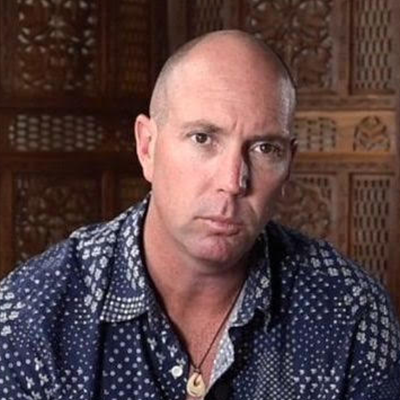

Chris MacIntosh, founder and editor of Capitalist Exploits and founder/managing partner of the Asymmetric Opportunities Fund, is a macro specialist. That basically means he’s an expert in everything market-related. He’s made some incredible calls in his career—including being bullish on bitcoin before it caught the world’s attention.

Today, Chris explains why unprecedented action by governments across the world could act as a tailwind for both gold and cryptocurrencies.

He also shares his contrarian perspective on the energy sector. [39:49]

Then, Big Tech has been leading this market higher… but we must act with caution.

As several heavy hitters—Apple, Google, Amazon, and Facebook—prepare to report earnings tomorrow, here’s why you should expect a short-term pullback in the markets… [1:12:23]

- Guest: Chris MacIntosh, founder and editor of Capitalist Exploits [39:49]

- Educational: Prepare for a short-term pullback [1:12:23]

Wall Street Unplugged | 732

Prepare for a short-term pullback

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on Main Street.

Frank Curzio: How’s it going out there? It’s July 29th. I’m Frank Curzio, host of The Wall Street Unplugged Podcast, where I breakdown the headlines and tell you what’s really moving these markets.

Frank Curzio: So, the past eight years, I’ve attended the Consumer Electronics Show. This is the largest tech conference, maybe the largest conference overall in the world, where over 100,000 people attend every year, at least for the last few years and at least, I would say another 25 to maybe 50,000 travel to Vegas during that time. During the show, so much is going on, restaurants, bars, special events, concerts, tons of after parties. Well, the CES just announced this week that it’s 2021 show, which they hold in early January every year, and that’s six months away, is now going to be all digital.

Frank Curzio: Basically, it’s not open, which is going to be horrible. Because if you guys know, if you follow me, I cover that conference extensively. I look forward to it every year. You see my live videos from the conference floor, sampling these technologies. Making an idiot out of myself just to show you some of those new technologies, new stuff that’s out there, like jumping into an eight-foot deep tank of water in the middle of the conference floor in a wetsuit to sample an underwater scooter. And look, I lost some weight over the past year, probably in the best shape of my life, but me in a wetsuit, not something easy to look at. Man, I looked like a giant black pear floating around the water, but that thing was awesome. I actually bought it. I mean, my daughters use it. My pool is fantastic.

Frank Curzio: But this is a massive, massive blow to Vegas. I mean, every room and every hotel is booked and it booked at least three, four months ahead of the conference. I know, it’s if I book late and it’s very difficult get a room. Restaurants. You won’t find a restaurant that’s not packed. You wouldn’t get into these unless you have reservations. The casinos are packed. Nightlife. Everyone’s going out for drinks. Streets are packed and that boardwalk is packed and Vegas loves it. They run up all the fees, hotel fees, rent a cot fees, and you get charged just shaking people’s hands and nobody complains because it’s Vegas and hey, you’re going to something that’s really cool. It’s a fun conference. It’s awesome. Sin city. What happens in Vegas stays in Vegas. A lot of people go out there they go crazy for they spend a ton of money.

Frank Curzio: And it sucks because it’s all digital this year. And for me, it’s the worst because I have this exclusive access given that this podcast and thanks to you, the amount of people that download, qualifies me for getting a media badge. And when these companies see a media badge, they open up everything to you. Everything. You talking to the top, you’ll see the interview and I do guys like top leaders in Amazon in charge of their auto division, and some of these interviews are fantastic. They’ll close down their floors to the public for 15 minutes and let me do a live video explaining these products and interview these people on the floor. It’s a lot of fun. And the most important thing is I always come back with awesome under the radar ideas that we’ve done fantastic on in technology, since I’ve been going to these conferences.

Frank Curzio: Getting into trends like Cloud before anybody knew it. You’ll get a 3D printer as it run up and telling people to get off wearables, how it wasn’t going to be a big deal and then now you’re seeing wearables come back a lot more. That trend got ahead of itself, and all these trends, if you’re looking at big data analytics, and Cisco baby speeches, how many connectivity and what was it? Seven or eight billion devices are going to be connected, or I think was actually 10 billion devices going to be connected. I’m looking going, “Okay, well, this what? Well, over seven billion people.” And it was like, “No, no. We’re not talking about just one device. Everything is going to be connected.” This is 2012, I made that speech.

Frank Curzio: But getting into these trends, talking to the right people, I mean, that’s something that I love doing. We get tons of views, everything, just showing everyone that experience and everyone’s just saying, “Man, I got to go. You definitely have to go to a conference.” So, it really sucks this year, it’s basically canceled. They’re going to have it on digital. I mean, that conference is the worst to be digital, because you’re not just going to like a mining conference and people going up their presentations and yes, it’s important with the interaction and stuff like that. People love going there because you sample all these technologies across all sectors, no matter who you are or what age group. It’s a lot of fun.

Frank Curzio: But you know what? Forget that for a minute, because there’s a much bigger picture that’s far more important. The coronavirus risk and the key word there is risk, the risk is not going away. I thought it would by now. Very surprised New York closed the economy. Good luck opening that back up, because when you do you’re going to see what Florida saw, what everybody else at Texas saw. You’re going to see cases explode, but you’re going to notice something really cool, that your death rates are going to be down because we understand that anyone under 60s pretty much fine if they get this, if you look at statistics.

Frank Curzio: But now, the Major League Baseball just suspended a few games after more than half of the Marlins team contracted the virus. You’re going to see the same thing happen across all these professionals, but NFL, NBA is going to open pretty soon at the bubble. NFL, there’s going to be more athletes that get it. I mean, they’re in close contact with each other, no matter what kind of bubble you create, it’s going to happen. And you just need one person to get it, everyone’s going to get worried. And again, New York still closed. California said, “We’re closing our economy again.”

Frank Curzio: Why is this a big deal? If we look back two months ago, the consensus from almost every economist, analyst, corporations was that, “Hey, we’re going to have a second half recovery.” Meaning, our economy will almost go back to normal by the end of this year. You got all of these Fed inflating everything. We’re just throwing tons of money, trillions into this market, and we’re going to have a great 2021. It’s kind of funny because these same analysts first called for a second quarter recovery, which I called bullshit on, that wasn’t going to happen. Then they said, “Well, it’s more like a second half recovery and then 2021, all the Feds spending everything goes back. It’s going to be a monster year. It’s going to be a great year.”

Frank Curzio: It explains why stocks really started moving up, and people started buying a lot of these things that were cheap along with our government who spent over $6.5 trillion dollars, 30% of GDP to support our economy. So far, a lot more is coming, a lot more is coming. But the economy getting back to normal this year, that will put on a scale to say one to 100, at one being the worst, it’s zero, zero, zero. Why is it zero? Because people are still scared to death of COVID. They don’t want to send their kids to school. Athletes are scared to play sports. Economies are closing. They’re watching States like Florida, Texas, Arizona and you read the stories that have skyrocketed, they used the word skyrocket, cases skyrocketed, record highs, out of control. These States are horrible. They don’t know what they’re doing.

Frank Curzio: And I can tell you right now, it’s the truth and it’s going to piss most of you off because so many of us when we’re looking at outlets or what we’re looking at to get our information, and we’re being conditioned to think a certain way by the media, by social media, so it’s not anyone’s fault. It’s the way our brains react and we love storytelling. It’s just, it’s ingrained. There’s a reason why when you look at Spider Man, Spider Man, whatever over the past 12 years, the same Spider Man has been made over and over again, it always generates a billion dollars. We love to be entertained, we love to be entertained. It’s easy to do that with social media and show you things that are happening to a small percent of the population, but it’s crazy out there.

