Last Tuesday, Fitch Ratings stunned the markets when it announced it had downgraded the United States’ credit rating from AAA to AA+.

In its report, the agency noted three key reasons for the downgrade:

The expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades.

Put simply, the downgrade is based on out-of-control government spending, several political standoffs related to the debt limit… and rising national debt.

This is only the second time in history the U.S.’ credit has been downgraded… with the first time taking place in 2011.

In fact, we can learn some valuable lessons from 2011 about the longer-term effects of last week’s news—including which sectors will benefit the most.

Let’s take a closer look at how to profit from the unfolding situation…

3 sectors primed for profits following the downgrade

In August 2011, Standard & Poor’s (S&P) downgraded its rating on U.S. debt. It was the first time in history that any credit rating agency downgraded our nation’s credit.

According to S&P, the risk that holders of U.S. debt would not receive interest or principal payments in a timely fashion had increased slightly… and the debt ceiling agreement reached earlier that year fell short of stabilizing the debt burden.

Notably, other rating agencies maintained their top-notch credit rating for the U.S., citing our nation’s central role in the global financial system and our flexible, diverse economy.

At first, the markets panicked… but by the end of the year, the S&P 500 was almost 6% higher than on the day of the downgrade, as you can see from the chart below.

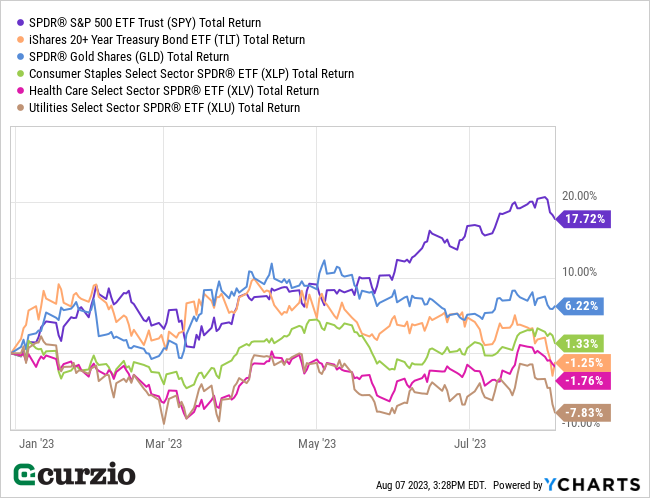

But the real winners in 2011 were the so-called “risk-off” sectors… like consumer staples, healthcare, and utilities.

As you can see above, the Consumer Staples Select Sector SPDR Fund (XLP) and the Health Care Select Sector SPDR Fund (XLV) both almost doubled the S&P 500’s return… while the Utilities Select Sector SPDR Fund (XLU) almost tripled it.

Following the 2023 downgrade, we can expect similar action from these sectors… And that’s because the 2011 and 2023 environments share a key feature: Growing national debt.

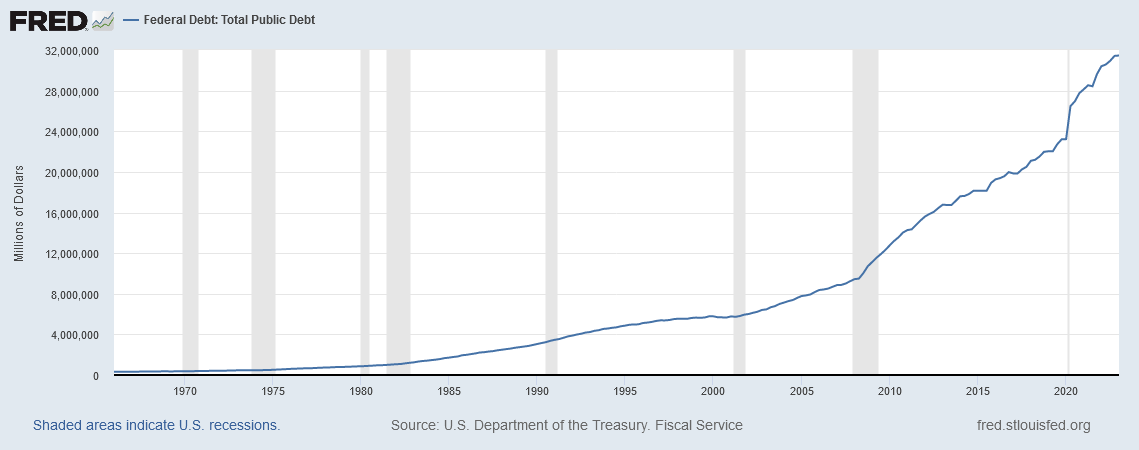

Over the past 12 years, our national debt has more than doubled, as you can see below.

Keep in mind, a “high and growing general government debt burden” is one of the reasons behind Fitch’s downgrade last week.

In short, the root cause of both downgrades is exactly the same.

And that means the market is likely to react in a similar manner. Just like in 2011, “risk-off” sectors are likely to be the biggest winners in the second half of 2023. As I mentioned above, this includes consumer staples, healthcare, and utilities.

These sectors are historically more stable than the rest of the market… and less dependent on the economy. (After all, you’ll continue paying for groceries and medicine, no matter what else you’re forced to cut back on.)

Plus, these stocks tend to pay steady dividends… which can also help investors stay afloat during a bear market—or outperform when the market spends months going sideways.

These sectors have underperformed so far in 2023 as investors have become optimistic the economy will be able to avoid a recession. This optimism has propelled higher-growth, riskier sectors like technology… while pulling money away from these “risk-off” stocks.

With the rest of 2023 shaping up similarly to 2011—especially considering the potential fallout from our nation’s debt woes—these sectors are set to outform again as investors look for safety and stability.

The three ETFs above—the Consumer Staples Select Sector SPDR Fund (XLP)… the Health Care Select Sector SPDR Fund (XLV)… and the Utilities Select Sector SPDR Fund (XLU)—are great ways to get exposure.

They hold the largest—and the most important—stocks in their respective industries… and you can buy and sell them as easily as you would a stock.

For more of my favorite plays, join me at Unlimited Income—our portfolio boasts several names across all three of these “risk-off” sectors.

Conclusion

Just like in 2011, the recent U.S. debt downgrade will trigger a “flight to safety” over the coming months… and create a strong tailwind for three of the safest corners of the market—consumer staples, healthcare, and utilities.

As investors flock to these “risk-off” sectors, the Consumer Staples Select Sector SPDR Fund (XLP), the Health Care Select Sector SPDR Fund (XLV), and the Utilities Select Sector SPDR Fund (XLU) are likely to be among the market’s biggest winners once again.