The markets have been celebrating over the past couple of weeks—thanks in large part to the end of the debt ceiling crisis… expectations of a pause in rate hikes… and renewed investor interest in artificial intelligence.

If you’re confused by the current “relief rally,” I don’t blame you. The simple truth is that you can’t be sure exactly what the markets will do in the short term. The next bull or bear market could always be around the corner…

Fortunately, a quick look at history paints a much clearer picture. Over the long term, the stock market goes up (a lot).

Regardless of short-term rallies, selloffs, bubbles, or corrections… the stock market has consistently moved higher over the years—reflecting economic growth and rising corporate profits.

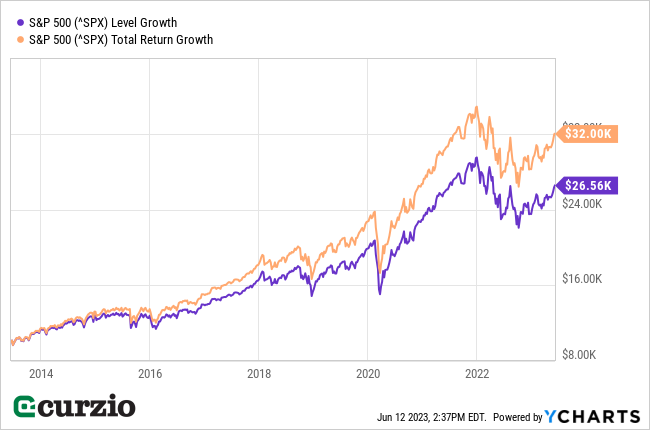

Over the past decade—a period that included two vicious bear markets—the S&P 500 returned almost 12% annually (as of the end of May 2023). (By the way, you can also make money during bear markets. In 2022, my Moneyflow Trader portfolio locked in average gains of 24.4% per trade.)

The bottom line: Even if the current rally doesn’t last, time is on your side. Staying invested is the surest way to build your wealth over the long term.

And that’s especially true when you take advantage of a simple market mechanism: compounding.

In fact, over time, you could easily multiply your wealth several times over—thanks to the power of compounding.

Before we dig into some numbers… let’s take a closer look at compounding…

How compounding works

Compounding is a simple concept: In short, it involves reinvesting all the earnings you make on a particular asset back into the same asset. Over time, you’ll keep adding to the amount you have invested, thereby amplifying your returns.

So let’s say 10 years ago, you put $10,000 into an S&P 500 index fund. Today, thanks to the index’s appreciation, your initial investment would be worth more than $26,000 (the purple line on the chart below)… a 160%-plus return.

Not too shabby…

But had you reinvested all your returns—including the dividends—back into the index (the orange line on the chart below), you’d have more than tripled your initial investment. Instead of $26,000, you’d be sitting on $32,000.

In short, reinvesting (compounding) your returns would have earned you an extra $6,000 over the past decade, giving a big boost to your gains.

And the story gets even better if you keep adding to your initial investment.

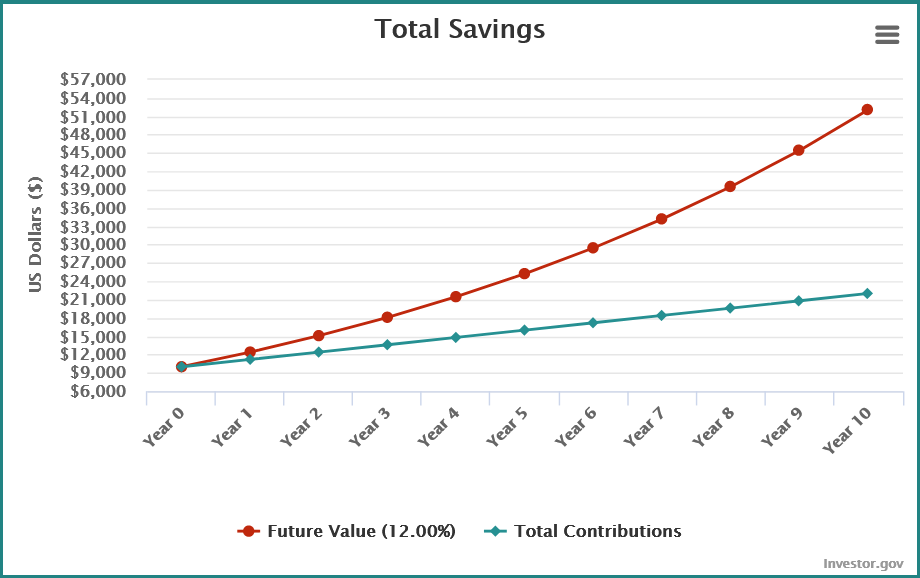

Let’s stick with the above example, but this time, let’s say you’ve also been adding $100 a month to your investment.

At the end of the decade, your total contribution would amount to $22,000. And your nest egg would have grown to more than $52,000, as you can see below. In other words, you’d have earned $30,000—vs. just $22,000 on the original lump-sum investment in the first example.

Most importantly, the longer you stay invested in the market, the more the compounding process accelerates.

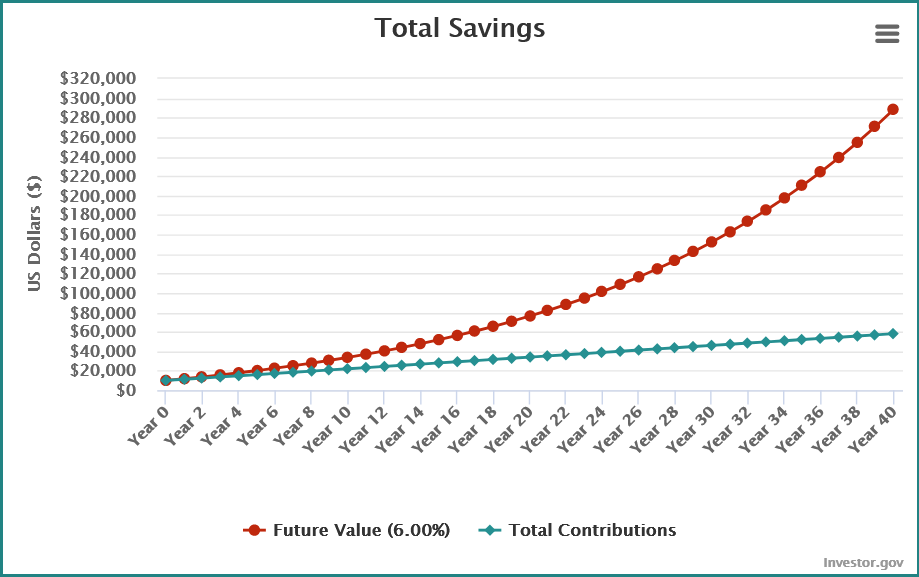

To see the massive effect time has on the compounding process, we’ll use a 40-year time period for the next example. We’ll also use a more conservative annual return of 6% (which is just half of what the market has delivered over the past decade).

Over 40 years, you’ll end up investing a grand total of $58,000: The initial $10,000 investment, plus a monthly $100 contribution times 480 months.

In the end, your total investment will compound into nearly $290,000. That’s a 400% gain!

I encourage you to test a variety of scenarios by using this simple compounding calculator. It will get you a feel for how compounding works… and how you can utilize it within your personal budget to maximize your returns over the long term.

Investing is full of uncertainties. But there’s one sure thing: the longer you stay with the markets, the better your chances of generating big gains. And you won’t need to worry about missing out on the next Apple or Microsoft. Thanks to the law of compounding, you can let time (and the S&P 500) do all the work for you.