Frank Curzio: And this truth I’m going to share is meaningless for a second. I’m going to show you why it’s important, but it’s going to be meaningless in terms of how you think about COVID. But you know what I’ve been saying for over 12 years, 12 years on this podcast, and I was doing this for over 25 years, 12 years, I mean, try and name 10 people that have a podcast longer than 12 years. I mean, I don’t even think I can. I think Andrew did it like a half a year before me. Andrew Horowitz, very few people. But a lot of you have been listening to me especially over the long term for the last five years at least or longer, you listen to me because I don’t bullshit you. That’s just the way I grew up. I grew up in New York, you say what you feel, you say what you mean and often that means, I’m on the other side of the popular opinion, which I like to be because it usually means that I’m right.

Frank Curzio: If you’re saying something and everybody disagrees with you, it usually means you’re right. That’s just the way it is. It’s funny, especially the more angry people get at you. Pound your positions and thoughts if that happens. Anyway, not being on the popular side usually amounts to a lot of interesting emails, which I should read to you sometime. It gets interesting. All right, keep coming, frank@curzioresearch.com. But my agenda over my 25-year plus career has always been the same, to help you become better investors, to help you create generational wealth so your kids and maybe their kids are financially secure, you can send your kids to college and in helping you, you’re going to subscribe to my newsletters, which should lead to me hiring even more employees, more credible analysts, more great newsletters, and building our brand. I mean, just incredible, where every investor has the same access to those on Wall Street.

Frank Curzio: So, my goal is leveling the playing field, which has never been leveled and it still isn’t, but if you following us, we’re teaching you how, how to get in ahead of Wall Street, how to be a part of Wall Street when they’re pouring into ideas, understanding how they think understanding what is going on. I built a very good reputation in an industry of financial newsletters that, let’s face it, it doesn’t really have a credible background if you talk to most people. A lot of people get burned. It’s all like high sales pitches and you’re going to make a million dollars tomorrow, all this crazy stuff. It’s tough. It’s tough to say, “Hey, you know what? We have the track record, we’re good, listen to us.” And when people come into our company and buy our newsletters, they see that. They stay and they buy others newsletters, but that’s the goal. That’s been the mission: to bring this to everybody out there.

Frank Curzio: So, here’s the truth: You don’t need to be scared of the coronavirus. It’s all bullshit. It’s all bullshit that’s being driven by politics. Now, you’re looking at one party that controls most of the media outlets. That’s a fact. You’re looking at Trump’s numbers starting to sink when the coronavirus started to spread across the U.S. and States began to close your economies. Again, that’s a fact, so if you’re looking at that party that wants to win the election, which they could win without a lot of bullshit, but it’s in their best interest to keep the economy closed, have people protesting like crazy. It’s amazing because you’re worried that the coronavirus is going to spread and you got to close your economies. How many people out there are telling people not to protest? And why? It doesn’t spread between protesters? Kind of interesting.

Frank Curzio: But it’s in their best interest to continue to scare the shit out of you, at least until they get that person of their party elected. For a political standpoint, the strategy is brilliant, it’s working, it makes sense. From a credibility standpoint, not saying that the other side of party is that much credible, but from a credibility standpoint, you’re killing Americans and destroying our country with this agenda, and there’s facts to support that. Now, I have a lot of friends on both sides with Democrats, Republicans, always going to have our differences, which is fine.

Frank Curzio: But right now in America, and believe me, this is going to come back to financials, so pay attention and I know some of you might tune me out already, pay attention is important. Because right now in America, I always knew how important power is to anyone, anyone that gets it. I’ve seen people change when they get that power, and I’ve seen it often because I worked at Wall Street. Very successful people that I worked for, you see it, they change, and that power is addicting. It’s very important and I get it. Okay. See it firsthand growing in New York and Wall Street. I never thought in my life, in my career, that any American would choose power over life or over lives.

Frank Curzio: So, I know because I read emails coming in frank@curzioresearch.com, but I want to elaborate, okay. Please listen. It’s going to be worth it because if you’re under 60 years old with no respiratory problems, there is less than a 0.3% risk of you dying from this disease, which puts it on par with the traditional flu, which we’ve been told, “No way. It’s worse than the flu. Don’t compare it to…” if we take out that group, which we learned now that that’s what COVID targets when it comes to fatalities people over 60 and people who have respiratory problems, right? We know that now. You want some real examples? Take our athletes. All right. I mentioned earlier, Major League Baseball. So, to Marlins, it was 17, 18 of them who got the coronavirus, suspending games, and they’re saying, well, maybe they’re going to have to cancel the season.

Frank Curzio: How many professional athletes do you know that got affected with COVID? I would say easily over 1,000. I’m a sports geek, loves sports, check websites daily several times and see what’s going on, golf, basketball, football, hockey. I just grew up with sports. I love it. love it, love it, love it. Hard to watch ESPN, which is a site that I admire. I love it. So, many great people on it because it’s all political now, right? I mean, the reason why you watch sports, the reason why you listen to music is to get away from all the bullshit. And now that bullshit is impacting the things that we even love in our past times, right? Who cares? But still, big sports fan.

Frank Curzio: So again, our athletes look like over 1000 and we hear the popular ones that get it. How many of these athletes died from COVID? I can’t name one. I might be able to name some European soccer player, but I can’t name one. Anyone in the NBA die, anyone in the Major League Baseball die from COVID that’s playing? There might be a couple, but really compared to how many people have gotten it. If you look in May, think about in May, guys, right? It wasn’t that long ago, but in May, I didn’t know anyone who had the virus. I’m sure some of you didn’t know anyone had the virus. A few people are getting tested. Today, everybody’s getting tested. And I know or heard of neighbors, friends, acquaintances, I have to say, easily over 100 people who have had the virus so far. I don’t know any of them that died, not one.

Frank Curzio: In fact, how many people do you know who are under 60, no respiratory problems, who contracted the virus, who have died? I may be talking to this where you know one or two, and again, these are lives. I understand, I get it. People are dying, a few people are going to die, but I guarantee that more than 95% of you listening to this right now, you don’t know a person under 60 with no respiratory problems that’s died of COVID. Why? Because it almost never happens. And the data from no matter what side you’re on, CDC, you’re looking at European data, ABC News, 100% supports this, but nobody cared.

Frank Curzio: Now, when it comes to our schools opening back up, this is interesting. The big fight is taking place, which again, it’s a one party’s best interest if this does not happen according to almost every poll you will see. Forget about what you think of me, this is the polls, this is polls talking. This is a fact. When we look at the percentage of kids who die from COVID, it’s less than the flu. And you know what happens if kids do test for the virus? I know this personally because my nine-year-old daughter was Crohn’s needs the procedure done next week, well, she got a COVID test three weeks ago, because I had a slight fever. So I said, “Let’s go,” but they were fine. But now that she needs this procedure, after seeing her doctor, we got to change a medicine, so they got to do a procedure, which sucks, she’s nine years old. But they said, “Hey, you have to take another COVID test.”

Frank Curzio: I took her yesterday to the doctor. Thank God, this COVID test wasn’t like the first one because I mean, these are pre-op, so I don’t know if you now this, but you need to take one 6 days before any operation or if you’re going under, right? Just because there’s going to be a lot of doctors, right? And you need to, so it doesn’t matter. And so they have a separate place for this, right? Because you don’t want to go where people who think they have COVID, and a lot of people may have it and get tested there, they have a special place that you test because most of these people don’t have it, but you need to be sure because doctors are going to be all over you.

