If you’ve been following me for awhile, you’ve undoubtedly heard me talk about Wrap Technologies, creator of the revolutionary nonlethal weapon, the BolaWrap.

For subscribers of both Curzio Research Advisory and Curzio Venture Opportunities, this name has been a huge winner… and it keeps climbing.

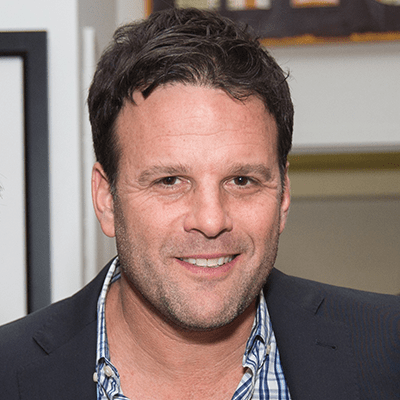

Today, Scot Cohen, venture capitalist and executive chairman of Wrap, breaks down the company’s latest quarterly earnings—and shares some huge news on company management. Here’s what to expect from this incredible company in the months to come… [19:59]

Then, the Federal Reserve could soon implement a policy that we’ve only seen one other time in history… and one group of stocks is poised to outperform the market as a result. [51:33]

- Guest: Scot Cohen, executive chairman of Wrap Technologies [19:59]

- Educational: This Fed tool could send one sector surging [51:33]

Wall Street Unplugged | 733

An 80-year-old Fed tool is about to send one sector surging...

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on Main Street.

Frank Curzio: What’s going on out there? It’s August 5th. I’m Frank Curzio, this is the Wall Street Unplugged podcast, where I break down the headlines and tell you what’s really moving these markets. I did something for the first time ever last week… Took the plunge and I bought my first gun, the Glock 45 nine millimeter. And all the gun people going to say, “You should buy this gun instead.” It’s such a die-hard community. It’s awesome. Getting so many emails from gun owners out there, especially people living in the South. You’re like, “Frank! It’s about time. I can’t believe it. What are you waiting for?” The Northeast, where I live most of my life, 36, 37 years. You can’t own guns in New York, I mean, outside of hunting. It was never part of our culture. Growing up in the South, it is part of your culture. New York, nobody talked about it, ever. We don’t own guns, really permanent stuff like that. But in a lot of the southern states, you really don’t need anything. You need a license, and you can get a gun. It’s pretty easy.

Frank Curzio: That’s what I learned. Being down in of Florida for now a little over 10 years, everyone owns a gun. Everybody I talk to. It was crazy. On one of the podcasts, I said I was thinking about buying a gun, and I had a subscriber reach out, his name is Rob. One of my subscribers happens to be a gun dealer. He actually drove from Atlanta to North Florida to train me, or at least go over the basics with me, and shoot the gun with me at the range in Jacksonville. And he didn’t just drive down here for me. His kids are playing lacrosse tournament in Orlando, so I was very thankful that he came down and helped me out tremendously. He took the time to come to my office the day before, go over all safety measures with me, and then we met at the range next day to shoot.

Frank Curzio: I did okay. Some bullseyes, but not many. But the funny thing here is Daniel Creech, who works with me, came to the range. Now Daniel’s from Ohio, but spent a lot of time in Montana. For me, I’d never put two and two together. I’m like, Dan’s a great guy. Again, I’m not a gun guy, but Daniel is. So Dan gets up there and starts shooting, and there’s four targets, it’s got one target with four separate bullseyes… He started shooting, and he’s destroying them. He sent bullseyes like crazy to the point where the guy that actually works there, just to make sure everyone’s following the rules while they’re shooting, he leans over to me and says, “Man, that guy could shoot,” which I thought was funny because I never knew. I didn’t put two and two together, but Daniel grew up shooting guns.

Frank Curzio: Thought it was pretty cool just to watch him shoot. For the record, if newsletter performance doing pretty good, if I do have some bad picks and you think about coming to my office, saying, “I’m not worried about Frank because he doesn’t know how to shoot a gun,” Daniel works in my office, and the guy will shoot your eyeballs out from 20 yards away, pretty easily. That is a joke. I am kidding for everybody out there, the most serious, “Frank’s going to shoot a subscriber.” No, I’m not. But all kidding aside, I never thought in my entire life that I would own a handgun, especially having young kids, which, of course, I plan to teach them how to shoot once they’re old enough, and the gun is going to be locked up. It’s a different world today.

Frank Curzio: People aren’t scared to break into homes or rob homes. There’s little consequences now, because slam a police officer in a head with a metal pipe when he’s trying to protect and serve, and all you need to do is pay a $7,500 fine, and you’re out on bail the next day, cheering, going, “Yes, I’m great!” I say this a lot because I’m not a paranoid person. I skydive, bungee jumping, jumping off buildings, like in Vegas. I’m always a believer in statistics and data, but also use common sense to come to my decisions. And when I’m looking at the world today, it’s different. It’s crazy. Who want to defund the police when there’s very little statistics that support that, and the reason why we should do that. Very little.

Frank Curzio: I know by saying that, it makes me a racist. I’m an outcast. I’m an asshole for the people for the left, I get it. I support police officers, black, white, male, female, because most, more than 95%, do an amazing job and risk their lives every single day. It’s just amazing how so many people are shitting on them now. You’re lumping them all together because of a few bad apples. It’s insane. But for me, becoming a gun owner for the first time, going to be going through more training, taking this very, very seriously, but I’m very glad to own one now. I pray to God, seriously, pray, I never have to use it in a hostile situation, but I’m glad I have it. I just mentioned statistics and common sense real quick, because I had several people reach out to me.

Frank Curzio: I’ve been providing a lot of statistics on COVID, why a lot of this is bullshit because of our politicians. Of course, you have people from all over, just a few emails. “Where’d you get those statistics from? You’re crazy!” One guy pointed out that crime is going down in most cities. Give you evidence of this. Like the past three weeks, he sent me a couple of charts and figures. You know what? If you look at the data and say, total crime, it is going down a little bit, that’s if you include rape, sex abuse. If you look at homicide, from the links this person sent me, in Washington alone, they were up 18%. Motor vehicle theft up 32%, arson up 57%. When you include all the stats, all crime, you’ll see Washington down 17%, which is pretty freaking obvious. Since most people, they’re not even on the streets today. In LA, from another link he sent me, homicide is up 32%, robbery up 5%, motor vehicle theft up, but there was a 35% decline in burglary, as most people who are stealing stuff have masks on, so they’re getting away with it and not getting arrested.

