Last week, Fed Chair Jerome Powell testified before Congress on the state of the economy… the Fed’s battle with inflation… and the Federal Reserve’s plans for interest rates.

In short, inflation is still a serious problem—which means the Fed will need to keep raising interest rates in the coming months.

“Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored,” Powell said in his prepared remarks.

In fact, as I explained last week, the Fed has no choice but to keep raising rates until it engineers a recession.

That spells serious trouble for the stock market.

And one rate-sensitive sector is in particular danger…

High interest rates are about to crush REITs

Across the commercial real estate market, the distress is almost palpable.

The sector has faced an uphill battle since the rise of ecommerce—which sent several malls and big box retailers into bankruptcy.

Today, a similar story is playing out in another corner of the commercial real estate market…

COVID forced countless businesses to send their employees home to work. Today, more than 25% of all office work is still done from home.

In short, the work-from-home model is here to stay… and office buildings aren’t returning to full occupancy anytime soon.

The bottom line: Commercial real estate was already in serious trouble… as ecommerce and remote work siphon off its customers.

And now, high interest rates are adding a major new headwind that could absolutely crush the sector.

As you probably know, the real estate industry is primarily financed by debt. Few investors have enough cash sitting around to make an upfront payment for a plot of land or a commercial complex… so they finance the purchase through bonds, bank loans, or mortgages. Of course, the principal loan amount is only part of a buyer’s costs; they also have to pay interest.

In the normal course of business, much of the debt gets refinanced. In other words, property owners typically don’t worry about paying off their outstanding loans. They just get a new loan when the old one comes due. As a result, it’s common for REITs to be leveraged to the gills.

That wasn’t a big deal in the days of ultra-low interest rates…

But today, any refinancing will need to be done at much higher rates. That means a big surge in expenses for property operators, as their annual debt payments will be much higher than what they’ve been paying for years.

And the numbers are pretty scary…

A massive $1.4 trillion in commercial real estate debt is coming due this year and next in the U.S. alone. In other words, real estate operators will have to come up with $1.4 trillion over the next 18 months to repay their maturing bonds and loans—or face default.

The bottom line: Higher-for-longer interest rates are setting up commercial real estate for years of hurt.

In fact, the situation is already unfolding… For proof, look no further than the recent performance in REITs (real estate investment trusts)…

REITs are basically real estate stocks. There are hundreds of publicly traded real estate companies, representing just about every corner of the industry—from apartment complexes to office buildings to industrial and storage facilities.

As I mentioned earlier, the vast majority of these companies rely on large amounts of debt. That makes them especially vulnerable to rising interest rates.

Below, I’ve plotted the recent price action in the iShares U.S. Real Estate ETF (IYR)—the leading REIT ETF—vs. the 10-year Treasury yield.

As you can see, the lines typically move in opposite directions. It makes sense, since REITs thrive when rates are low and stable… and suffer when they rise sharply.

Over the past year, IYR is already down more than 8%. And with the Fed ready to continue hiking rates through the end of 2023… real estate stocks face even more downside ahead.

Adding to the sector’s pain, commercial property prices are set to decline (as much as 40% according to some estimates) due to the combination of slowing demand and massive oversupply.

According to a report from MSCI Real Assets, the amount of “troubled” real estate assets in the U.S. was nearly $64 billion in the first quarter (Q1) of this year. That’s up 10% vs. the same period a year ago.

And this number is sure to rise…

In fact, the Fed’s Financial Stability Report from May named commercial real estate as one of the greatest risks to the U.S. financial system—along with inflation, the U.S. debt limit, and the banking crisis.

In short, commercial real estate is in hot water right now… and things are set to get even worse.

Fortunately, there’s a simple way to profit from the turmoil…

The best way to play the pain in commercial real estate

The ProShares Short Real Estate ETF (REK) is an inverse ETF designed to return the opposite of IYR’s daily performance. In other words, this fund goes up when REITs decline (and vice-versa).

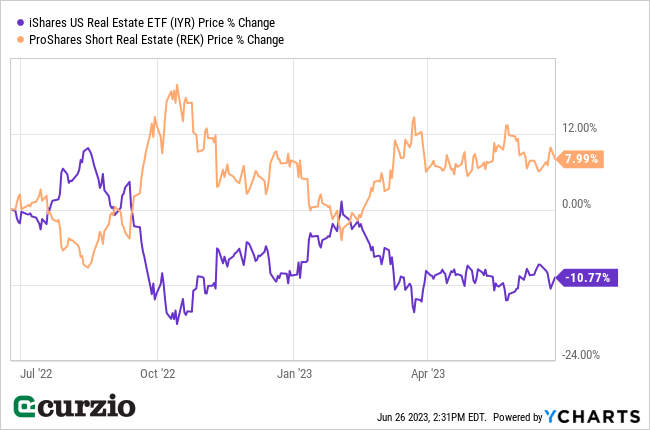

As you can see from the chart below, REK is up more than 5% over the past year—and there’s more upside ahead as REITs continue to suffer.

As I mentioned above, the Fed will continue to hike interest rates until it engineers a recession… So to give you an idea of how much upside REK has ahead, let’s take a look at how REITs fared during the last two recessions…

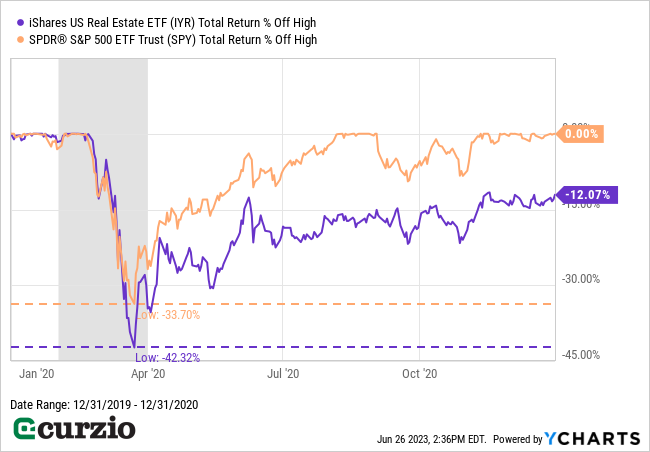

As you can see below, IYR lost more than 42% during the COVID crash of 2020 (vs. a 33.7% drop for the S&P 500).

And during the Great Recession of 2008-2009, IYR plunged 74.1% from its highs (accounting for dividends). That’s much worse than the S&P 500, which fell 55.2% at its lowest point.

As the Fed raises rates and forces a recession, REITs are in for another devastating drop… which means REK will see proportionate upside.

Conclusion

Commercial real estate is in for a lot of pain… thanks to the combination of changing consumer habits, an economic slowdown, and the highest interest rates in four decades. And REK gives us an easy way to bet against REITs… and score big profits as they fall. (Just remember to follow these guidelines for investing in inverse ETFs.)

P.S. For more of my favorite ways to play a falling market, join us at Moneyflow Trader.

This advisory’s results speak for themselves…

In 2022, as most investors were losing their shirts, members had a shot at 18 winning trades for gains as high as 271%.

Learn how this strategy can save your portfolio in a bear market.