Frank Curzio: So they said, “Well, no news is good.” And I know she doesn’t have it. So they were like, “You know no news is good news, but if she does have it,” these are the nurses, doctors, “Just stay at home, make sure she’s quarantined.” So, you don’t need to go to the hospital unless you have breathing problems, which almost never ever happens with kids. I mean, does it happen? Yes, there’s very small examples and God forbid, like if your kid did die from this, I mean, it’s a tragedy, but we’re looking at percentages and there’s no perfect solution to this. Like, do we really want a perfect solution to this? If we go to war with someone and expect that they’re not going to have any casualties, we’re going to lose our freedom, because we’ll never go to war. You have to weigh the risk/reward just like you do in investing. If you look 99.8% of kids have mild symptoms and are perfectly fine and it’s less than two weeks later.

Frank Curzio: That’s why almost every leading doctors on both sides of the aisle say kids need to go back to school. It supports the facts. So you say, “Well, what about the teachers?” And I get it, okay, but when it comes to kids and transmitting COVID, here’s something interesting, very few transmit the virus to adults. In fact, it almost never ever, ever happens. So, when it comes to teachers, who are worried about contracting COVID when we open schools back up, right? That’s a worry, and if you’re over 60, you shouldn’t be going back, if you have respiratory, you shouldn’t be going back. But everybody else, all the teachers, here’s something interesting.

Frank Curzio: You know how many teachers have gotten affected from a child that has the coronavirus? Take a second. Any guesses? Zero, zero. There’s no recorded cases. You may say, “Well, Frank, they’ve been out of school for last few months.” Bullshit. It was the second week in March, we started closing schools through the rest of the month and at that period, every single State was reporting cases on COVID and it was spreading, so kids were in school with teachers, still zero recorded cases, zero. Yet, that’s a big thing. And what about the teachers when they go back, we’re at risk? Zero. Not only are the kids, the symptoms are low, they don’t really transmit the disease. Again, facts support this.

Frank Curzio: And when you look at the data, it 100% supports the opening of schools and keeping them closed, preventing the kids from socializing, learning, building their character, learning how to interact with people, skills they can’t really learn from their parents, it’s a big place, the building blocks of growing are essential. You’re robbing these kids of that experience, again, which is a necessity in terms of building you as a person all because of a fucking political agenda.

Frank Curzio: Now, when it comes to COVID, I haven’t seen another analyst on Wall Street predict a major collapse in early February, when stocks were all-time highs, we seem to be getting the stocks. Anyone say that the U.S. will have more case than other country in mid-February? Again, something I said, criticized for. I got these right because I have amazing sources. It’s not because I’m a genius. Okay? I have sources that have no agenda that email me all the time. Just like me, I don’t have an agenda. If you go, “Oh, Frank. You have an agenda.” I don’t have agenda. I want the best for everybody. I want this country to open back up. I look at data all the time. For me, I’m willing to switch on a dime if I see the facts change in any stock I recommend or on my market prediction. Okay? That’s the way it is. That’s why I’m want everything. I don’t care who wins this election. What I care about is how we’re going to benefit.

Frank Curzio: But I have those amazing sources, interviewing people in Europe seeing how serious they took the lockdown, cops in the street, masks everywhere, taking temperatures. Same in China. We didn’t do any of that shit here. No way. It’s just about the time. It was pretty simple, that it was going to spread, if you had the right data, but most people didn’t. We’re saying, “The U.S., we’re fine. New York City, no, I don’t worry about it.” I don’t care whose fault it is. It’s a fact. People who got the coronavirus in New York, they decided to put them into nursing homes. Really good idea, right? Turns out to be a horrible idea. It’s okay. Nobody understood it, but it’s everybody else’s fault. Everyone’s going to blame everybody else back and forth. Crazy. But that’s why New York’s death rates skyrocketed, there’s no one even close to their death rates even though they haven’t been reporting death rates because they had their economy closed.

Frank Curzio: But they’re all going to follow Florida, they’re going to follow Texas. These states actually, and Arizona, they’re going to wind up closing their borders because there’s going to be spreading. Look at Ohio. Some other states that opened, you seeing it spread. You have to go through, call it a second wave, whatever it is, as you open these economies, it’s going to spread, but we know more now, which is important. We know more now to help people, and having these sources is amazing. And why am I bringing this up? Because do you know how many doctors have reached out to me that are in the field dealing with COVID patients every day? Have data that is absolutely essential that’s going to help save lives and the data they shared with me is amazing. Again, no agenda.

Frank Curzio: I don’t know if the Democrats or the politicians, they work with people, they work with COVID patients. On the Daily Show, like how kids need to go back to school, how the virus targets six years old or over, knew that in early March. How the hospitals are really not at full capacity? Again, they had no agenda. They tell me this. How ICUs are not crowded, we have enough ventilators. And by the way, if you’re looking at ICUs, they need to be operating over 90% or they’re going to have to fire nurses and most are in the 70% across the country, right? They’ve been lower.

Frank Curzio: I took my daughter to the hospital yesterday, there was no one in the hospital. No one in the hospital in terms of spaces and the same hospital my mother was at, after four and a half months, I was going to visit almost every single day, jam packed, no one’s getting anything done because of COVID, nothing. Everything had been shut down. How the death rate as a potential to affect it has gone down considerably, these doctors shared with me, since we have drugs now that treat patients with severe symptoms that lowers the risk of death by over 60%. But you know what’s funny? You know what these doctors, every single one of them said? “Please don’t use my name if you’re going to share the data on your podcast.” Think about that for a minute.

Frank Curzio: So, these are doctors, great people on the frontline, great information that could help save lives, but everyone who emails say I don’t use their name. And I get it because they’re going to get scrutinized by their peers, the people who have power have an agenda. Who knows what’s going to happen? It’s just you have no benefit of opening your mouth about something that’s not the status quo because there’s people who are going to hate you. What’s the benefit? There is no benefit when you look at it. So, doctors on the frontline, they can’t tell us the facts about what they’re seeing. And how insane is that?

Frank Curzio: I mean, again, you’re looking at Florida, Arizona, Texas, remember the stories over the past two weeks. You say, “It’s so irresponsible. They were reckless.” Media lashed out again saying we had some of the top doctors who by the way, and these are stats even shared from my doctor friends, which are cool, that have email me again, no agenda at all here. If you look at most of the leading doctors out there, they’re all over 65, I mean, they’re in the target zone. Aren’t you going to think about this virus differently compared to kids who are, “All right, you’re forcing me to stay home. I know that if I get it, probably nothing’s going to happen to me, and I’m going to go out.”

Frank Curzio: And they’re criticizing them, you’re going to have a bias, just like everybody does. Nothing wrong with that. I mean, depending on where you live, who do you know, who you talk to what you listen to, but the doctors out there, who are not in the field, right? They’re getting updates and more concerned with going on TV all the time, throwing out pictures and stuff, that’s fine, good for you have fun, enjoy celebrity status, that’s awesome.

Frank Curzio: And I’m talking about doctors on both sides, not just Fauci, now, both sides. It’s so funny because Democrats, Republicans, like every other couple of weeks, like they switch back and forth, whether they like them or don’t like them, depending on what agenda. I mean, if he’s reporting something that he thinks, which again, he’s trying to report things that he thinks, his track record has not been good. Nobody’s track record has been that good, that’s fine. What I fucking hate is how these doctors can’t come out and say, “Look, we’re going by science. This is what we learned. Here’s why we’re changing.” No, nobody’s allowed to be wrong ever or admit it, right? Ever, on both sides, which is crazy.

Frank Curzio: But if you’re looking at these States and you’re looking at their stories, how they were written, they’re reckless. Media just lashed out against them. Destroying everything. Even though death rates are down considerably as a percentage of infected, hospitalization capacity is below 70%. You’re looking at some of the data. I know in Florida, it’s completely fabricated and then needed to be revised. I mean, come on, there’s an agenda there. Even today, there’s a great story on CBC is says, “California, Texas, Florida, all reported record high averages in VOID deaths.” What they don’t say is that this death rate of infected, that are dying, is considerably lower when you’re looking on a percentage basis. In other words, there’s tons of more people right now that are being tested, so you’re going to see much more people infected, so of course the death rate as a number is going to go up, but if you’re looking at the percentage of infected that die from this, it’s down considerably across the board because we know so much more about this.