Frank Curzio: But when you look at the data and you can interpret it, however it’s going to support your agenda. I understand that, but this is where common sense comes in. We just can’t look at data and say like, COVID, I’ll get to this in a minute with COVID and the death toll is rising. Of course, but wait until you hear the numbers, how great they’ve been. No one wants to talk about that. I mean, no one talk about that. “It’s just in case, they’re exploiting it and no one’s…” I’ll get to share more numbers with you. When it comes to this person talking about crime, use your common sense here, because I’m gonna ask you this question. This is all that matters. This is all that matters.

Frank Curzio: Would you take your kids for a walk through a major city at 10, 11 o’clock at night right now? Would you really feel safe doing that? I wouldn’t. No way. I can honestly say for over 30 years, I’ve never felt like that. Basically, since the days of living in New York and Dinkins was our mayor, New York City was a disaster. Holy cow, you go by 42nd Street, had crack vials everywhere, graffiti everywhere, video porn shops. A lot of the blocks. Prostitutes walking the street, incredibly dangerous. Before my thirties, I’ve never felt like that where I wouldn’t take my kids out on the street any place in America. Well, most places in America. You know what I mean? But the major cities? Really? New York is beautiful, New York City. Now, holy cow, you go there, it’s beautiful, the tourism. It’s nice. It’s great. I took my kids there to see it first time a couple of years ago.

Frank Curzio: Okay. You can look at the stats, interpret them however you please to support your agenda. I have no agenda here, other than to make you money and tell you what’s really going on. When it comes to COVID, I had a doctor reach out, his name is Matt, email me and said, “I was listening to the podcast.” This is from last week. He made some strong comments about the death rate of COVID versus the flu.

Frank Curzio: “The image shows a clear difference,” and he sent me an image. “The number of deaths for anyone aged 25 plus, in fact, you stated the flu has a higher IFR, which is an infection fatality rate, than COVID, and I realized that you say that people with underlying conditions are at a higher risk and that this image doesn’t control for underlying conditions. That’s interesting, because we can make the assumption that the number of people with underlying conditions doesn’t change from year to year. Thus, I am not sure how you arrive at your statement that the flu has a higher IFR than COVID-19. So anyone under 65, if you have data to support your claims, I’m happy to look at it. However, I am deeply concerned about your statements of stating the facts if you don’t have the data. What facts are you using to make these claims? How am I supposed to trust you with investing advice? Why am I a paying subscriber if I can’t trust any facts that you provide? If you can’t provide me with any nonpartisan data that supports all these facts, I would like a refund for my Curzio Research Advisory subscription.”

Frank Curzio: So Matt wrote. Now, Matt, to be honest, when you asked me why you’re a paying subscriber if I can’t trust your investment advice, the old me would have answered this by saying, “Maybe you’re a subscriber because I made you a shitload of money since I started that product and you’re paying less than it’s going to cost to fill up your Mercedes last month. I keep this price super low so every mom and pop investor can afford it. They can get quality Wall Street research. It’s going to educate them to become better investors, create generational wealth, or maybe, maybe, hopefully that their kids are going to be secure, and their kids are going to be secure. Give them that quality Wall Street research without having a $5 million dollar account at Goldman Sachs.” That’s the old me. The old me would say that, but I’ve matured over the years. Definitely matured over the years.

Frank Curzio: Instead, I’m going to answer you with numbers. According to the CDC, which right, would you say partisan nonpartisan? Everybody believes in those statistics, right? CDC? There are estimated 48 million people in the U.S. who had the flu last flu season, so that’s October through April. Okay, that’s the average, 48 million people. That resulted in 43,000 deaths. That’s 0.9% of people who contracted flu end up dying. Pretty simple. Now, when we look at COVID, the CDC latest stats on the site are from July 25th. The latest stats, where it listed of people who have died of COVID based on age group. There’s subsets, 55 to 65, 65 to 75, 75 to 85, 85 years and up. As of July 25th, 135,000 people have died in the U.S. from COVID, while 3.3 million people in the U.S. have been infected from that date. Amazingly, if we look at the groups of 55 years and older, it accounts for 125,000 of those deaths. That’s 92% who are in the danger zone, and 55, I said 60, it doesn’t matter because they can’t get 60 because they go between 55 and 65. Doesn’t matter.

Frank Curzio: Maybe it’s a little bit high, so you’re looking at maybe it’s 91%, but 92% of the total. Now let’s take out that subgroup of people are over 55, which by the way, doesn’t include people with respiratory problems or people who are obese, either, that get this. Also, the people that die, it doesn’t include it. You talk, you’re a doctor, you know this. If you have terminal cancer, you’re gonna die three months from now, you get COVID and die, you get listed as your death is COVID, not cancer. You know that because you’re a doctor, you should know that. I hope you know that. Okay? I’m not including those people either. If we’re looking at the group under 55, that amounts of 10,717 people under the age of 55 that died after getting affected with COVID. July 25th again, this is a total of 3.3 million people in the U.S. were infected with COVID. When we do the math., the amount of people under 55 years of age that died after being infected with COVID is 0.32%, much less than a 0.9% of people who died from the flu last flu season.

Frank Curzio: You still want to cancel your subscription, Matt, you may do so. It’s up to you. You are past your refund period though, but I’ll give you a refund anyway. I don’t mind. I don’t mind the questioning of stats. What I mind is when the threats of giving me my, again, this is one of the cheapest newsletters we have, and I keep that price low. It’s our break-even price. Why? Because my goal is to give you that type of research for very, very cheap in hopes that you’ll subscribe to our more premium products, which is how we build our business. So for me, I’ve always been a show-me guy, not a talk guy. I want to show you the results. You’re going to say, “Wow, this guy knows what he’s doing. Here’s why he has great products. He’s why he has great people working under him that could help me make money… That could help me generate that generational wealth I always talk about.”

Frank Curzio: That’s the goal, but that’s what ticks me off a little bit, but you’re a doctor. You should know these stats. These stats are from the CDC, and that’s fine. You should question everything. That’s okay. But remember, I don’t have an agenda here. If I see these rates skyrocket, it’s crazy, but it even gets more encouraging, because if you’re looking at data from this week, guys, the total U.S. case mortality rate has gone down tremendously. As of last week, it’s 3.14%. That number was 7%, close to 8% in May, and it’s 3.1%. Why? Because we know more about this disease now. A ton about this disease. We’re not looking at the beginning with these stats, where New York, they didn’t know better. Every politician’s blaming each other, but when people got COVID, they put them in nursing homes. That’s where most of the deaths came from right away. It’s why the numbers are sky rocketing. Now we understand the risks. We know if we keep these people who are in that danger zone and we protect them, these rates go down tremendously, tremendously.

