Dear Reader,

The 2016 election marked the beginning of America’s fourth economic revolution. Today, its key elements—deregulation, corporate tax reform, and international trade reform—are fueling a resurgence of middle-class prosperity.

If history can serve as a guide, this revolution will continue for generations.

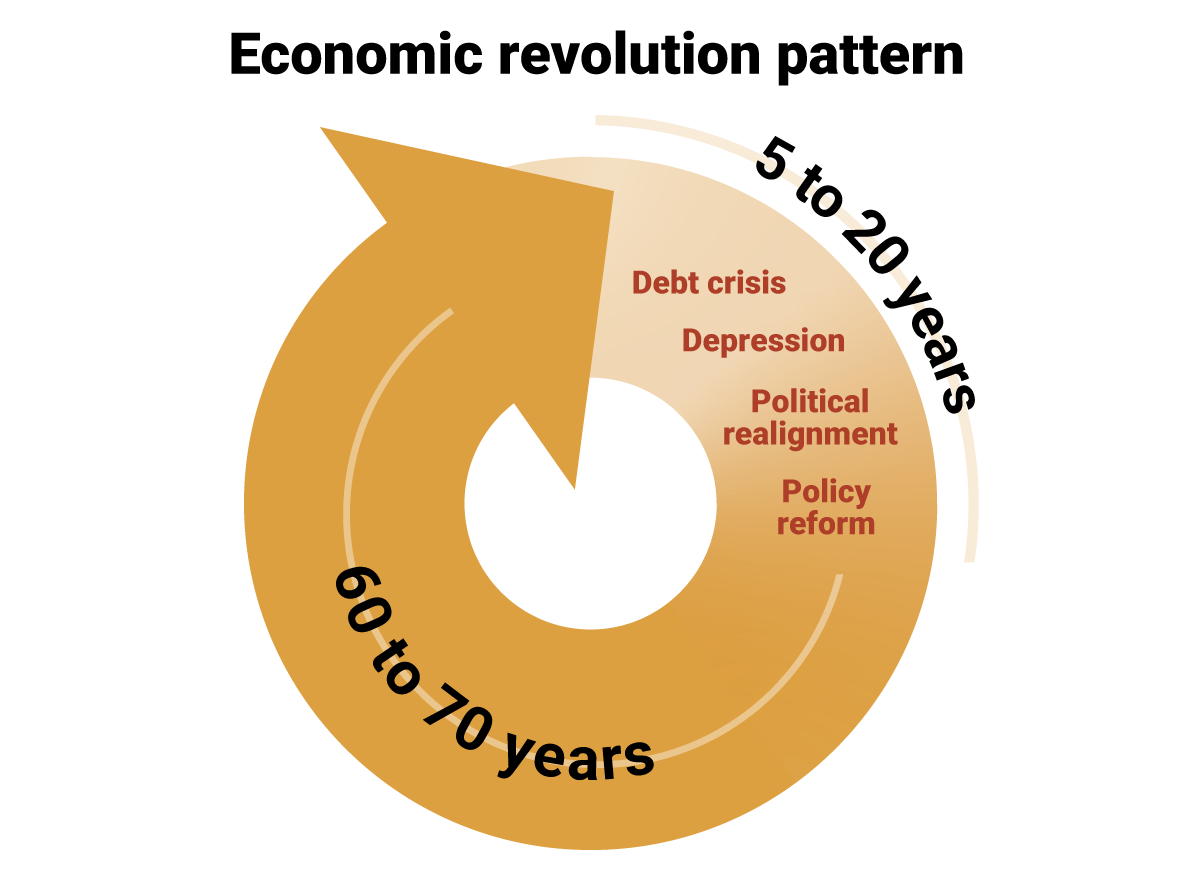

You see, economic revolutions only occur once in a lifetime… about every 70 to 80 years. They also tend to follow the same pattern:

First, there’s a financial crisis and economic depression. Then, hardship leads to voter dissatisfaction and political realignment. Finally, a new government enacts policies to correct the problems that caused the recent crisis.

Before we get into today’s developments, it will help to understand the three economic revolutions that came first.

The 1st Revolution – 1783: Paying off the war

The nation’s first Treasury Secretary, Alexander Hamilton, resolved the nation’s first debt crisis…

In 1783, many states were bankrupted by debts accumulated during the Revolutionary War. In response, Hamilton federalized state war debts in 1789 and then repaid the debt by developing an effective system for collecting tariffs and excise taxes. With the debt burden erased, the economy boomed.

When Thomas Jefferson won the presidential election of 1800, he retained each and every Hamilton reform… despite previously opposing Hamilton’s policies. Jefferson knew he needed Hamilton’s tax-collection machine to fund the Louisiana purchase and to pursue his policies of westward agrarian expansion.

The 2nd Revolution – 1857: Expansion and emancipation

In the late 1800s, railroads, farmers, and slaveholders borrowed massive amounts. Credit standards eventually collapsed, and fraudulent borrowing schemes proliferated. For example, some railroads securitized landholdings with inflated valuations. Then they used the overvalued securities as collateral to obtain more loans.

The collapse of lender Ohio Life Insurance Company in 1857 started a chain reaction of loan calls (when lenders demand full payment before a loan is due). Two midwestern railroads went bankrupt. Railroad building ceased. Loan calls forced the bankruptcy and closure of nearly 6,000 businesses. Multitudes of investors lost a fortune on worthless railroad securities purchased with borrowed money. But the problems didn’t stop there…

The global iron industry shut down due to the lack of rail demand… And all around the world, large banks failed. Liverpool Borough Bank in England, Credit Mobilier in France, and numerous lenders in Hamburg closed during the crisis.