Frank Curzio: We’re not allowed to say that. We have to scare the shit out everybody. Don’t go out. If you protest again and go out, it’s okay, you’re not going to spread it. But close New York. Close California. You need to close these places. Again, you can go out, protest as much as you want, but close these places. I guarantee you, I’m telling you, no matter who wins the election, the coronavirus is going to be gone probably by, you’re going to see December, January, February, you’re going to see a lot lower numbers with COVID because everyone’s going to be, “Okay. It’s over with. Now, we can really report the truth.”

Frank Curzio: But again, throwing facts, throwing stats, yes, I have strong opinions about this, but this is based on information that I’m getting all over the world. Thanks to you guys listening to this podcast, connection, different businesses, different industries. Some are very wealthy. Some are millennials that send me fantastic information who know more about technology than anybody else and technology trends. And I have to tell you, before you stop listening to this podcast, if you haven’t already, I know a lot of left leaders out there who like to make money in stocks and say, “Frank, stick to stocks because I don’t want any.” Listen, this matters. And all these other people, they hate facts, they don’t care, they’re have an agenda, I’m not going to change.

Frank Curzio: It’s fine, and I don’t care what your politics are. I’m just telling you this because this is what’s happening. And if you’re right, left, middle, whatever race, forget everything I just said, forget everything I just said, I don’t care. The bottom line is most people are still scared to death of getting COVID, and masks which are relevant and both people across the country are wearing masks, it’s going to be a reminder to everyone that that exists. I mean, it’s a fresh reminder when you see a mask when go into, I can’t tell you how many stores, wear mask every time I go into the store, but sometimes I just run out of the car to go in and to the store real quick, I’m like, “Oh, I got to just go back to the car and grab a mask.” It’s a constant reminder of like, “Holy shit. I can get the coronavirus.”

Frank Curzio: And couple all of this to the fact that we won’t have a vaccine this year and probably not, it’s a mid-2021 at the earliest, and our economy has zero chance of recovering this year. And when it comes to your portfolio, which is what I care about, I could tell you, the markets are not pricing this in. They’re not pricing in the biggest States like New York, California are closed for a few more months. No real revenue from sports. Hollywood still shut down. Disney Park is under 40% capacity well into 2021. The travel industry operating below 25% capacity into 2021. This was not on the table. And cruises still think that they push it out to the end of October now. Well, we’re not going to be shipping. They’re not going December, January, February. Their revenues are down 75%, 80%. How much longer can I sustain this?

Frank Curzio: So, as an investor who cares about creating generational wealth, so that your families can have a better life, you have to understand this fact: coronavirus risk, it’s going to be out there. People are not going to change and you need to know what’s going to happen next. Well, I could tell you, if our economy’s closed through the first quarter of 2021 and we still don’t have a vaccine which is very, very likely, we’re going to see a lot more bankruptcies. Oil companies, commercial real estate, retails with small online presence, restaurants, hotels, casinos, cruise lines. Those guys are in huge trouble and how could they survive with sales down 75% plus for 12 to 18 months, nobody models for that.

Frank Curzio: The companies that are COVID place that have run up incredibly from their March lows will likely do even better. Software companies, online stores, Shopify, Overstock, Etsy. I love Overstock. I mean, they were dying to sell that business to fund tZERO and nobody wanted it. And I sure wanted to buy one today. The Zooms, you’re looking at Cloud companies, Amazon, Microsoft, Google, Do-It-Yourself home stocks, Home Depots, Lowe’s but even going more into Sherwin Williams, Masco, Whirlpool, Owens Corning. I mean, the Walmarts, the Best Buys, exercise equipment companies. Those are ones that let you work out, Peloton, Nautilus. The biotech names with exposure to vaccines. Yes, we’ve seen these things move up a ton, but we’re more desperate right now for a vaccine, right now, than any other time since this virus has started.

Frank Curzio: Most of us, “Look, herd immunity. Florida’s doing it.” I mean, New York’s not even opened yet, New York City. You got to go through the process. We don’t have a vaccine. What are you going to do? Keep it closed for two years. You got to open it back up. When you do, you’re going to see more cases but be smarter. I think you know now that if you do see people with coronavirus cases, just do me a favor, don’t put them in nursing homes, probably a good idea. Again, who cares whose fault that is, but I think we could all agree on that. Don’t do that this time and please protect people over 60 with respiratory problems. That target area that the whole world knows about, but yet, we’re shutting down the economy for everyone under 60 even though we know the rates of you contracting COVID and die are less than the flu.

Frank Curzio: Now, based on traditional metrics, we normally see the markets fall sharply if the economy was surprisingly going to be shut down for an extra six months and originally predicted, right? And that’s coming as a surprise. Again, I look at the numbers, I look at the analysts, I listen to the surveys taken by Southside analysts, my job is to read all this stuff and understand it, so I watch Fox, I watch CNN, I need to know the consensus, because if I could prove the consensus wrong, that’s how I make money for you and me, right? And it’s not priced in that this is going to take another six to nine months.

Frank Curzio: So, using traditional metrics, how the markets work, I would say we could see return to the March lows for stocks, but we’re not in normal times where the Fed, which they said, “We’ll do anything it takes to stimulate this economy.” This will include yield curve measures, keep rates super low, actually taking stakes in companies, expect that to happen and they’ll probably take warrants. That will definitely be in the money when you have the Fed backstopping these industries in three to four or five years just like we saw at Fannie and Freddie. What did it take? Two years, before those things started generating money. They’re still under conservatorship, the government doesn’t what to do, but they’re collecting billions, right?

Frank Curzio: Because you just put every single freaking house under that, a home loan under that umbrella and the housing market took off and now, the government’s making a ton of money. It didn’t take long when you have a printing press capable of printing $50 trillion backing it that eventually is going to backstop it and push this market higher. But the Fed, you think it’s been crazy? They’re going to go nuts. They’re going to go even. They have to spend at least another $6 trillion to support this economy, at least $6 trillion, if we don’t see the coronavirus risk slow this year, which won’t. We definitely won’t. It’s election year. It’s not going to stop. We’re not going to see. That’s going to mean 60%, or account for 60% of the economy that they’re going to spend to put a floor under.

Frank Curzio: That’s another section thrilling. That’s coming. It’s definitely coming. I mean, even just $2 or $3 trillion, I can’t believe you can say, even if it’s $2 or $3 trillion, right? I mean, think about that. It was $480 billion for TARP to bail out the whole entire financial world. And I’m like, “Yeah, even if it’s just $2 or $3 trillion.” That’s the world we’re in right. It’s crazy, right? What does it mean for you as an investor? Gold, silver continue to soar. Even with the recent rise and you see a lot, the commodity prices are rising along with the surge in gold and silver stocks, the sector is still significantly under owned and other assets are going to soar to new highs is Bitcoin. We’re seeing that now. Until 11,000, a little below that. It’s more than doubled from its March lows of 5,000.

Frank Curzio: I know there’s a lot of emotions here. I know some of you are pissed, and some of you are going to be like, “Frank, thanks. I agree with you.” Forget all the all the bullshit. The politicians do not give a shit about you. We’re putting people in power who are idiots, who are complete idiots and it’s amazing, they’re getting paid, right? They’re making all decisions on everybody else who gets paid or we get more money. They’re not in a position you and me are in, they don’t care, they don’t. They care about getting elected, that’s it. That’s all they care about is getting elected and having more power.

Frank Curzio: What do you care about? Generational wealth, your families, making money. So, instead of looking at social media, getting pissed at the posts that don’t support your beliefs, instead of holding up signs outside a courthouse to protest someone else’s cause, you think you’re protesting a cause, you’re really not, it’s someone else’s cause, instead of getting pissed at the rich while their assets inflate due to Fed policy, you need to focus on how you can get rich from everything going on right now.