Frank Curzio: When we look at kids under the age of 15, which one kid is, again, fatality for a kid, tragedy. We have 42 kids of the 135,000 plus who died of COVID in the U.S., which amounts to 0.001%. The data supports our kids going back. Again, I have a lot at stake here, too. One of my daughters, as you know, takes medicine, too, that’s going to lower her immune system, for ulcerative colitis. That’s what got diagnosed now, after I know that yesterday, he said, it’s more ulcerative colitis than Crohn’s. It flips back and forth with people that know that. My daughter’s doing well, thank you very much. But, I’m involved in this, too, and I’m going to send my kids back to school, but you’re looking at the data here, come on. Yet, we have teachers in LA who said they want to defund the police before they go back to work and start teaching kids. You know what I call that? I call it a fucking disgrace, that you would damage kids’ lives just to support a bullshit political agenda. That’s where we are in this world.

Frank Curzio: Why am I bringing this up and talking about this so much? Because it matters for your investments. It matters that this shit’s going to go on past the election, even though it’s nonsense, even though we should be opening up the economies like crazy. The debt freeze is going down tremendously. It’s going low. Look at the CDC, just go on this site. You’re going to see the weekly deaths. Look at the weekly deaths from the peak to now. You’re gonna see them coming down tremendously because we know how to, and people who get the worst cases of this, where they have the worst symptoms, we now have drugs out there that can lower this, lower that fatality rate by 60%, that’s coming out of Gilead. Again the drug, I always pronounce it wrong, but we know what we’re up against.

Frank Curzio: We didn’t understand this three months ago. We do now. We understand it now. If you get this, you’re going to be okay, tell you to go home, hopefully you don’t get it that bad, and if you need to go to the hospital, there’s respirators, there’s room in ICUs. Come on, it’s all there. This isn’t bullshit sites that I’m pulling from either Fox or CNN. No, they’re going to pull whatever they have to support their agenda. Again, their agenda is to make money. They’re companies, and they make more money by bashing Trump, by supporting Trump 100% by just telling you all kinds of bullshit. Doesn’t matter.

Frank Curzio: I think about it. I think of Floyd. The video just came out, the full video of what happened. Why the hell don’t we have access to the full video? This is America. This is where we can make our own choice, but why wouldn’t you have access? It’s just amazing what is going on right now, what’s being hidden from you. What’s not being told, the information. Guys, that’s why I have this podcast. I’ve done this all my life on Wall Street. For me, I’m the first to call bullshit on things, to let you know things you don’t have to worry about. 12 years plus doing this podcast. We’re going over the statistics because they are extremely important, because the people that don’t think that you’re safe, they’re going to go out there and there’s trouble.

Frank Curzio: They don’t want to put their kids in school, which is insane. When you look at the numbers, it’s insane. There’s not one recorded case, not one, that a kid has transmitted COVID to a teacher. Not one in the U.S. I’m not saying we don’t protect the teachers. I’m not saying every kid should go back. Every parent has their right. Every parent thinks differently. But we need to open up the schools and let the parents make their own choices. If they want to bring them back or no, maybe some are nervous or not, but we need to open them up, based on statistics. We need to open them up. We’re hurting our kids. LA teachers don’t give a shit, but hey, let’s defund the police before I go back to work. I’d fire them all. I’ll probably lose subscribers. I got a lot of subscribers in California. I don’t care. That’s bullshit.

Frank Curzio: Anyway, just know the facts. I appreciate all the questions coming in. It’s awesome. But everything you hear on TV, everything you hear out there, just be challenged. Do your own research. There’s a lot of great sites out there and you’ll see, if you’re looking at unbiased sites, you’re going to understand, COVID, a lot of this is BS right now. A lot of it. Do we have to worry? The people in a danger zone, of course, they have to worry. Everyone else? This is more like the flu. The statistics support that.

Frank Curzio: Now, great interview for today. I had this person on when a stock was at four, now it’s at 10. Scot Cohen, executive chairman of Wrap, been a roller coaster ride, went up to 13 reported earnings. New CEO, stock came down, got lots of questions on it. It’s going to be a fantastic interview. I’m asking tough questions. No layups. Again, guys, this is very important. This isn’t promotional. This isn’t anything. This is something that I own personally. I still remember original position. I haven’t sold shares. I love this company. If they get it right, it’s going to go a lot higher, but I asked him those tough questions. The questions that you want to know, your concerns. He’s going to answer them all. Fantastic, fantastic interview coming up, and then my educational segment.

Frank Curzio: I’m going to explain why this move that’s likely going to be done by Fed to move, very few people are talking about, could result in this small group of stocks surging over the next six to 12 months. This is not a BS segment. This is something you need to know because the Fed’s about to do something that has been only done once in its history, it did 80 years ago. You think they run out of tools? Here it is. Here’s a new one, but it’s not that new because it’s been done one time, during World War II. If they do this, there’s one sector of this market right now that could explode in value. It’s a great, great educational segment. Please listen up. It’s a way to make a lot of money. This I believe I’m positioning myself in it. Fantastic. But first, let’s get to my interview with the one and only Scot Cohen.

Frank Curzio: Scot Cohen, thanks so much for joining us on Wall Street Unplugged again.

Scot Cohen: Thank you, Frank. Good to be here. Thanks for having me on.

Frank Curzio: No, no. The last time you were on a few months ago, your stock was in the forest range, is now over $10 based on a lot of positive developments. Now rabbit’s a position a lot of my listeners own. My subscribers are in at much lower prices than where it’s trading today, and I want to get to a lot of stuff today. Recent earnings call where your stock didn’t pull back a couple of ties, the new CEO announcement, and also short sellers and things like that. I want to start from the beginning to get the newest listeners up to speed. As someone myself who has been covering small-caps for over two decades, the progress you have made with this company, especially off the past 18 months since I got shot with more like the prototype, I don’t know if that was a great idea or not. It’s remarkable. Can you talk about that, of how far you’ve come in 18 months? Because when I compare this to Taser where you are, you’re light years ahead of them. It’s amazing how far you’ve come.

Scot Cohen: Sure. Yeah. So, let’s just start with the product. Yeah, that’s true. When you were wrapped in my apartment almost two years ago, 18 months ago, product was working probably 40 to 50% of the time. When I say working, I mean, wrapping consistently. It was anyone’s best guess the laser, I think we just had put the laser on. It wasn’t stable or using many more suppliers at the time. Our costs were higher, yeah. Now, I’m happy to report that this wrap, the BolaWrap’s working over 90% of the time, and we’re closing in on that. It’s just getting better and better. We’re using less suppliers. We’ve been able to bring our costs down, and now with the new hire that I’m sure we’re going to get into with Mark as CEO, he’s got a lot of changes on the manufacturing side, on the logistics side. It’s really going to drive costs down and we’re hopeful that the effectiveness of the product is even get better from here. That’s one.

