Back in 1983, legendary traders Richard Dennis and Bill Eckhardt were arguing about whether regular people could be taught to become great traders.

Dennis thought trading was a teachable skill… while Eckhardt was skeptical, arguing trading required born talent.

To settle the debate, they started an experiment…

They took out ads in a few newspapers—including Barron’s and The Wall Street Journal—looking for candidates to teach. Out of over 1,000 applicants, they whittled the final group down to 10.

Those 10 traders became known as “the turtles” (named so because turtles can be farm-raised).

This story is covered in one of my all-time favorite investment books: Trend Following by Michael Covel… it’s one of the books in Covel’s series about the Turtle Trader system.

Covel’s book does a great job of laying out the concepts that Dennis and Eckhardt used to turn the turtles into successful traders. Most importantly: You never know where the next big trend is going to be… That’s why you want to keep following a system.

According to Dennis and Eckhadt, price action tells you everything you need to know about an asset’s value. You see, all assets that explode higher have an uptrending price. If you keep following breakouts, eventually you’ll stumble upon a trend that keeps rising for a long time… making you a ton of money.

Trend following is an easy concept to understand. As you can probably guess, it centers on the idea that asset prices tend to keep heading in a certain direction (up, down, or sideways) for long periods of time. While prices might bounce up and down each day, traders should ignore these fluctuations and instead focus on the longer-term “big picture” price trend.

It’s not about winning all the time, it’s about spotting trends, hopping on board, and eventually catching (and riding) a massive winner.

Over the course of the book, the turtles learn a systematic approach that often results in selling losing positions quickly… while riding a few big winners for as long as possible. In the end, the few big winners easily make up for the losing trades.

In a nutshell, Covel teaches the importance of using price action to spot when an asset is breaking out (either up or down). For example, if a stock suddenly blasts higher, there’s likely a fundamental reason behind that move… and the same goes for a stock breaking down to fresh lows.

Today, a lot of traders refer to this concept as “momentum.” The idea is the same: Once an asset is heading a certain direction, there’s an above-average chance it’s going to keep moving that direction.

Dennis and Eckhardt didn’t invent the strategy, but they certainly were early pioneers. Many systematic approaches that exist today have their roots in the Dennis/Eckhardt playbook.

I know it certainly changed my investing career for the better…

After I read the Turtle Trader books, I tried my hand at commodities trading. But it didn’t take long for me to focus on my passion—growth stocks. As time went on, I realized the long-term trend of great stocks is all that matters. Once a stock establishes an uptrend, it usually keeps going higher—sometimes for many years.

I began studying stock breakouts. And I fell in love with Big Money—the signals created by institutional investors buying stocks—and how it drives these breakouts. Once I married those two ideas together, my mission in life was set: Follow the Big Money to find the best stocks.

Covel’s Trend Following helped supercharge my career… but there’s a bigger lesson here:

If you’re truly serious about investing, you should start reading. You don’t have to copy the strategies exactly. In fact, it’s better to use books as a foundation, then follow your passions and find what works for you.

But every successful investor I know will tell you the key is to keep learning and improving—and the best ways to do that is by studying the success stories of investors that came before you.

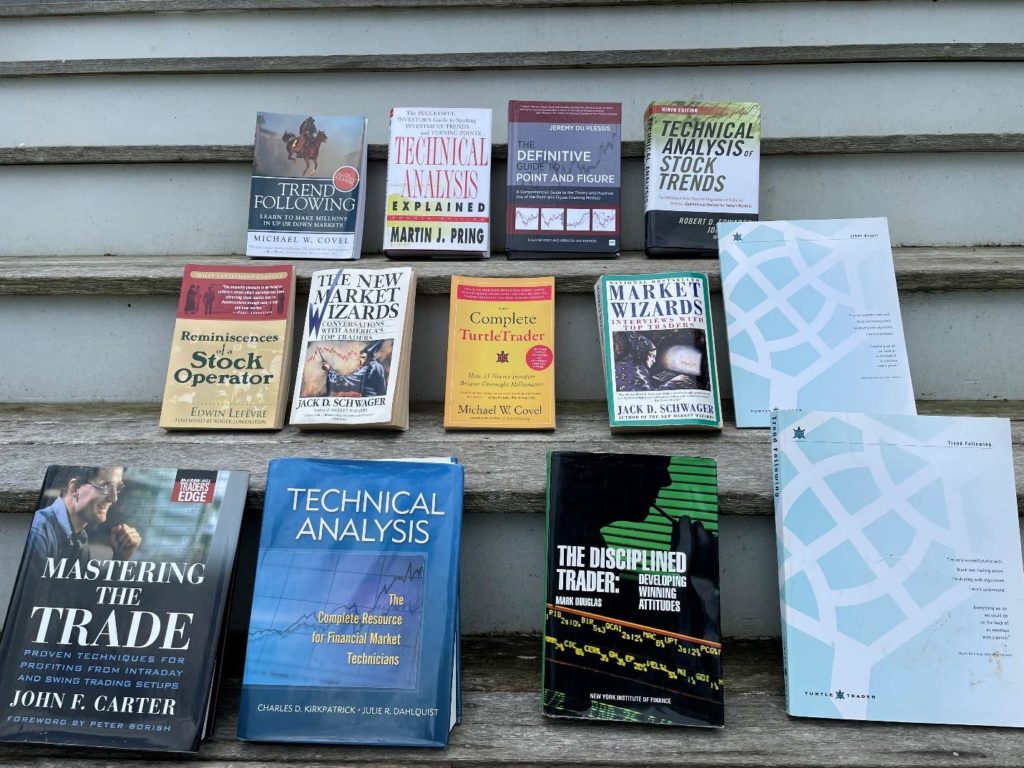

I snapped a pic of my favorite titles from my bookshelf. Each of these books shaped the way I think about stocks. The Turtle Trader books are the ones on the bottom right. You’ll also notice Michael’s Covel’s The Complete Turtle Trader… another great option if you just want to learn about the story of the turtles.

My investing journey continues to this day. There’s always some new nugget I find tucked inside a page somewhere. We’ll never fully master investing. But we should all strive to!

If you have some favorite books that changed your investing career, shoot me an email here… I’d love to find new books I’ve never heard of.

P.S. For my absolute favorite growth stocks… check out my newsletter, The Big Money Report.

Several of these names are up double digits in just a few months… and there’s way more upside ahead.

Become a member today and get my newest recommendation—a play on small cap growth—delivered to your inbox TOMORROW.