Frank Curzio: Economies are going to be closed through this year. It’s not priced into stocks and into 2020. The only way to stop this market from crashing is more government spending. The Fed is going to go nuts. Central banks around the world are going to go nuts. You haven’t seen anything yet. There are clear winners and losers that I told you about already. Which group do you want to be a part of? That’s a question you have to ask yourself. Emotions are probably running high and I get it from both sides, but the bottom line, you can listen to the stats, whatever, you don’t have to worry about dying from COVID. It’s all bullshit. It really is. It’s all bullshit.

Frank Curzio: But that bullshit is going to continue, and what kind of investor do you want to be? Do you want to be someone’s who’s like you are going to complain about social media or do you want to make money off of this trend? If you do, I just gave you a whole bunch of ways to do it because the Fed is going to go nuts. They need to go nuts to support this economy. I look at the numbers. I look at these service corporations. Nobody has COVID going through December and we’re not going to get a vaccine by then. If we do, I’d be surprised if anybody takes it because it’s not going to have the safety efficacy that we need, that information that we need before taking something like that.

Frank Curzio: So be very careful here. There’s ways to make money in this market and if you can, my job is to see what’s going on out there and report to you what I’m hearing and seeing, regardless of what side of the island is or whatever, but just understand this is about you. Care about yourself, care about making money, because there’s ways that you can get incredibly rich right now. Things are happening that never happened in the history of the world and you could be part of it if you’re positioned right.

Frank Curzio: So, it’s a great segue for my interview with my buddy, Chris MacIntosh of Capitalist Exploits. Someone who told you 18 months ago to buy Bitcoin at $4,000 and actually, first time buying Bitcoin and mentioning at $400, but 18 months ago, he said that and we pushed to $11,000 a couple of days ago. Also someone who launched new newsletter, this is in early 2019, where credit investors get to private places to gold stocks. His timing couldn’t have been better. If you look at Chris, he’s not a gold bug, he’s not so crazy. Bitcoin enthusiast. He’s an asymmetric investor. He looks at industries, and his timing has been right on so many different things.

Frank Curzio: When you look at asymmetric, it means he finds the best sector stocks to own that have massive upside potential while taking a little risk, which kind of means Chris is a little bit into train investing, we’ll get into that. But he’s been dead on with his calls in this podcast, which is good news for you. He’s going to share his newest ideas with us in just a minute, and the idea he shares is something that I don’t like, and it’s actually changing my mind. Something I told you, a sector to avoid, but that’s how Chris looks at it. That’s why I love hearing someone else’s opinion on things, you’re going to love this interview.

Frank Curzio: Then our educational segment, I’m going to explain why we may see a pullback and it could be significant starting tomorrow, yes, tomorrow, Thursday. Before we get to all that, here’s my interview with the one and only, Chris MacIntosh.

Frank Curzio: Chris MacIntosh. Thanks so much for coming on the podcast.

Chris MacIntosh: Hi, and thank you very much for having me, Frank. It’s been far too long.

Frank Curzio: It’s definitely been far too long. I believe we’ve been so busy here. It’s probably on me because when I go back and look, and I always do a ton of research on all my guests, even though I know them more, I see what you’ve been writing for a long time and I just went back and looked, the last time I had you on about 15 months ago, or 17, 16 months ago around there. Your performance from the time I’ve had you on and probably about three, four times over the past couple years, I don’t think there’s anyone that has a better performance than you.

Frank Curzio: And I want to start by talking about your methodology for picking stocks, sectors, and a lot of it has to do with asymmetric investing. Could you explain that in the easiest term possible, where you and I know what that is, but we also have a lot of listeners out there that are learning for the first time, listening for the first time, because that has a lot to do with your strategy and why it’s not just you picking sectors, but we’re going to go over the timing of… How amazing your timing has been in certain in sectors and stocks and recommendations that you’ve given in this newsletter, of course, to your clients.

Chris MacIntosh: I’ll do my best. Okay. So, all right, well, look, I mean, an asymmetric fate or an isometric investment is simply one that has a high probability curve, which is in your favor, so, whereby you bet $1 and the ability to make say $10 exists, and that doesn’t mean that that it’s going to happen, but if you bet the dollar, you get the $10, right? And if you get it correct. On the other hand, if you get it wrong, you lose your dollar. Now, naturally, if you just think about it, you can do that 10 times, so your probability needs to be greater than one in 10 for it to overtime work out.

Chris MacIntosh: So that’s just the sort of if you can just think about probabilities. Everything is just an is a matter of proper probability. Now, what we do at Glenorchy Capital and the insider program that we run, which is really just a derivative of the work that we do for our high-net worth clients is we’ll look for these probability setups and we don’t look for it in particularly equities. I don’t really give a shit what an equity. There are doubtless countless equities out there that exhibit that asymmetric type of structure, but I’m not interested in those. A, because I’m not actually a stock picker per se, and B, because I’m lazy. And what I mean by that is that I want to be in sectors which have the asymmetric setup rather than simply one equity.

Chris MacIntosh: There’s far too much risk in one equity, you can have one equity that looks like there’s an asymmetric profile and it could be as a consequence of that particular company haven’t gone through a restructuring, maybe they committed fraud and so the stock price has been hammered, maybe there’s a jurisdictional problem in that, it’s got assets. Some country that is now undergoing a coup, like there’s any number of different things that can be particularly problematic for one particular company. On the other hand, when you find a sector that exhibits the same profile then typically you’re onto something. Now, so that’s the first step, I guess in terms of identifying an asymmetric setup.

Chris MacIntosh: Then the second step, one which we use and spend a lot of time on, which is less scientific, I guess, is that we will overlay a macro outlook. A sort of geopolitical, we look at geopolitics, we look at geography, we look at a whole host of trends, certainly all of the fundamentals such as supply and demand and so on and so forth, technology. And we’ll take this macro overlay, and then where that intersects with these, with any sector that is on our radar, and at any point in time, we’ve got probably 20, 30 things that we’re looking at, but we don’t necessarily invest in them, they just sort of sit there on the side, lurking. They sit there and we know that they’re there, but we don’t have sufficient confidence yet to participate in them until we feel like we can really understand why they exist in the first instance, like why does that particular sector look as cheap as it does because sometimes you get a value trap.

Chris MacIntosh: So that’s the first thing is trying to understand like where have you come from. If you don’t know where you come from, then your ability to identify where you might head to is next to impossible. So, what we do is then we weigh those, that macro overview outlook intersects with existing asymmetric sectors. That is where we get much more comfortable, and then we’ll start positioning accordingly. And then it’s just a matter of risk management and position sizing across a portfolio, which is, it’s sort of a separate topic, I guess, but it is one that is largely not dealt with by many, certainly not many newsletter writers. And really, that’s just because it doesn’t hype people up and nobody gets super fucking excited about position sizing.

Frank Curzio: It’s true.

Chris MacIntosh: But really, it is extraordinarily important. So, that’s basically how we go about constructing a portfolio, and-

Frank Curzio: No, go ahead.

Chris MacIntosh: I’m sorry.

Frank Curzio: No, I didn’t know you’re going to pick this. I wanted to stop there because it’s more… I don’t know if it’s right to say where asymmetric you could say is contrarian because, like you said, you’re risking $1 to make 10, right? So in order to do that, which is a very low risk profile with super high reward potential, you have to look at things like you mentioned things that you don’t like or things that are out of favor, I mean. Things that are really out of favor that which, yeah, when you’re looking at equities, just so you’re not really too concerned with, not too many things out of favor or evaluations through the roof.

Frank Curzio: But the last time I had you on Chris, you talked about Bitcoin and it was when it came down to $4,000. You said it’s going to go a lot higher and I know you were looking at what’s going on in the world and you were one of the first people, I think too many people could say this, that you’re talking about Bitcoin when it was $400. But the other call that you made, I was extremely impressed with because I’ve been investing in gold, I’ve always had. I’ve been investing in private placements, but this is like 2016, ’17 and now of course, a lot of these things are doing very, very well because gold’s in a bull market.