Scot Cohen: Starting with product training, Frank, when you first got shot, we didn’t even have training established. We’ve got a whole master trainer program, train the trainer program, that’s been in place for almost a year now. We’ve trained hundreds of departments. There’s thousands of line officers trying to just take one city right now, LAPD. We’ve got over 1100 trained. I don’t even have the total number of trained, but it’s in the tens of thousands. We had no training, barely had customer support set up, our balance sheet when you first met us was probably at the time around 15 million, and I’m glad to be able to talk about a $45 million balance sheet. At this time, liquidity’s increased in just the way that the sheriffs trade, where we were in maybe one or two departments at the time, a pilot test going on, and now we’re close to 200 departments.

Scot Cohen: The C-suite has just improved up and down at the executive level, so we’re just bringing better people on, the product’s getting better, the environment has changed so much. As we all know, this is really, people are begging for an alternative. The communities are begging for more training. But the police are wanting or needing alternatives to what they’ve got on their belt right now. You got product improvements, you got an environment that’s perfect for this time for our product, and then you got leadership that’s just gets better and better and, of course, the balance sheet, just to name a few.

Frank Curzio: When I look at this and you tell me that it’s great, I didn’t really know that it was only working 40, 50% of the time and the laser was a little off. It’s good to know that now, I guess, but it just goes to show you guys, I’m there for you. I wanted to do the research. I got shot by this, and then I put out a video to everybody just to show everyone. But for me, the big story was you had retired police there. When I interviewed them, for me, this was more than something I thought people could make a lot of money off your stock. I got emotionally involved in this, seeing their faces, interviewing them where they’re in the field for over 30 years, some of these guys, and even longer, and they just knew if they had this device, it could have saved lives.

Frank Curzio: Nobody, what I learned, too, were like, nobody wants to take out, even if it’s a clean shoot, you have to live with that for the rest of your life. They’ve seen so many officers like that, deal with that. We only hear about those stories where the four or 5% that are bad, or even less than that, but most police officers, they don’t want to use their gun. They don’t want to shoot anyone and just learning about the device then when your stock just on the pink sheets and getting into this thing, is pretty incredible. So no, I appreciate you letting me in. Even my subscribers, too, recommending it very early, which I want to thank you for now. A lot has happened-

Scot Cohen: When you came in, we had probably maybe 100 to 150 investors. We hadn’t hired Tom Smith, the co-founder of Taser, so you came before Tom. You came when, like I said, maybe 100 or 150 different investors today, we have over 25,000. The interesting thing about it is they’re mostly from law enforcement. Over 25% of our shareholders, it turns out, are from either law enforcement or they have friends that are in law enforcement. You were way before any of that started, super, super early, and you’re right. This isn’t just a product that the community feels good about or can relate to, so, we need something like this. We need an alternative. Turns out that the police themselves are open armed to us. They’re embracing this they’re excited about it and they’re pushing for this cause. We’ve got both the communities and the people that are serving us. The law officer, the police actually supporting this are coming from both ends, which is really unique, pretty unique for any business to have that kind of welcomeness around our product.

Frank Curzio: Yeah. I appreciate that. I know a lot of my subscribers are in this early, and should be in below $10. All of them, if not, maybe a tiny bit more, but most of them are doing well in your stock. However, with that said, we’ve seen the stock go up to $13, a little bit higher than that. If you count like the intraday high, and then when you reported earnings, it pulled back. I want to talk about some of those things that, the reasons why it might pulled back, but I want to talk about the biggest news. I know this is really big for you, too, is the hiring of a new CEO, Mark Thomas. This is a guy that’s a veteran, has experience in really, really, really growing companies. What does he bring to the table for you? Why is this a game changer?

Scot Cohen: Think about this guy’s background. He’s coming from Stanford as an engineer, then opting to go into Special Forces, then opting from there right into the White House, and then from the White House, working for a Senator, then getting all simultaneous to getting a law degree, getting a master’s in business, and getting his engineering degree. He’s doing all this while he’s serving the country, then going and serving the country at the White House. Then he goes into GE to work and run multiple divisions at GE, and then goes into private equity. That kind of experience, experience around manufacturing, logistics, even sales and marketing. He’s got it all, and his leadership skills are what’s really stood out. This guy knows how to lead.

Scot Cohen: He led while he was in service, he’s led while he was at GE, he’s had numerous leadership roles when he was working at the private equity fund. So Mark, at probably the things that come to mind, why he’s going to have so much impact, is his ability to lead and to make sound judgments is another big, big one that I think we all, when interviewing Mark, we’re able to relate to and see very clearly that he had those just two fundamental qualities about him that, that we thought could have big impact for this business.

Frank Curzio: Yeah. I mean, hiring Mark, I thought was amazing, then another huge positive where you have over 40 million cash on the balance sheet. You’re a small cap company that again, someone was covering this industry a while, that’s what you want to be. You want to be where, hey, our product is no longer like a proof of concept. It’s actually being sold in law enforcement magazines, and we have a huge cash hoard to market, it’s the perfect position for small cap. With that said, one of the negatives I think on the call where people would, what I hear, is they expect the backlog to be a little bit bigger, and the backlog was 1.5 million.

Frank Curzio: However, for me, I looked at it as, we’re in a COVID world, you were doing hands on training, which requires a lot of travel, but now you announced a virtual training, which is amazing. I’ve seen this up front, even on some of your calls. Talk about the backlog because right now, if we see this, and I know you know this as well, for the stock to get to the next level, like it does with Taser and it’s much faster, much ahead of their growth trend, where you are compared to where they were the first 24 months, first five years, probably six years, talk about the orders or how many police stations are testing this device. Do you see those orders going out considerably? It seems like everywhere I look, they’re testing this. I’m hearing it mentioned to the president, directly to the president from politicians. We need to have more of these, but eventually, as you know, you want to see that number grow.

Scot Cohen: A couple of different ways to talk about, well, let’s get to that question. Starting with just Tom is a cofounder and architect of Taser, so it took Taser 15 years to do what we’re doing in one year. Okay. Just starting there, police aren’t quick to change. It’s hard. This is a group that has unions involved and has lots of different take points politically. It doesn’t happen overnight, but when it happens, it really has sustainability. When that change takes place, we think it’s going to be a real domino effect. Being mindful that our quarters are choppy at the beginning, just like any new business, it’s a new technology. It requires training, it requires marketing and just some time to get through budgets. With that said, the pace in converting from the demonstrations to orders is happening.

