As vice chairman of Berkshire Hathaway, Charlie Munger might not have been as visible or revered as Warren Buffett…

But he was just as instrumental to the company’s success.

Buffett said in 2014: “In 56 years… we’ve never had an argument. When we differ, Charlie usually ends the conversation by saying, ‘Warren, think it over and you’ll agree with me because you’re smart and I’m right.’”

Put simply, Munger’s death a couple of weeks ago—just shy of his 100th birthday—is a huge loss for the investment community.

Fortunately, his stock market insight will be a valuable resource for generations of investors to come. Today, we’ll look at four of Munger’s rules for buying companies.

But first, let’s take a quick look at why Berkshire Hathaway’s portfolio is (justifiably) regarded as a beacon to investors seeking guidance.

Berkshire Hathaway’s incredible track record

From its humble roots as a textile business, Berkshire Hathaway (BRK.B) has grown into one of the largest companies in the world.

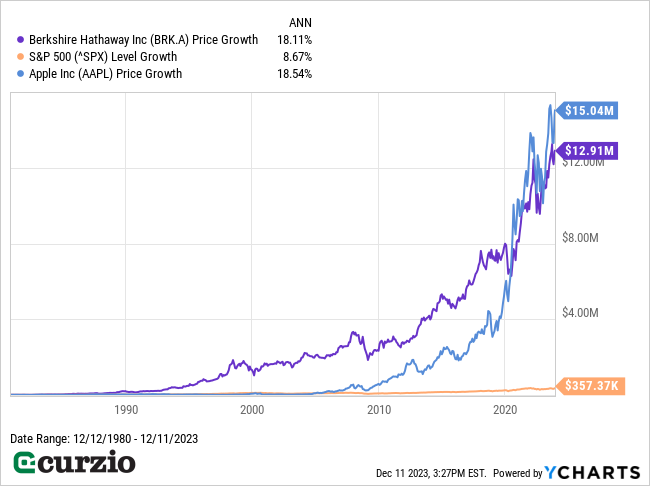

From December 12, 1980 (just a couple of years after Munger took the reins as vice chair) to today, Berkshire’s stock has delivered an 18.11% annualized return… more than double the S&P 500’s 8.66% growth rate—and nearly equal to Apple’s (AAPL) lifetime annualized gain of 18.52%.

If you bought Berkshire’s shares in December 1980, you could have turned a $10,000 investment into almost $13 million (as shown in the chart below).

While some of Berkshire’s recent returns can be attributed to Apple (which the company began accumulating in 2016), you can see that even before then, Berkshire’s gains were consistently impressive (especially compared to the overall market).

So how were Munger and Buffett able to generate such a remarkable track record?

By following a handful of simple rules, which every investor can apply to their portfolio.

Buffett briefly listed these rules in Berkshire’s 2007 letter to its shareholders—but didn’t get into the details. Today, I want to distill these rules into something we can apply to our own investments…

4 rules for investment success

1. Invest in businesses you understand

One of the foundational rules of any good investment is to understand how the company operates… what it sells… and what its target market is.

It’s easy enough to follow the crowd into the latest hot stock. But if you don’t understand the underlying business, it can lead to huge disappointments. (Look no further than the rise and fall of SPACs, an investment class whose ambiguity was one of the reasons for its short-lived boom in 2021.)

And it’s much easier to sleep at night when you own businesses you understand. It means you can confidently hold onto their shares for years, through good times and bad.

Berkshire’s portfolio is full of businesses that are easy to understand and follow. And nothing epitomizes this rule more than companies like Coca-Cola (KO), which has been in the portfolio since the 1980s… and American Express (AXP), of which Berkshire currently owns a majority stake (20.8% of the company).

2. Look for ‘favorable long-term economics’

Understanding trends that will stand the test of time is a critical component of investment success.

For example, as early as 2008, Berkshire began investing in electric vehicles (EVs)—a long-term growth trend most investors didn’t see until much later. It paid $232 million for 225 million shares of the Chinese plug-in EV maker BYD (BYDDF). By the end of 2021, this stake was worth almost $7.7 billion.

Meanwhile, Berkshire Hathway avoids “companies in industries prone to rapid and continuous change.”

Consider how many market leaders (across different industries) have been unseated by changing technology over the years: from photography (Eastman Kodak) to movie rentals (Blockbuster) to paper-based copying (Xerox).

And while some folks might criticize Berkshire for avoiding most tech companies, it’s worth noting that Apple—Berkshire’s largest holding by far—is a beneficiary of all of these trends, with its iPhones (which include a digital camera)… its burgeoning streaming business… and its cloud-based storage services.

In short, it’s important to stay on top of your investments to make sure the underlying trend remains sound. And if it doesn’t, it’s better to sell—even if it means taking a loss. After all, it could save you from a much bigger loss down the line.

3. Invest alongside ‘able and trustworthy management’

Look for a company that has a steady—and reliable—hand guiding the ship.

You need to be able to trust a company’s management… its reported numbers… its insights… and its business outlook.

Buffett and Munger not only invested by this rule, they followed it themselves. Through their detailed annual letters to shareholders, they maintained transparent communication for decades.

Some good indicators of a strong management team include long-term tenure… clear succession plans… clear and open communication… and the company’s ability to consistently deliver better profit and revenue growth than its peers.

4. Look for a sensible price tag

Great companies are rarely cheap. That’s because the entire investment community is constantly combing the market for companies that can grow revenues and profits… and dumping stocks that can’t stay competitive.

You need to pay attention to a stock’s price tag—but that doesn’t mean it’s a good idea to buy the cheapest companies. Their stocks tend to be cheap for a reason!

And, as a rule of thumb, neither the most expensive stocks in the market nor the cheapest ones will generate big profits as long-term investments.

There are many ways to value a company (I’ll cover this topic in greater detail in the future). But as a shortcut, you can always look for a company that trades at an average valuation vs. its peers—while growing faster than the market. All else equal, these businesses are well-positioned for future profits… and for share-price gains.

Conclusion

For decades, Buffett and Munger utilized the four investment rules above to guide their investment decisions. Their performance speaks for itself… as Berkshire was able to beat the market consistently, while generating billions in gains.

Today, we can use these same time-tested rules as a roadmap for generating our own market-beating profits.

Or you can simply piggyback off of Berkshire’s success by owning its shares in your own portfolio.

Image: Charlie Munger (Nick Webb, Creative Commons 2.0, Derivative)