The hardship… and the borrowing binge that led to it… inspired an obscure London journalist to write about economics for the New York Daily Tribune. His name was Karl Marx.

The 1857 depression also aggravated a split in the Democrat Party and handed the 1860 Presidential election to Abraham Lincoln. A new political realignment had started.

Lincoln had campaigned for policies that would “contain” the practice of slavery. In turn, containment would diminish the value of slaves and intensify Southern financial hardship. Since about half of Southern wealth was tied up in slave holdings, these factors contributed to the South’s urgent drive toward rebellion.

The Union’s Civil War victory cemented a political realignment. President Lincoln (and successors) ramped up infrastructure development. Railroads and telegraph lines proliferated. The most important railroad, the Union Pacific, connected eastern cities with pacific ports. And infrastructure expansion culminated with the construction of the Panama Canal, which connected all of America to the rest of the world.

Great infrastructure empowered rapid industrialization. Meanwhile, high import tariffs protected American industry from foreign competition. Never in the history of mankind has an empire risen so quickly. From the devastation of the Civil War in 1864, it took less than 50 years for the U.S. to become the dominant industrial and military power on earth.

The 3rd Revolution – 1932: The big crash

In 1920, every major non-U.S. economy suffered from an immense war-debt burden. Not to be left out, the U.S. created its own horrific debt crisis.

To help ease the debt burdens of England and France, the Fed suppressed interest rates in the 1920s. Low rates encouraged borrowing and a massive real estate boom… Rampant speculation spread from real estate into the stock market… And as stock prices soared, multitudes of naïve investors were sucked in at the worst possible time.

When the market inevitably crashed in 1929, a vicious cycle of debt repayment caused a 46% contraction in GDP. Banks called every loan possible. Foreclosures accelerated. Asset sales caused the price of real estate (the primary source of loan collateral) to plummet. And so, the crisis escalated.

Unemployment soared above 30%. Voter dissatisfaction swept the Democrat Party into power. The New Deal revolution took shape. President Roosevelt established agencies to regulate the capital markets. Investor confidence returned, and the economy stabilized. Eventually, a robust capital market would develop, and it funded the booming post-war economy.

Starting in 1945 with the Bretton Woods agreement, the U.S. promised to share its prosperity with any country that would join a cold-war alliance against the Soviet Union. The U.S. granted free trade privileges to all allies, and the war-torn economies of Europe and Japan quickly recovered. Eventually, this policy enabled “emerging economies” to grow and prosper, too.

And it helped sow the seeds for the next revolution.

The 4th Revolution – 2016: The Trump Presidency

In the decades that followed, U.S. companies became less competitive. Regulation and high corporate tax rates raised production costs. The U.S. extended free trade privileges to former enemies, including China.

When U.S. businesses outsourced production to foreign workers, foreign wages soared while American wages stagnated. The merchant class grew wealthier and wealthier while the gap between rich and poor widened.

Despite the slowing industrial economy, the U.S. maintained modest growth. The internet bubble of the 1990s was followed by a real estate bubble in the 2000s. With all that debt, it was just a matter of time until the collapse.

The 2008 financial crisis helped President Obama get elected. It seemed that a political realignment was taking shape, but no one changed sides. A sluggish economic recovery sowed the seeds for more true realignment.

Industrial laborers, longtime supporters of the Democratic Party, overwhelmingly voted for an outsider… campaigning as a Republican… in 2016. The was the political realignment needed for the next revolution to begin.

President Trump’s deregulation and tax cuts reinvigorated the economy. Protectionist trade policies helped to reverse the decline in manufacturing employment. Middle-class real income started to grow for the first time in 30 years.

Right now, all reputable election models predict Trump’s reelection in 2020. If that happens, the revolution will proceed. More tax reform, deregulation, and trade protection will lift America’s industrial economy.

How to cash in on the 4th Revolution

As the industrial economy goes, so goes the packaging business. This makes a lot of sense in that if a business produces more goods, it must also package more goods.

The primary product of Packaging Corporation of America (PKG)—corrugated containers—seems like a simple commodity business. PKG differentiates itself with customized and innovative packaging solutions that make better use of space. This lowers transportation costs for its customers. Because its packaging solutions add value for customers, PKG earns the highest (and most consistent) margins in the industry.

PKG’s business model generates consistently strong returns. Its stock returns outperformed its peer group by a cumulative 184% between 2012 and 2017.

At this moment, a global slowdown and a strong dollar are putting pressure on PKG’s profit margins.

But eventually, robust U.S. growth will stoke demand for PKG’s packaging products. If a near-term profit disappointment causes PKG to fall below $100 per share, it will present a bargain opportunity for investors.

Next month, I’ll tell you the real reason for America’s economic dominance and success…

All the best,

![[signature]](https://www.curzioresearch.com/wp-content/uploads/2019/09/SKoomar-sig-1.png)

Steve Koomar

Editor, Vigilante Investor

Editor’s note: Earlier this month, Steve shared why bonds are not only poor investments today, but also risky ones. The good news is, the Fed has gifted us with a much better alternative… Find out what it is here: A gift from the Fed every investor should take.