Scot Cohen: It’s hard to get the real good, strong visibility at this point in time. It’s only been really 12 months since we started selling it, maybe just slightly more than that, and so, as we do more demos, as we have more pilots running, as we put out more quotes, I don’t know if you were on that quarterly call in the second quarter, but we talked about 30 to 40 different inquiries coming in from departments a day. That was happening a quarter before. Last year, this time 30 and 40 inquiries coming inbound a month, or actually, probably not even that we were having that probably on a quarterly basis. We’re having that on a daily basis now, so the pace of this has just picked up, and you want to talk about the backlog.

Scot Cohen: It’s a lumpy business right now because we’re just really coming out, but the big thing to look for is for those major cities to start rolling out these units on a full deployment. Look for some big international contracts that will be, we think there’ll be chunky, but when they come, you’ll see that reflected in the top line and you’ll see that also reflected in the backlog. In the beginning, it’s always chunky and not totally not clear, but as we start getting into the rollout, I think you’ll start to see things smooth out and it will be more consistent. That’s how we’re seeing it at this point.

Frank Curzio: Yeah. You’re definitely right about Taser. I mean, that’s something that I covered in the single digits when I was at street.com and just saw their market cap swell. It’s over $8 a share. It’s a closer to a $6 billion company today. It was incredibly lumpy back then, just before they really started getting going and getting light years ahead of them. I love that, but in today’s world, it’s so different with social media. Three months is a long time. But for me, I love that you explained 18 months of how far you come. I want to talk to you because you’re familiar with this, but because you’re in this industry for a long time, myself as well. You have short sellers and they use platforms like Seeking Alpha, a whole bunch of other ones where they’ll build up a huge short, because you can’t do this on a long side, you can do on a short side for some reason, build a massive short position, come out with whatever you want to say.

Frank Curzio: Disclaimer, it’s going to say, “We think it’s reliable, but it may not,” or whatever. These guys could be out of their position within three, four days, but those short reports I’ve seen, I’ve got a lot of email subscribers saying, “Should we worry?” I read the whole thing and he highlighted the revenue numbers and how we haven’t seen any big departments and stuff like that, but he also highlighted a lot of things that were just out there and didn’t make sense and are outright lies. How do you deal with this as a company? Because management teams deal with it differently all the time, and I’ve seen some deal with it, bad, some deal with it good. But when you’re looking at this and you’re looking at long-term goals, do you pay attention to things like this? I know you see it coming, but it’s funny how almost every smoke app that I’ve covered at that has this massive growth trend, you always see this pulled back a little bit, but it’s someone speculative and just trying to make money really quick.

Scot Cohen: Yeah. Let me answer the first part. We first started probably about 12 months ago, the first short started building his position and they were out loud about it because a published report on it. The short really never went away. My belief, and I’m not the only one that has this opinion, is to show it’s just getting more and more, I should say out loud and accelerating their efforts to advertise this position. They’ve been short since $3. When a stock goes against you, you’re short at three, and now you’re in the double digits, that becomes more painful for a short. You start figuring out how many, if you can get more people in the short idea, you could scare out retail and that’s precisely what’s happened.

Scot Cohen: They were marketing that short report probably a week before it came out. They were really trying to get people behind it and trying to scare retail investors the best they could, which was just fine. To answer your questions, does it worry us? It would have worried me more if we had $3 million on the balance sheet and a stock that wasn’t really trading, that would be concerning. If we had a weak pipeline and weren’t confident about our business, that would be concerning, and felt like it could run certain product liabilities that will be hard to account for it, that would be concerning. All those things still concern us, but we’re not going to be hurt by a balance sheet, our capital with that kind of cash position where I can meet capital for years to come.

Scot Cohen: I’m not worried about that. The product gets better and better. When we wrapped you 18 months ago, pretty effective, but now it’s a completely different story. You’re not moving post a wrap and you have no chance to move in, particularly when we’re hitting high and low. You’ve got no shift. It’s just that much more restricting. So yeah, I’m grateful, but the quiddity has the interest in this has increased and continued to increase. Like I said, you had, when you first came on, there was probably two to 300 shareholders. Now, it’s 25,000. I think we jumped 8,000 in six weeks. I don’t think that’s going to slow down. I think people are hearing about this or reading about it, they’re seeing this, they’re connecting George Floyd issue, and in that situation, the protest with our company, with our product.

Scot Cohen: To put those two together, our product with the current environment, is really powerful, which I think should get more and more people interested and engage more and more people. I think our shareholders will go, that number increases, liquidity increases. Like I said, we’re not a balance sheet risk anymore, so the shorts, it doesn’t bother me. It never really has, to answer your question. I think the more short they get as we start to get on our business plan, it becomes a really painful situation for them. Particularly if they’ve been short in the low single digits. It’s expensive to hold that short position. It costs, the bar or the stock is over 50%. In other words, if you’re lending shares out or if you’re borrowing shares, you’re going to pay 50% interest.

Scot Cohen: When you’re paying 50% interest and you’re down, you started shorting it three, and now that stock’s over 10, that gets very expensive and could be very dangerous because if we have a Taser like moment, like you catch that big order and the stock in Taser in one year, and you know this, went from five to 105 in the 12 month period of time. That was because of one or two orders that they got. If that happens in our situation, which is certainly possible given the size of the departments we’re working at domestically internationally, as a short, you could be put out of business. Shorting its story stocks is very, very dangerous, and those story stocks actually start performing, they have a taser like moment where your stock goes from up 20, 20 fall.

Frank Curzio: No, it definitely makes sense. I’m glad you brought up the shorts and the interest on the shorts and how that is, but I want to get back to one more thing here. How many departments would you say are, was it inquiring about the device, law enforcement departments?

Scot Cohen: On the quarter call, you heard that we get 30 to 40 a day for the last six weeks or two months. It’s probably been, you heard that the inbound inquiries that we get are over 50 a day. These are from departments spread out throughout the country.

Frank Curzio: Talk about, I want to get to that virtual training part, because this was huge for you. I remember talking to you and you’re traveling a lot and your teams are traveling a lot and they’re training these officers on-site, but has a virtual resulted, it looks like that more people are inquiring, but what about the training part? Are you still, I think, the number was 250 plus police departments, so currently, training or be trained or whatever it was, I’ve got that number, but are you seeing that number increase now? If you didn’t go to virtual, it would be impossible for these offices to train. That’s why it’d be nervous about the orders, but talk about the virtual and how important that is, because it seems like officers and law enforcement agencies are perfectly okay with that, as long as you’re training us and we have that certification.

