Back in the mid-2000s, I wasn’t a skilled investor.

I knew I had a lot to learn. And I was still in the process of crafting my own investing strategy.

There was one thing I was sure of: I loved growth stocks.

If I wanted to become a great investor, I needed to study the best growth managers. And there was one firm that was the best in the business when it came to growth investing—Tiger Global Management, founded by Chase Coleman III.

If you haven’t heard of Coleman… in his early years, he worked under hedge fund legend, Julian Robertson. Robertson made insane gains during the 1980s and early 90s. And he had a stable of protégés—guys who spent years learning his investment strategies—called “Tiger Cubs.”

Many of the cubs became wildly successful, including Chase Coleman.

Coleman is known for investing in technology stocks. He’s been one of the best-performing hedge fund managers for years, with a 21% compound annual growth rate over the last two decades.

And there was just one way for me to learn from Coleman… by reading Tiger Global’s 13F filings.

In a moment, I’ll share two of my favorite assets from Tiger’s latest 13F. But first, here’s why these documents are so valuable…

Large institutions (with assets over $100 million) are legally required to provide a public record of their equity holdings each quarter, called a 13F.

That means anyone can peek over the shoulder of big institutional money managers and see what they have in their portfolios… including any changes (buys or sells) they made during the recent quarter.

One thing to keep in mind is that the records are filed 45 days after the quarter ends. In other words, they’re delayed… which means the firms’ current holdings could have changed in the six-plus weeks since the end of the quarter.

Nevertheless, we can still gain a ton of insights from these reports.

After studying many 13Fs, I noticed that Coleman constantly had positions in stocks that I either owned or was interested in. In short, he invested the way I wanted to invest.

Soon I was reading up on him… and researching every stock he bought or sold.

Each 13F let me see his newest positions, plus any existing positions he added to or trimmed. All of this homework helped shape my investing style.

I always wanted to know what the smart investors were doing with their money. And that’s still true today.

That’s why I always watch out for the latest 13F filings. They’re a fantastic source of ideas for even the most experienced investors.

Tiger Global remains one of my favorite funds to track. And based on the fund’s latest 13F, there are two positions Tiger recently added to that I also love as long plays.

The first is DocuSign (DOCU). They dominate the paperless signature market. And with COVID not going away anytime soon, this company should benefit.

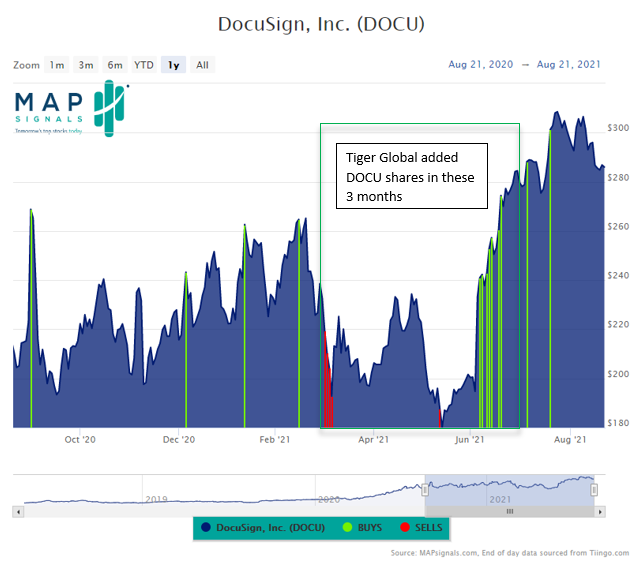

Below is a one year chart of DOCU. I’ve outlined the recent quarter where Tiger Global was adding to its stake in DocuSign:

The green and red signals come from my Big Money software. They indicate the days when DocuSign’s stock rose or fell on high volume, which means institutional investors were either buying or selling shares. Early in the quarter, there were red signals, and late in the quarter, a lot of green big money buys hit.

The latest green signals are what grab my attention. See all the buy signals in June and July? That tells me the stock was getting scooped up in a big way.

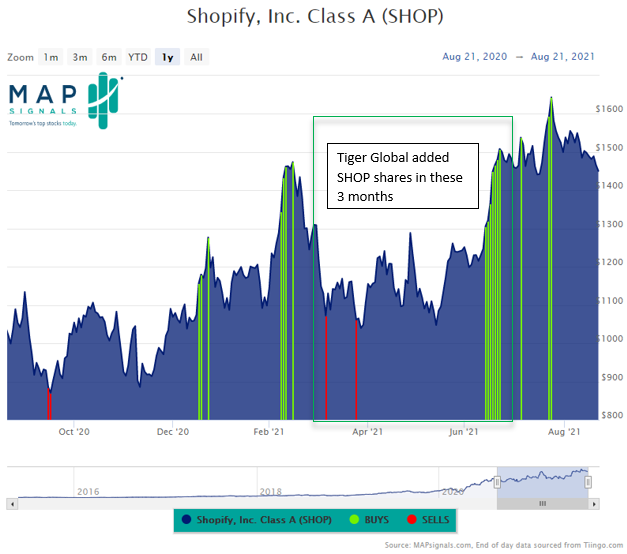

Let’s look at another name Tiger Global was buying recently—Shopify (SHOP). It’s another beneficiary of the new COVID world. Shopify allows people to seamlessly create e-commerce storefronts. As more people stay at home, they’re creating more online stores… which means business is booming for Shopify.

Here’s a one year chart of SHOP. Notice the sell signals in the beginning of the quarter, then big green signals at the end of June:

Some of those green signals might have come from Tiger Global buying the stock…

Look, when a manager of this caliber is betting on a stock, that’s a feather in the bull’s cap.

Over the years, I’ve spent a ton of time studying 13Fs. I use them to hone in on the managers I most identify with.

So, if you want to be a better investor, find a few managers that resonate with you… and watch their 13Fs.

For more details on 13Fs and where to find them, go here.

P.S. Want to know which growth stocks are on my radar now?

Join my newsletter, The Big Money Report, and start investing like the world’s greatest money managers.