Frank Curzio: But in 2000, and I’d say late 2018, you correct me if I’m wrong in that, early 2019, you started as, I don’t know if it’s the newsletter that you started, which was Resource Insider where you said, “Listen now’s the time with everything going on with the government that you need to invest in gold specifically Junior.” It looked like Gold Junior is in private placements and you created this newsletter for credit investors, but what amazed me was the timing of that because you’re not a gold bug. You’re really not. You’re not like, “Oh, you got to buy gold.” And I get people on here that are just like no matter what at the end of 2012, ’13, ’14, ’15, ’16, buy gold, buy gold, a lot went down. The timing on that couldn’t be perfect then I saw the results of your portfolio, you sent me a snapshot, which is amazing.

Frank Curzio: I want to talk about when do you know is the right time because that’s everything with every investment. I mean, if you pick the wrong time period, you could be right. If you’re wrong on time, you’re dead, you’re going to lose a ton of money and you may stop out, but how do you focus on the time when you’re looking at that especially looking at beaten up sectors like that?

Chris MacIntosh: You’re looking at such an important question and look, the first answer, Frank, is you need to be humble and you got to realize that you don’t know everything and you’re going to be very, very careful that you don’t buy your own bullshit, like that’s the first thing. But you mentioned something earlier, which was around contrarian. Now, I don’t think of things in that, I don’t. I almost don’t want to even consider whether something is contrarian or not.

Chris MacIntosh: By default, when you find a sector, which exhibits a nice metric profile, it will be contrarian. How can it not be? All right? It’s just that’s the dynamic that will exhibit itself, but I think it’s important to not go about things and say, “Oh, what’s contrarian out there? Let me go and look for that.” I mean, I think that you certainly could come to the same sectors, but I think the risk behind taking purely a contrarian viewpoint is that you miss out on all of the due diligence that you should be doing in order to get you to the same place.

Chris MacIntosh: So, it’s a little bit like having all the muscles but not having gone to the gym every day for seven days a week in order to build that physique. If you haven’t done the work, then A, you’re not going to actually know when to get out, B, you’re not going to know why the structure of that particular market looks like it does. And so really, you land up being lucky, maybe, in terms of investing in a particular sector, simply by sort of looking at things from a contrarian bait. So, I don’t like looking, I don’t like that word, basically or at least not for my own, not for how we manage capital. So it’s more important, I think, just to look for all of the underlying attributes that would get you to that asymmetric profile. Like I said, they will automatically be contrarian as a consequence, but there’s a distinct difference.

Chris MacIntosh: In terms of timing when you talk about gold and all that, yeah, I mean, I’m not a gold, I’ll buy anything. I’ll buyback things, if that make sense. I think it’s important to be agnostic across what you’re investing in. Certainly for a macro guy like me, I’m not a gold bug. Like right now, we have very, very heavily long commodities, but I’m not a commodity guy. And so, coming back to Resource Insider, back in 2018, we started seeing a number of signs within the liquid markets in terms of currency flows, and the valuations of gold cross different currencies.

Chris MacIntosh: At that time, gold wasn’t moving in dollars, but we wrote an article for our insider program, and we highlighted it and we started dipping our toe for our clients at Glenorchy into gold equities, and the reason that we did it was quite simple. We had gold moving higher in every single currency bar, the dollar. And so many, many money managers are far too U.S. centric. They’re denominated in dollars in their portfolios. They’re often American by citizenship, and so on and so forth, so there tends to just be this inherent bias with respect to how they view any market because they’re denominating in dollars. And it’s important to look at things from multiple angles.

Chris MacIntosh: So when we did that from multiple angles, we could see that something was happening. That was coupled with the fact that we had a resource that’s cyclical. So, 2012 roughly was the last time and so we’ve had a pretty decent, I would say, fairly brutal bare market ever since. So for all that time, we weren’t short, but we were certainly not long, just maybe it seems to be investing or diving into a sector which has just come off of a multi-year highs and is clearly tapped out. And especially knowing that it’s a cyclical sector.

Chris MacIntosh: So, coming back to the private placements, if you just simply take a look at where your most asymmetric returns tend to exist, certainly at the sort of first and second inning of a commodity bull market, they exist in the private placement space, that’s as a consequence of the timing that you have with respect to capital coming into a sector, demand exceeding supply. As you know, Frank, you want to get a mine up and going. That’s going to take you a lot more than a few months, and so there’s this gap and a window whereby the price moves and the underlying supply does not come on quickly enough in order to satiate that demand.

Chris MacIntosh: In that space, you have companies scrambling to go and meet that supply gap. And so, it’s just that’s the structure of the market, so that’s where the returns become the most. Now, I don’t know the bloody, a hole in the ground from anything else, and so I needed to find somebody that was a technical expert in that space, who had exceptional contacts. And so back in actually 2017, I started looking, not intending yet to do anything because I didn’t feel like I could. I felt like we were getting to the point where it would become a time to take advantage, but that I wasn’t rushing.

Chris MacIntosh: I did have a lot of struggle to actually find someone in the sector or even find another newsletter or something like that and I just wanted a no-bullshit technical expert and then I, after interviewing for over a year and discarding probably 50, 60 applications, I kind of had Jamie, who’d got introduced to me through another Gen2. I really, really actually wanted to bring on board, but has another gig at a mining company and I couldn’t entice him away. And so, we got introduced and long story short, he’s a rock star, and so that’s worked out really well.

Chris MacIntosh: But the timing was really a matter of just looking at those underlying structure of that market and then the thing that you got to remember with respect to precious metals, is that gold, silver, they move when you begin to have a loss of faith in the currency. They don’t move as a consequence of money supply, for example. I know that a lot of guys will rant on about that and they go, “Oh, the money supply is doing this and this and that, and the other thing.” That is an underlying driver, but only once the populace, once people figure out what the consequences of that could be. Do you then have a loss of faith in the currency and then those precious metals tend to outperform?

Chris MacIntosh: The other thing, too, to consider and that is also the way like, so for example, you can have your monetary aggregates like M1 and M2 expanding in credits and that hasn’t had any real impact on inflation in the money in sort of CPI, I guess. So if you go back to like 2008, you had the Fed’s policies, they were bailing out banks, they bought mortgage-backed securities, asset-backed securities, but the thing that they started doing, and now they’re doing at an accelerating rate since COVID, is the buying of corporate data, junk bond, CLOs. They’re buying everything. And actually, now, and this is really important, they’re making primary loans to businesses, so this has never been done before.

Chris MacIntosh: The Federal Reserve has never made a loan to a corporation. They just used to buy data in the secondary market. And this is important because the Fed’s actions and the fiscal policy, which isn’t basically even ran around banks, what you’re doing is you’re saving money directly to consumers and businesses. And that means that your broad monetary aggregates of M1, M2, and M3 are actually expanding rapidly, not just your base money supply, not just Fed credit. Those broad monetary aggregates are exploding in size and in the context of an economy that’s increasingly unproductive, this is basically stay inflation. And what it brings with it is a loss of faith in all sorts of things.

Chris MacIntosh: When you have a non-productive economy, there’s social ramifications, which we’re seeing, you have inequality starts accelerating, you have, and we’ve seen has now, increased calls for socialism/Marxism. All of those things are extraordinarily beneficial for stuff I would say and at the top end of stuff is gold and silver. So it’s a long, a very long way of answering your relatively short question.

Frank Curzio: No, no, that’s great. That’s great. So Chris, now here’s the big question. Based on what you’re saying, you see that entire market when you looking at gold, you just talked about the acts going on behind the scenes, we understand central governments are going to continue to spend, COVID, I don’t think anyone’s really factoring in it this is pushing into 2021 now. It was supposed to be a second half recovery.