Scot Cohen: Yeah. There has been virtual training available to large and small departments. Problem is cost. That virtual training has been expensive. There’s just several companies that manufacture that equipment. They’re big screens. They’ve cost hundreds of thousands of dollars for that kind of installation, so it’s a big commitment. We’ve gotten that price way down with this new partnership they launch, and it is going to be a subscription based model. It’s the virtual training that we’re going to be doing that will allow you to get this certification without us having to be there. This is as much about, you can’t just put the BolaWraps out there without training, so it does compliment what we’re doing, but we actually think that the virtual training piece of the business could be much larger than BolaWrap itself.

Scot Cohen: You have BolaWraps or not, training is going to be a massive component of any department, big and small. That’s obvious just with all the noise about defunding police and what we’re hearing about how police are handling these protests and handling today’s environment, but we all know that to have a training offering around BolaWrap and allow them to deploy without us being there, really scales our business, helps us with not having to… It’s impossible to service 18,000 departments around the country. This gets us way more feet on the street. We’re able to certify at a much faster rate, and most importantly, we’re able to train people how to deploy this product in a safe, effective manner remotely, which is really an awesome step up for us. Saves us a lot of time and money.

Frank Curzio: I guess just the last thing here, I guess what everybody wants to know is talk about that the next steps for the company. You put yourself in a position. I mentioned earlier where a nice cash hoard there, your small cap where now this is being sold, you have a product that’s actually being sold. It’s no more that, “Hey, we have to prove this concept that it works.” What are the next steps now that you’re in this great position as a small cap company? I know you talked about your new BolaWraps. They’re not going to be as loud when they’re shot, because they’re very loud. I got shot by this thing. If you do that in Times Square, it’s gonna scare the crap out of people. I know you’re talking about where, they shoot two and not just one, but talk about that, maybe growth plans of what investors can expect going forward, because we all know, okay, we have to get more orders, but what are the next stages? Because hiring this new CEO, it’s clearly like, you understand it’s about growth right now and you’re going all in on this.

Scot Cohen: Yeah. So, just to go back for a sec, once you start, we feel like this is going to be a need-to-have product, because if your officers are going to a dispute or confrontation, and they’re using an aggressive use of force, let’s say a gun, taser, pepper spray, and they don’t start out with a lower use of force, we think that is going to be more and more criticized, is going to be looked at in a negative way. This is going to be a required piece of equipment to come early with the BolaWrap. One big department, and now we have we’re testing and deployed in several large cities, but one big one that goes full deployment will really, we think not only wake up that area, let’s say that state or that region, but should start to open up the rest of the country.

Scot Cohen: It might even start internationally where you have one country deciding to go full deployment and it could have a ripple effect back here in the States, so I’m looking for one that I think we’re all looking for one or two of these departments to go full deployment. It’s sending a message that will be heard around the world. When you get that coveted real estate on that belt, there hasn’t been a new device put on law versus belt in this country in 30 years with Taser. You start seeing BolaWraps show up in those local communities on the officer’s belt, that’s coveted real estate, almost impossible to get on, but once you’re there, Frank, you start getting into other business lines, you start getting into the data capture, you start getting into cameras. You start getting into being able to pivot into other areas. As long as you’re on that belt, we’ve been approached or talked about this by plenty of strategic partners.

Scot Cohen: The big question is, if we’re on the belt, then we could go lots of different ways. Clearly Taser took advantage of that real estate that they were to get on to and created a $6 billion market cap as a result of that, we’re still really in the early, early stages. If it becomes clear that we’re getting on that belt, and we’re capturing that real estate, one small department or large department at a time or country, then you’ll start seeing some new lines of business that we’ll probably be getting into really quickly because we own the space. We’re there, we’re present, and from getting, once you go from the belt, there’s lots of other ways to sell into those departments. That’s the next big play for us, establishing space on the belt think will unlock the value that was fortunate enough for the Taser investors to experience a decade ago or so, and I’d like to believe that we’re next.

Frank Curzio: No, that’s great. That’s great. Well, Scot, listen, I love you coming on because you don’t come on when you’re stuck at all-time highs, you’re coming on even when your stock pulled back to four with COVID and everything going on and stuff. For me, I want to always be transparent with my subscribers, so I know a lot of people do own this because of me and you coming on and just giving us an update. I really appreciate it. I know how busy you are. I know it’s crazy. I just want to say thanks for that update. I really, really appreciate it, buddy.

Scot Cohen: Hey, Frank, thanks for your support. We are as strong as we’ve ever been with the leadership, with the C-suite, with Mark, with the new people that have been coming on board with our balance sheet, with the training protocols, with the development of the new product, this is just in the environment, we’re fortunate to be here and you were first, so we are respectful and very grateful for that early on support.

Frank Curzio: I appreciate it, Scot, and yeah, hopefully I have you on soon to update us. Thanks a lot, buddy.

Scot Cohen: Super. Thanks everybody.

Frank Curzio: Hey guys, great stuff from Scot. I want to let everybody know which most of you already know this, you should. Curzio Research, we’re a hundred percent independent. I don’t get paid by anyone to recommend their stock. I have to show your gains, and if I do, hopefully you’ll subscribe to our products here. That’s how it works. It’s nobody pays me nothing. I never see money, never took a dime for someone to recommend their stock. Now for subscribers, almost all of you should be in below $10, which you know, is a bottom to price and take a half position if you need to, full position, depending on which newsletter, we have in two of our newsletter, but most of you should be below 10. We recommended this name a lot lower if you’re subscribed to my newsletters.

Frank Curzio: With that said, this is a small cap, aggressive stock. Don’t go all in. Don’t put all your money in it. Scot’s excited, just like every other CEO talking about their company, of course, I’m talking about Curzio Research, I’m gonna be excited. So the way it is, he’s excited about his company. That’s fantastic. But again, it is risky. You have to do your homework on this. People would ask me, “Well, Frank, there was insider selling.” There was, insiders own over 30% of the stock, including Scot. They sold some of it, yes, and that’s what you do when you put a ton of money into something and things start working out. You want to take a little bit off the table, but 30% insider ownership from someone who covers small caps, that’s a massive, massive number, guys. That’s a big number. You don’t really see that too many places. It tells you that they have stake in the game to make this work.

Frank Curzio: If you’re looking at a backlog, one and a half billion dollars, and saying, “Wow, it’s got such a high market cap and we want the higher backlog,” I agree. Now, if they don’t see those sales explode, and not seeing that number go up tremendously, I say the downside for this, again, it is being sold. Police departments all over the world that are sampling this thing. I think the downside’s around seven bucks from here. If they get it right and they start getting big orders, you’re looking at 30, $40 stock. That’s not out of the question. The risk-reward is still great, but there’s no guarantee here. You need to know that. So for me, it’s not, “Hey, promoting this.”

