you’re nearing retirement and need security and income right now.

But first, let me explain the problem with the 60/40 portfolio…

The 60/40 portfolio is no longer safe

In every prior recession this century, central banks cut rates to support the economy. This, in turn, supported bond prices—just when stocks were falling—and prevented the value of a 60/40 portfolio from fluctuating too much.

But amid 40-year-high inflation, the Fed has no choice but to keep hiking rates.

And with interest rates poised to rise, bond values are bound to decline (bond prices and interest rates have an inverse relationship: the higher rates go, the lower bond prices sink, and vice versa).

In other words, with the Fed on a rate-hiking path to combat inflation, the negative correlation between stocks and bonds—the foundation of the 60/40 portfolio—has disappeared.

The bottom line: Low bond yields and rising rates create additional challenges for investors looking for stability and income in this market.

Bonds still have a place in many portfolios… especially if you have a shorter time horizon (in retirement or about to retire).

Quality bonds and TIPS are lower-risk investments (especially if you invest in a bond directly and hold it until the principal is returned at maturity)…

But you can lower your risk with stocks, too.

The best stocks for near-term security

If you’re about to retire and will soon need cash to cover living expenses… you should consider a well-diversified mix of quality value stocks.

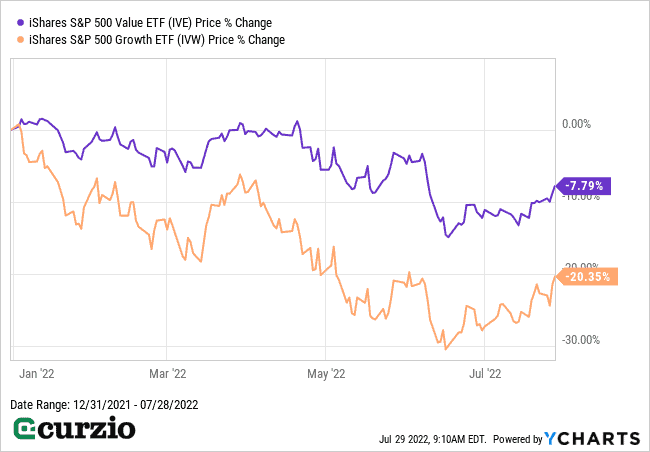

Value stocks—the cheaper half of the S&P 500—have been a relative bright spot in the market this year. As you can see below, they’ve easily outperformed the other half of the market—represented by the iShares S&P 500 Growth ETF (IVW).

Most value stocks pay dividends… while giving you exposure to safe, well-established businesses at reasonable valuations.

But don’t reach for the highest available yield…

An unusually high yield (double the yield of the average peer or more) is often a sign of trouble—the result of a falling stock price rather than a growing dividend… And if a company is giving away too much of its cash flow, it increases the chances that the dividend is not sustainable (and could be cut if the business suffers).

Consider stocks with a history of paying—and even increasing—their dividends throughout the toughest markets… These are the ones most likely to weather the 2022 storm—and provide you the most safety. (The simplest place to start would be with the list of S&P 500 dividend aristocrats—companies that have consistently raised their payout for at least 25 years.)

The bottom line: Invest for your age. The shorter your investing time horizon, the lower your risk should be. Stay with the market… but go easy on the most aggressive investments… be cautious with bonds and don’t rely on the 60/40 split… and own as many quality, dividend-paying stocks as you can.

Editor’s note:

When you join today, we’ll cut the price of our premier income-investing service, Unlimited Income, by a whopping 66%.

As a member, you’ll receive monthly recommendations that could not only hand you consistent cash payments… but also capital gains as high as the triple digits.