Frank Curzio: So, one is you nailed it, you show me your portfolio, which is up around 125%, I think which includes 12 resource names that you got into which is unbelievable. But I have to think you would hate this now because when you liked gold and again it’s not that you’re looking contrarian but when you liked gold, not a lot of people are talking about it. Today, the world loves gold and talking about it. I know you’re not looking to maybe, you can hold on to your portfolio in early, but are you still seeing ideas in this industry that you want to invest in or is it, “Here’s a trade that worked out.” It’s probably going to work out a little bit longer and we’ll just hold what we have?

Chris MacIntosh: I think it’s got long ways to run. If you if you just look at the structure of the market, firstly, we’re coming off the lows of a cyclical bare market. Those don’t typically solve themselves within a six- to 12-month timeframe. That’s the first thing. They tend to be, it’s a cyclical market, so from to the next time, and I think that we have the potential for this one to be in order of magnitude greater than the previous cycles, one could easily make the case that we’ve got a roughly at least a five-year timeframe.

Chris MacIntosh: Our portfolio is structured such that we have for the chaos that we see coming in the next few years, we’re very, very heavily positioned for that. Coming out of that, we have what we believe to be, how do I want to put this, we’re in the cusp of watching the waste lose the east. That the first phase of that is a chaotic phase. It’s a, “Oh my God, I don’t know what the hell is going on. I need security, I need something of stability, and what is it that I buy?” It’s not a matter of trying to figure out where’s the growth in the world. “How can I turn $1 into $1.20?” It’s none of that. It’s, “Shit. I don’t want to lose anything. I’m already losing. Things are really getting hairy. I’m really afraid. What do I do?” So, that’s the sort of chaotic phase.

Chris MacIntosh: In the process of that is a number of different things that I’ve been running about, whereby both in terms of bureaucracy, in terms of geopolitics, a whole host of different things, we are seeing the capital, and especially the intellectual capital in the world, increasingly shifting to the east. That I believe is going to accelerate and we are very cognizant of that and watching that and we’ll be looking to start taking our gains from what I would sort of determine as a chaos-type portfolio and deploying them into where the brightness in the world is likely to exist going forward. And I will probably be about two years too early but I’m quite comfortable with doing that and so that’s how we’re viewing things at this point in time.

Frank Curzio: So, you know as well as I do that when you have something right, your clients, subscribers, your high-net worth individuals, they’re high-fiving each other, “Chris, you’re the best,” and that ends pretty fast because all they want to know is, “What’s the next big idea?” I get the all the time with my newsletter subscribers. “Okay, what’s going on? We did great with this. Where’s the next place?” Are you finding anything out there? And I know you said you don’t care about the equity market.

Frank Curzio: But I did notice something inside your portfolio where it’s two positions, it was in the same stock, but I think different time periods in lithium. I mean, when people see lithium, they think electric cars or maybe that’s it, or that’s considered like your commodity theme or is there something else out there? Because you’ve been known to give us ideas and share ideas with me that are so far off the radar that I love that you’re not going to hear anybody else, anywhere else, so I’m building this up really good. I’m hoping you have something for us. If not, I understand. But so yeah, I’m just curious what you’re looking at now.

Chris MacIntosh: Look, I think right now, if people want to have a truly asymmetric beta and they’ve got a long enough timeframe, and they are patient, and they know how to position size, think of energy. Energy is going to be absolutely spectacular. Probably for the next couple of years, it’s going to bump and grind. It’s going to be boring as hell, and no one’s going to care about it, but energy is going to be truly spectacular. So, I’m doing a number of things and one was just on a personal basis, I was going to go out and buy with a couple of hedge fund buddies, some apartment in Dubai, which is a synthetic coal and oil. At least in a way, Dubai about 4% of their GDP comes from oil, but it’s actually the hub for Middle East energy. It will continue to be.

Chris MacIntosh: There’s a whole host of things. I won’t get into the whole sort of Dubai thing, but it’s certainly been absolutely hammered because it’s running on two things. It’s running the synthetic oil positioning where it is in terms of it’s kind of like the Switzerland of the Middle East. And the second has been conferences and tourism. Both of which have been decimated. But on our look forward, go forward basis, it presents extraordinarily good upside and some going out and investing in that. Not quite, I’d sort of put it out to subscribers, a lot of guys thought it’s a wonderful idea, so I’m probably just going to put a vehicle together in order to participate in that at a sort of bigger scale.

Chris MacIntosh: That’s one thing that people can just have a think about is energy. Energy is also going to bifurcate. It’s going to become much more localized. There’s going to be extraordinary opportunities in particular jurisdictions as supply chains break, as the U.S. slips back from its policing the world structure that it’s been enjoying since Bretton Woods, we’re going to see a power vacuum open up and we’re going to see a lot of different changes, especially within the energy sort of bracket. And so, I just put energy on your watch list. That can include everything from uranium to coal to lithium to oil, of course, natural gas.

Chris MacIntosh: So, all of those, if you kind of think through a stagflation or environment, all of those are actually quite beneficial asset classes to be invested in any way. Yes, I’m fully aware that we have a massive supply glut in oil, but so is the market. That’s not a surprise to anybody. Also, we have this extraordinary setup whereby demand has been hammered and increasingly, the uncertainty in terms of when that demand may come back with any real vigor has really massively weighed on the energy markets. It’s set ourselves up for just a pretty phenomenal place. So, that will be my tip, I guess, if you’re going to call it that under that radar in terms of it.

Frank Curzio: No. I mean, I love that because for me, especially in today’s world, right? I mean, where politicians, at least in the U.S., because we’re doing this New Zealand which is amazing that we have this kind of technology to do this kind of interview. But it’s always when you disagree, you hate the person, right? So, for me when I look at energy, I’m kind of looking short term like you saying, like you mentioned where’s demand going to come from, everything shut off right now if you supply in the market, but just to hear that it makes my wheels start turning. Okay? It does make sense. It is going to work and we’re so short term oriented now, right? I mean with the markets, it’s kind of amazing that holding something for a year is like your dinosaur these days, right?

Chris MacIntosh: Yep. And that’s where your edge actually exists. The other thing that you can think about, Frank, is that oil, like… look, when we had the oil spike in the ’70s, the global oil supply was sufficient. There wasn’t an issue with respect to global supplies of oil. What happened was that we had a set up whereby access to supply was curtailed. Have a look at the geopolitical world today, just have a look, stop and think and run through the probabilities and then reassess the entire framework. We don’t need to have a supply destruction in respect to oil for it to spike.

Chris MacIntosh: Although, we are getting in just incredible supply destruction. I mean Venezuela was gone anyway because they went down the Marxist route. Shell’s pretty much gone. Nigeria is shut for business. Mexico screwed. I mean, this oil war between, well, conducted essentially by the Saudis and the Russians is absolutely decimating so many producers and so much supply and that supply is not going to be turned on in a month or two. It’s going to take a lot to turn that supply back on. So, we’re seeing just incredible supply destruction and incredible concentration of power in the energy markets right now.

Chris MacIntosh: People aren’t paying attention to this. There really should, and you couple that with the geopolitical uncertainty that goes along trade, tariffs, you name it. The probability of us having a curtailment of access to oil is much, much higher than anybody anticipates. Now, I’m not saying that happens. Again, you can look at this from a longer term timeframe. And when I say longer term, I’m happy to sit and chat and say, “Okay, what’s this look like in five years’ time? What’s my probability ratio? And how do I participate in this? And then what is the cost to participate?” I mean, right now I can buy assets for less than it would cost to actually go and build those assets, like if I’m thinking about to Dubai real estate, which is a synthetic coal.

Chris MacIntosh: And then we’ve got another not so little factor, which is that all of the dollar paid countries in the Middle East are under extreme pressure. because their effects reserves are collapsing, people need to have a look at Oman, Qatar. The potential for us to have an emerging market sovereign default in the next six months, I think is absolutely extraordinarily high. Whether that reverberates through and starts a knock on effect, like we had in the ’97 crisis in Asia, time will tell. But if that happens, oh, wow, I’m going to be just over the moon. I’ll be looking to buy assets for cents on the dollar, at just extraordinarily cheap prices with the long-term view where I think I can make many, many multiples on my money.