Frank Curzio: We were very early to the party two years ago. Again, he used to make fun of me getting shot by this device when I didn’t know that they just got the laser and stuff like that. I just said, “Hey, I’ll get shot by this device, it’s not lethal. Well, we’ll see on me.” But it’s cool. I put that in the video, but I really got attached to this thing. It wasn’t just a stock. It was emotional behind it. Where I interviewed police chiefs, just a lot of work I put into the research behind this and boots on the ground going there, interviewing these people in person. I’m glad to see that stock’s working out. Is it going to pull back? It pulled back a little bit from 13 to ten-ish and it’s a show-me stock now. To show-me stock, they’re going to have to get orders, and I believe that they are going to get ton of orders. That’s what I believe. I just believe this device makes sense.

Frank Curzio: It works. It saves lives. It prevents a lot of crazy stuff happening in the world today. We’re in that world where things are pretty crazy right now. Where politicians on both sides want to put more funding specifically into the BolaWrap. It is pretty interesting. It has pulled back, pulled back more. I’m probably gonna buy a little bit more, so, but that’s your choice. If you’re full positions, full position, but again, you wanna highlight the positives and negatives. I thought he did a great job answering all the questions there. I love the new hire and let’s see how it turns out, but my job is to really bring on these people because I know this is a story stock and most people on my file own this, which is really cool, because you should be doing pretty well. I wanna update you constantly.

Frank Curzio: Last time I had them on, it was at four. It was an exciting story. I don’t want to bring them on at 13, 14, wherever it was. I want to bring them on at a time where I’m like, “Wow, this makes sense right here.” This stock has pulled back and didn’t deserve it, and that stock has went up tremendously, but make sure you do your own homework, do your own research. There’s no guarantee. It is a small cap company. You have to be careful. You have to limit your risk at all times, so just make sure your risk-reward… For me, it’s absolutely fantastic even at these levels, but everyone’s different, and make sure you do your own homework.

Frank Curzio: Now let’s get some educational segment. Seeing the Fed go crazy, just trillions of dollars being printed. Look at the last beating. Every single committee member said they expect the Fed funds rate to stay new zero until 2022. They’re bailing out everybody, nonprofits, and their loan eligibility program by 95% of all eligible loans made by banks, but for nonprofits, backstopping all bunch of stuff, including the government, but you’re looking at the Fed, where people say, “Well, the Fed is running out of tools,” and they don’t really run out of tools. I think we actually know that, but there’s one tool that they used that is probably going to be announced in the next couple of months. I’ve seen a story, too. I’ve been doing a lot of research on this, and if they do announce this, you’re going to see small caps in particular, I think, really take off here.

Frank Curzio: Now this obscure Fed tool is called yield curb control. It’s YCC for short, so if you never heard of it, don’t worry about it. I’m not surprised because it’s only happened one time. The Fed only implemented this policy one time in the history of America. That was in 1942, 80 years ago, set off one of the biggest bull markets, I bet, ever. YCC, when that policy was put in place, the S&P 500 went from its lowest point in a decade to highs not seen before the Great Depression. That’s how big this was.

Frank Curzio: When you look at YCC, it’s like quantitative easing, but with a little bit of a twist. So, QEs, when the Fed agrees to buy a set amount of government bonds, you guys know this as printing money. With YCC, the Fed doesn’t agree to buy a set number of bonds. Instead, it sets a target price and says it’s going to buy any amount of bonds the market would sell for that price, which could affect the limitless. And when you use the word limitless, which someone who has a printing press that can print a lot of unlimited amount of money, it’s pretty crazy.

Frank Curzio: For me, when I believe that this market was going to come down tremendously because of COVID, it was a little bit late. We could’ve participated on the way up, but for me, it was the numbers, like Disney. Disney reporting numbers that their stock is up. I can tell you, if there’s no COVID, Disney’s going to be at 300-400 stock. It’s at 125-130 now. Revenue’s down 40%, every single segment got killed. They took write downs. The only thing that’s doing that they say, they pointed to the amount of subscribers they have on their platform, and everybody cheers that, but the operating loss for that segment direct to consumer, went from 500 million to 700 plus million, because, like I said, streaming’s a terrible business. It costs a fortune in order for you to maintain, you constantly have to put content on it, which is telling you that more subscribers that they’re adding, the more money they’re losing, and that’s the vision that they’re bragging about.

Frank Curzio: Everything else is getting crushed, but hey, we’re in a different market. You’ve got to look at it and say, if the Fed’s going to come in and spend 6.5 trillion, which is 30% of our GDP to keep the economy afloat, there’s more trillions coming, but the yield curve control, in effect is going to fix the price of bonds, and doing so, it fixes their interest rates. They did this in 1942 to help the treasury fund cheap debt, and that was in World War II, but now, YCC is going to ensure big corporations can either get cheap money in the foreseeable future. I don’t know if you saw laced bonds that were raised. You should buy Google. What was the interest rate on that? .45% or something? I forgot what Microsoft … these guys are borrowing money 40 years out for nothing. For nothing. Our mortgage rates are 3%. If you talked to someone in the ’80s that bought a house, they’d be like, “Are you crazy? 3%? No way.”

Frank Curzio: That yield curve control, it’s inevitable. It’s a tool that they’re going to announce. I’m not the only one that think this. For me, there’s two people that you want to follow when it comes to the bond market right now. To me, there’s a lot of them, you have your own name. Jeffrey Gundlach is one of them, June 10th. If you’re not familiar with Gundlach, he’s a billionaire fund manager, probably considered Warren Buffett of the bond industry, he goes, “I certainly do expect,” and I’m quoting him here, “that J Power follow through on controlling the yield curve should the 30 year rate really get unhinged, which it is.”

Frank Curzio: Scott Minerd, if you haven’t heard of him, managing partner, chairman, global CIO of Guggenheim Partners and manager of 270 billion, one of the most respected people in the bond world, on June 8th, he said, “Yield curve control could prove an interesting tool to limit money supply growing, or money supply growth while keeping interest rates low in the event of a sudden surge of inflation.” What are we worried about here? What are we hearing, everyone’s popping up. Something that I said in March when the Feds started going crazy. We’re going to see inflation beyond belief once this COVID thing dies down, so here is Scott Minerd. Guy is much, much smarter than me, much smarter than most people out there, especially when it comes to bonds.

