As you know, costs are rising everywhere.

The Consumer Price Index (CPI), a common inflation measure, jumped to a 40-year high in January. That means costs for common everyday products are accelerating.

The Federal Reserve plans to raise interest rates to combat this rampant rise in costs. And that’s spooking investors… which is why major indices like the S&P 500 and Nasdaq are down 10%-plus since the start of 2022.

But the current situation is nothing new. In fact, we went through a similar bear market a few short years ago…

And as that time period teaches us, these bear markets often create amazing opportunities to pick up beaten-down stocks…

Rewind to 2018

Four years ago, the stock market suffered big losses due to a variety of factors. These included tariffs, interest rate hikes from the Fed, congressional investigations of big tech companies, and sky-high price-to-earnings (P/E) ratios.

The concerns made 2018 a bumpy ride for investors. From January 1–December 1, 2018, the Nasdaq Composite Index lost 10.5%, and the S&P 500 lost 11.2%.

But the pain was particularly sharp from August to December: The Nasdaq and S&P lost 18.2% and 13.6%, respectively.

The two biggest catalysts for the carnage were interest rate movements and Fed policies. The Fed raised rates four times in 2018… triggering fears that easy money wouldn’t be so easy in the future. You see, rising interest rates mean higher costs of capital for companies… and slower economic growth.

How did Big Money investors react? They sold. And the selling hit growth stocks particularly hard… just like we’re seeing today.

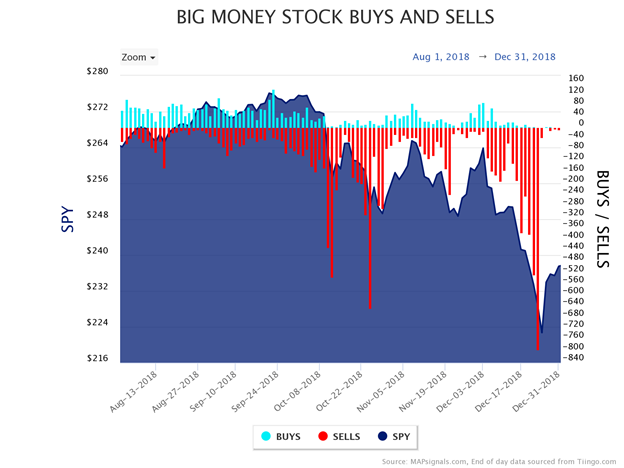

You can see the late-2018 carnage in the chart below. Notice how the selloff got worse over time, with massive selling in October (the deep red bars) followed by an even steeper selloff in December:

Also notice how the buying (represented by the tiny blue bars above the x-axis) completely vanished during the last few weeks of 2018, while the selling (the red bars) accelerated. It’s a very similar setup to today…

Fast forward to 2022

Over the past few months, we’ve seen stocks plummet—especially technology and healthcare companies. As of today, the Nasdaq is down 12.5% this year (and down 15.5% from its November 2021 high). Meanwhile, the S&P 500 is down 9% from its January high.

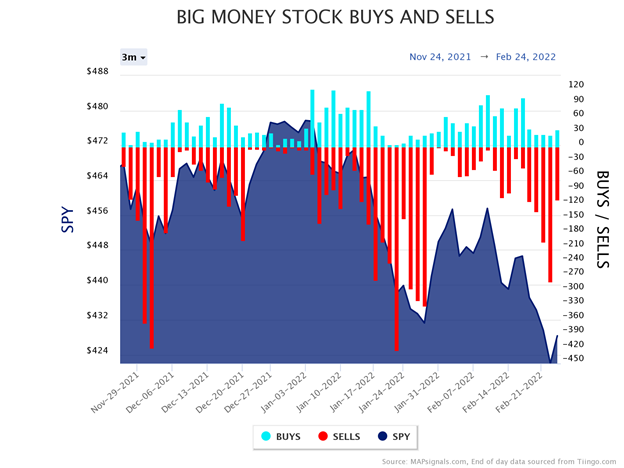

What has Big Money done during this time? It’s been selling. Check out all the red bars below.

Just like in 2018, investors are worried about a slowdown in growth resulting from tighter monetary policies (especially higher interest rates). And the Russia-Ukraine conflict adds an extra layer of uncertainty, keeping investors on the sidelines.

Keep in mind, these kinds of market-wide selloffs hit all stocks. You’ll see plenty of risky, low-quality companies with negative earnings suffer… but you’ll also see declines in great stocks. That’s why it’s so important to keep your emotions in check when the market hits a rough patch. Instead of selling into the declines, the smart move is to use the weakness to build positions in high-quality stocks… at great prices.

Nevertheless, most folks want to know how long the current bear market will last. No one knows for sure… but we can look for hints in the past.

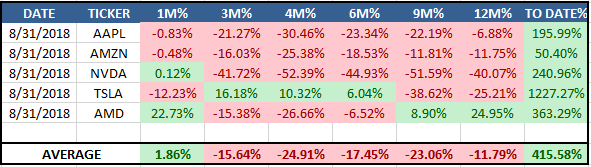

Let’s take a closer look at the 2018 selloff. Below, I’ve included a table showing how a few top stocks performed during the pullback… and how they’ve soared since then.

I picked five stocks that most investors know about: Apple (AAPL), Amazon (AMZN), Nvidia (NVDA), Tesla (TSLA), and AMD (AMD).

Notice how each of these high-quality stocks fell dramatically in 2018. Four months into the selloff, the average return for those stocks was -25%. But, look at the far-right column, which shows the return from August 2018 to now.

Source: FactSet

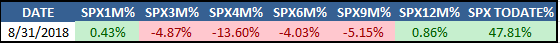

Here’s what the S&P 500 did during the same timeframe:

Source: FactSet

As you can see, short-term pain equals long-term gain. For those who understood this, 2018 was a chance to get great assets at discount prices. That same opportunity is here right now…

The bottom line

Many stocks out there are seeing red. But review the tables again and notice what happened after holding through the pain—I call it the JUICE!

Forces like inflation and interest rates regularly jostle markets… and high-quality stocks will suffer from short-term pain.

But eventually things settle down… the fundamentals regain control… and profitable companies rise.

This will pass… and the best stocks will ramp up again, as they have over time.

If you’re curious about the stocks I’m focusing on right now, check out The Big Money Report, where we follow quality growth stocks with massive wealth-building potential.

Editor’s note:

Last week in The Big Money Report, Luke revealed his favorite materials stock—a company starting a new uptrend on a wave of Big Money buying.

Get access here… before the rest of the market catches on.