Frank Curzio: Well, definitely makes sense, Chris, and I have to say what I really love about you, too, is you’re not one of those guys out there where, especially in my industry, newsletter industry, I mean, people look at big and we’re trying to change that where the perception is just as old as hype and marketing. You’re a guy that’s “Here’s my results. If you like what you see, follow me. If not, I don’t care.” So for me, I love having you on and I’m sure people listening to this will say, “Wow, this guy makes a lot of sense.” If they want to find out more information about you, read some of the things that you write, how could they do that?

Chris MacIntosh: Well, I write a blog at Capitalist Exploits. You can go there, capitalistexploits.com or .at. And then for institutional and high net worth clients, we have Glenorchy Capital. It’s just glenorchycapital.net. You can find me on either of those. And that’s it.

Frank Curzio: Well, that’s great stuff. Well, Chris, listen. We can’t wait this long to get you back on the podcast. It’s funny. A couple of guys, I asked them, “Man, when’s the last time I had Chris on?” So, that’s on me. I love to have you on every few months and pick your mind because you always make me a smart investor and I love some of the ideas. The ideas I get from you I don’t hear anyplace else. So, I really appreciate you taking the time. I know it’s a big time differential, so I appreciate that, too. And yeah, we’ll definitely have you back on soon, buddy. I really appreciate it.

Chris MacIntosh: Oh, you’re far too kind. You make me sound like I’m not smarter than I am, Frank.

Frank Curzio: Not true, buddy. Not true. Not true at all. Based on your performance, no, that is definitely not true. So, we’ll definitely talk soon. I appreciate it.

Chris MacIntosh: Good chatting. Thanks, Frank. Take care.

Frank Curzio: Okay, guys. Great stuff from Chris. And when I look at people I’ve interviewed and you’ve listed people, I’ve interviewed, it’s funny because I mentioned earlier how I love storytelling and we have fast talkers. I mean, Chris, he does a market. He’s just a real guy and he’d interview like that, please pay attention. I mean, the guy is very, very smart. He’s given us some really good picks. I mean, man, he talks fast like most New Yorkers, but he’s brilliant. I mean, the timing that he has on his investments has been great. I love having him on. I’m going to have him on even more in.

Frank Curzio: Again, him doing that from New Zealand, which is incredible, right? That kind of technology we have today, which is amazing and it was hard to put together that interview, but I love this idea and energy, that challenges my thesis. So me, I want to dig in even more, and I am going to dig in even more, but that’s how you become a better investor. You always want that. That’s why it’s helpful politics. It’s either you’re one way or the other. You don’t even care about facts or listen to the other side. You don’t care, which sucks right now. And we all understand it’s a political year, but you can’t put lives at stake. I mean, you can’t put freaking lives at stake and that’s what’s happening right now and it’s insane. Anyway, let me know of what you thought that interview, frank@curzioresearch.com.

Frank Curzio: Now, let’s get to my educational segment, so we’re going to have an incredibly busy day tomorrow, with four largest tech companies reporting earnings in the same day, which is Apple, Facebook, Amazon, Google. If you look at the whole S&P 500, the total market cap of all the companies combined is $27 trillion. If you look at those four companies, Apple, Facebook, Amazon, Google, they have a combined market cap of close to $5 trillion. That’s 19% of the entire S&P 500 index in terms of their market cap.

Frank Curzio: Now, they’re all reporting tomorrow and if you look at their status, they have a lot of influence, meaning if those stocks do pull back, you’re going to see significant market pullback. Now, these company has done great. A lot argue that Apple is not doing great considering revenue was $265 billion in 2018. It fell to $260 billion, 2019. And this year, it’s supposed to be about $265 billion, so almost, it’s zero growth in two years. If you’re looking at earnings, they only grew in the same timeframe about 4% annually from 2018 and if they beat their numbers tomorrow, they match estimates. In the meantime, its market cap has nearly doubled or at $800 billion, $800 billion dollars since 2018, which is equivalent of four Coca-Colas based on market cap, five Exxons, eight City Groups or 10 American Expresses. Again, in just two years not too bad.

Frank Curzio: Well, sales over this period had been flat and earnings have grown 4% annually, much, much slower than the overall market. Not to mention most Apple Stores remain closed with the biggest recession since the Great Depression, which will translate into fewer iPhone 11 sales, given that your stores are closed, and I’m sure people are probably not going to pay over $1,000 shell out for your new iPhone in September, given that the unemployment rate this year is the highest rate, the highest rate since 1940.

Frank Curzio: Aside from that, aside from that, because valuation doesn’t matter, I’m sure these guys going to report numbers that are ahead of the reduced estimates. You’re going to think they’re doing good, but when you look at it as a whole, relatively, you’re not seeing much growth, because of coronavirus, but the analysts have these estimates really, really low, and they’re going to come in, they’re going to beat the estimates a little bit.

Frank Curzio: But if you’re looking how the market usually works, when you see companies run up tremendously, like we’ve seen with these companies into earnings, no matter what they report, if they report numbers that beat which are expected, that’s why they’re running up, and they report decent guidance, you might see like a 4%, 5% pullback and then the way the market works is those stocks may pull back a little bit more, then it will eventually catch a bit and go higher.

Frank Curzio: Now, I’m expecting these earnings to be better than expected what the analysts have out there, right? That’s a consensus, but I’d be surprised if these companies raised guidance. I mean, we know right now the worst thing, the biggest thing right now, the biggest topic is the discrepancy and the separation between Wall Street and Main Street, our rich are getting richer because of the Fed policies, the poor are getting poorer, they don’t have jobs, being told to stay home.

Frank Curzio: The last thing you want to do is one of these companies is going to report record earnings and say, “Things are great. We’re kicking ass and we’re going to kick ass the whole year,” when 60%, 70% of Americans are really struggling right now. Not to mention these guys have a target on their back. The Facebooks, the Googles, collection of data, their agenda on suppressing some information compared to others, even though if the same released by political party. We’ve seen. It’s factual. There’s a lot going on. Again, they have targets on their back. You have to be very careful. I just think it will be nuts for them.

Frank Curzio: If I was managing those companies, I would not report blowout guidance. I would definitely be a conservative. Again, you couldn’t be conservative. You’re not lying. You don’t know what it’s going to be. It’s a prediction. You could say, “Hey, we’re going to meet estimates or we’re going to remove guidance,” which most of these companies said last quarter. Who knows? We’ll probably have one or two who will say, “Well, we’re not going to talk about guidance like Apple,” which I thought was great, but, hey, it doesn’t matter, it’s not all-time high.

Frank Curzio: My point is even when you look at Facebook, Google, you look at Apple, even when you look at Amazon, I mean, Amazon’s going to be spending a shitload of money to bail out Cloud, raise work and pay, increase retail exposure, which may result in earnings coming down. So, when I look at all these at a whole and what I’m getting to is if these stocks fall after earnings, we’re looking at a market pullback of 2% to 3%, easily, easily.

Frank Curzio: And if that trend continues, again, there’s been a rotation of money, it’s not like all this money pouring into stocks at the same time. It’s money pouring into certain sectors at the same time, and it’s a rotation. Not all the sectors are doing good, look at the traveling industry. You’re looking at utilities. You’re looking at the oil industry. Now, technology is doing fantastic across the board. I mean, you’re seeing the software, even hardware companies are doing great. Certain sectors that are benefiting, and certain ones that aren’t.

Frank Curzio: But given the massive move in this sector, if we still have some profit taking these names, and they say, “Hey, you know what? They report tomorrow and they don’t offer that amazing guidance,” because that’s what they’re going to need to sustain this trend. And they’re up tremendously. But if we see, we could see a little bit of a pullback tomorrow and then if we see that trend change, we could see a 5%, 10% correction over the next month or so. It’s possible. I could be wrong, but I can tell you, I think that’s a great bet based on risk/reward because I don’t see the markets surging over the next month compared to if these guys don’t report those earnings that are expected and don’t report that good guidance, then come down sharply.