Frank Curzio: Hey, yield curve control keeping interest rates low in the event of a sudden surge inflation, so yes, big corporations are going to benefit, but if you’re looking at what they’re doing here, it’s really going to inflate the high risk assets, and if you’re looking at small cap stocks, they underperformed the market so far. In fact, if you’re looking at the top five stocks, just count off 22% of the S & P 500. They counted for over 55% of the gains over the past 12 months, while the rest of the market accounted for .6% of the gains. If you don’t own any of the major technology stocks, it’s not a thing to take out the N for Netflix and throw in Microsoft. You have those five stocks. If you don’t own them, chances are, if you’re beating the markets, good for you, but most people aren’t. That’s why a lot of you are at home going, “The market’s hit new highs! I’m here at Tesla going “Here, hold this cup, he’s going crazy!”” It’s really five companies. Tesla’s getting up there, too. It’s pretty crazy, and Netflix and a lot of technology companies, but most companies are still underperforming, which is just the facts, but the Fed, I believe, is going to announce this before September. If they do, you want to position yourself in small caps.

Frank Curzio: I say this all the time to you. Every single time. Whatever we promote our products, I try to promote my products at the right time, because the last thing I want to do is promote a crypto product when crypto prices and Bitcoin is at 19,000, because it’s an easy sell, everyone’s going to get in. It’s a story and you get distraught. I’ve known this for 25 years. No one’s really talking about small caps right now. We have, I personally think, yes I’m biased, the best small cap newsletter on the planet. Something I’ve been doing for 25 years, that’s when I launched this business on, Curzio Venture Opportunities. We saw it for a lot of money, I’m discounting it by 60%. I’m going to do that for the next couple of weeks. Anyone that listens to this, they’re going to send it out to you, and if you want to subscribe, subscribe. It’s up to you. Again, it’s not a sales pitch or anything for me. I want to get you involved in the right industries at the right time. When you do, you’re going to make a shitload of money, and of course, you’re going to buy more of our products, but that’s my goal here. That’s why I do this podcast. I’m going to try and help people out there. I want to try give you guys the real story.

Frank Curzio: This wasn’t even my original podcast when I took it over straight from Kramer and Aaron, who’s really cool. I haven’t spoken to Aaron in a while, but anyway. When, for me, I look at small caps and the Fed initiates this policy, again, it’s probably going to happen, so the best bond managers say it’s going to happen, you’re going to see a lot of these assets really go. We haven’t really seen that move with small caps. Small caps that involve technology? Yes, of course, because of COVID, but you’re looking at the COVID problem that these politicians are going extend out through the election, so you’re looking at seven more, I mean November’s election, but you’re looking through Q1. We’re not going to get a vaccine before Q1, if there is, nobody’s going to take it, but you’re looking through Q1, what, seven, eight months, so put that in perspective, how bad is COVID been that’s changed the world? It’s only been six months.

Frank Curzio: There’s COVID that’s going to be pushed out, where our economy’s going to be, “We’re going to close.” It’s going to force the Fed to do this yield curve control, and when they do, risky assets are really going to take off, and you’re going to see risky assets even in not just in secular sectors, where we’re seeing what we have in technology, but cyclical as well, the ones that underperform. If you nail some of these things, I said a couple of weeks ago, the risk reward for small caps has never been as great as it is now. You might say, “Frank, that’s insane!” Look at Wayfair, went from 20s to 200. You’re looking at how many stocks have you seen this zooms? These are small cap stocks. You’re looking at so many of these names that under a billion dollar evaluation that have taken off to five, 10, 15 billion dollar valuations. You don’t really have markets that you can do that. Now, could it reverse? Could everything fall apart? Could the Feds say, “We’re not going bail out anybody.”?

Frank Curzio: Of course, that’s why you want to put stop losses in. But right now, with that newsletter, risking 35%, you’re able to generate two, three, four returns, which is a fantastic risk reward. Is it risky? It is risky, but the reward is worth it, considering what some of these stocks that… even you’re looking at Televac Health and just virtual health companies, and right sectors, these companies who are very, very small, you’re going to see a huge boom in small caps, and if I’m wrong, all right. You’re going to risk a little bit and you’ll lose a little bit, but still, you want to limit your losses on this. But if I’m right, right now, the chance to buy some of these names that’re down tremendously that have not outperformed or kept up with those technology stocks, it’s one of the best times I’ve seen to buy small caps, again, based on risk-reward.

Frank Curzio: I’ll be sending you guys that offer we did, great promotion. We did a video promotion on, if you guys are interested, it’s fun, it’s Curzio Venture Opportunities. That’s our flagship newsletter. That’s the one I launched, encourage your research on. It’s something I’m very proud of, something I’ve been doing all my life, but you don’t hear me talk about it often. You don’t hear me mention that often. You don’t hear me offer discounts often on that product. I’m going to do that over the next couple of weeks for you guys, because I really want to see you guys get in and benefit from this, because this is where I’m putting my money as well.

Frank Curzio: Okay guys, so, any questions, comments, feel free to email me, frank@curzioresearch.com. That’s frank@curzioresearch.com. You can also follow me on Twitter @FrankCurzio. We have a Curzio Research YouTube page, where we’re doing lots of videos and video interviews, and we’re going to do even more than that going forward. I’ll tell you this, the past couple of weeks that Daniel is going to be joining me on the podcast. We’re going to have video of it and put that out on YouTube and our channel, stuff like that. It’s going to be really, really cool, so really upgrading everything, going all out on the podcast because we’re really starting to get a lot of downloads. Yeah, it’s going to be a lot of fun, so again, follow me, follow those videos, everything. You can go on Twitter, you can go to Curzio Research YouTube page. And as always, guys, really appreciate the support.

Frank Curzio: Keep the emails coming in. I know a lot of you say the same thing, “Frank, I love your podcast. I don’t agree with everything you say.” You don’t have to agree with everything I say. That’s fine. It’s okay. My intentions, for me, I want you to make money. I want you to learn the system. I want you to avoid the bullshit that’s out there. That’s what I’m trying to do. That’s why I try to find all these statistics for you, and we’ve been ahead of this thing on COVID, we’re still ahead of it. I feel like nobody’s really talked about the stats that I had mentioned. Everyone’s still worried about it. You don’t need to be worried, especially if you’re fearing your life, unless you’re in that danger zone, and we know that the numbers support it. Guys, just be careful out there. Be safe. Again, appreciate all the support, as always, I’ll see you guys in seven days. Take care.

Announcer: The information presented on Wall Street Unplugged is the opinion of its hosts and guests. You should not base your investment decisions solely on this broadcast. Remember, it’s your money, and your responsibility. Wall Street Unplugged, produced by the Choose Yourself Podcast Network, the leader in podcasts produced to help you choose yourself.

P.S: I just reported on an unusual asset class that has a history of skyrocketing after a financial crisis. We’re talking about gains like 542%… 620%… and even 1,217%. Watch here as I break down exactly what you need to do TODAY to cash in on this massive opportunity.